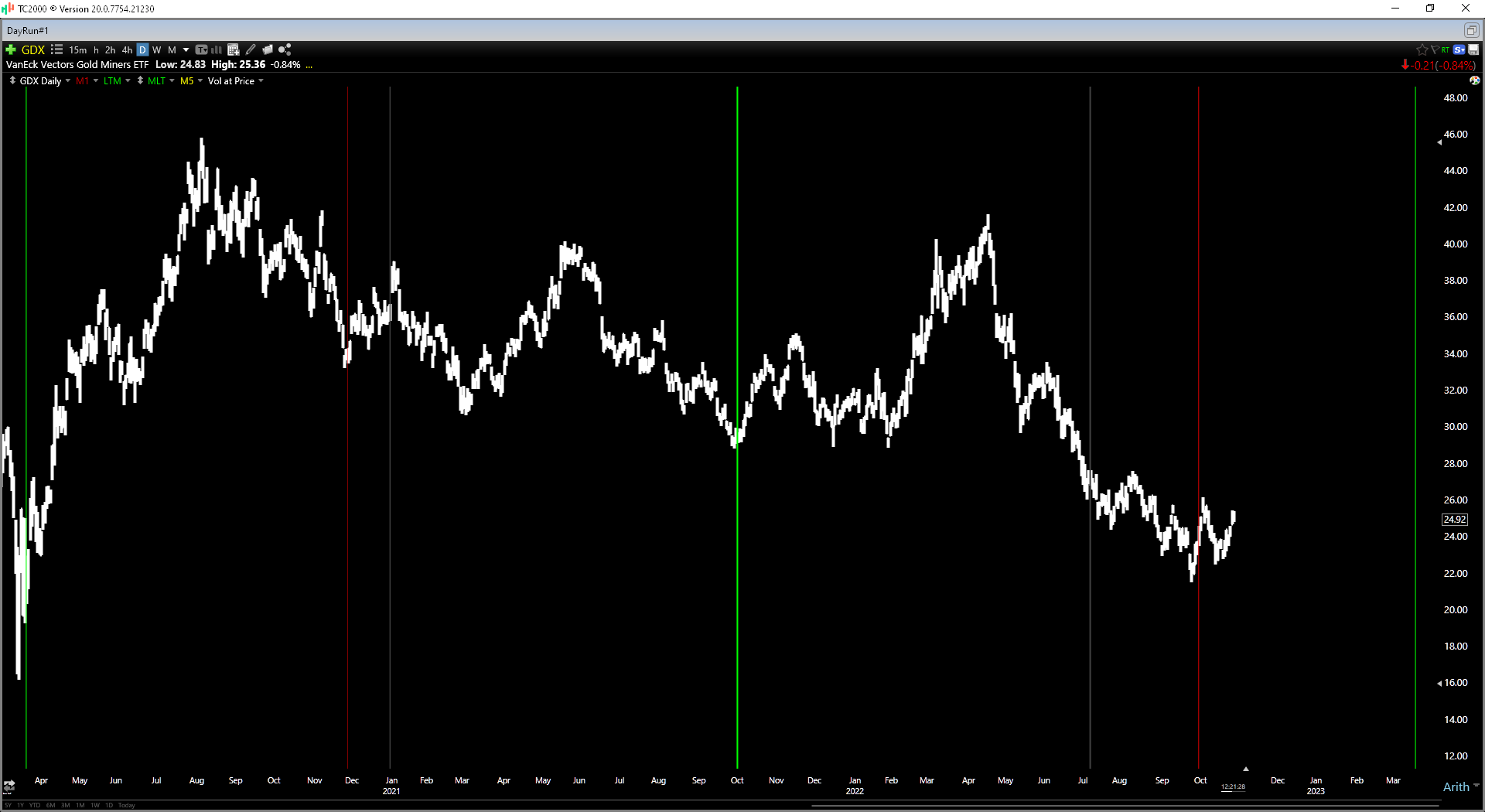

It’s been an exciting year for the Gold Miners Index (GDX) with the index up 12% year-to-date and significantly outperforming the S&P-500 (SPY) for a second consecutive year.

This strong performance can be attributed to the recent strength in the gold price, with the metal launching 10% higher over the past month to hang out near psychological resistance at $2,000/oz.

The recent strength is a big deal for the average producer, which up until January suffered from considerable margin compression with a flat gold price since 2020 yet inflationary pressures across the board.

Unfortunately, for investors hanging out in the gold developer space, the returns have been dismal. Not only have the developers massively lagged the producers and many are scraping along the lows of their multi-year ranges, but they’re under-performing this year despite already lagging by 2000+ basis points last year as well.

This is obviously quite disappointing for investors and in some cases it may be leading to some irrational or forced selling as some investors are tired of not participating in the gold price move and choose to dump their shares.

In this week’s update, we’ll look at two names that continue to trade at massive discounts to fair value that offer a way to get leverage to gold without chasing names already up substantially year-to-date.

i-80 Gold (IAUX)

i-80 Gold (IAUX) is a $840 million market cap gold developer that has a resource base of ~15.0 million ounces of gold in the state of Nevada.

This is an enviable position to be in given that Nevada is one of the top-ranked jurisdictions globally for mining with an abundance of resources, access to a considerable workforce, and favorable permitting historically.

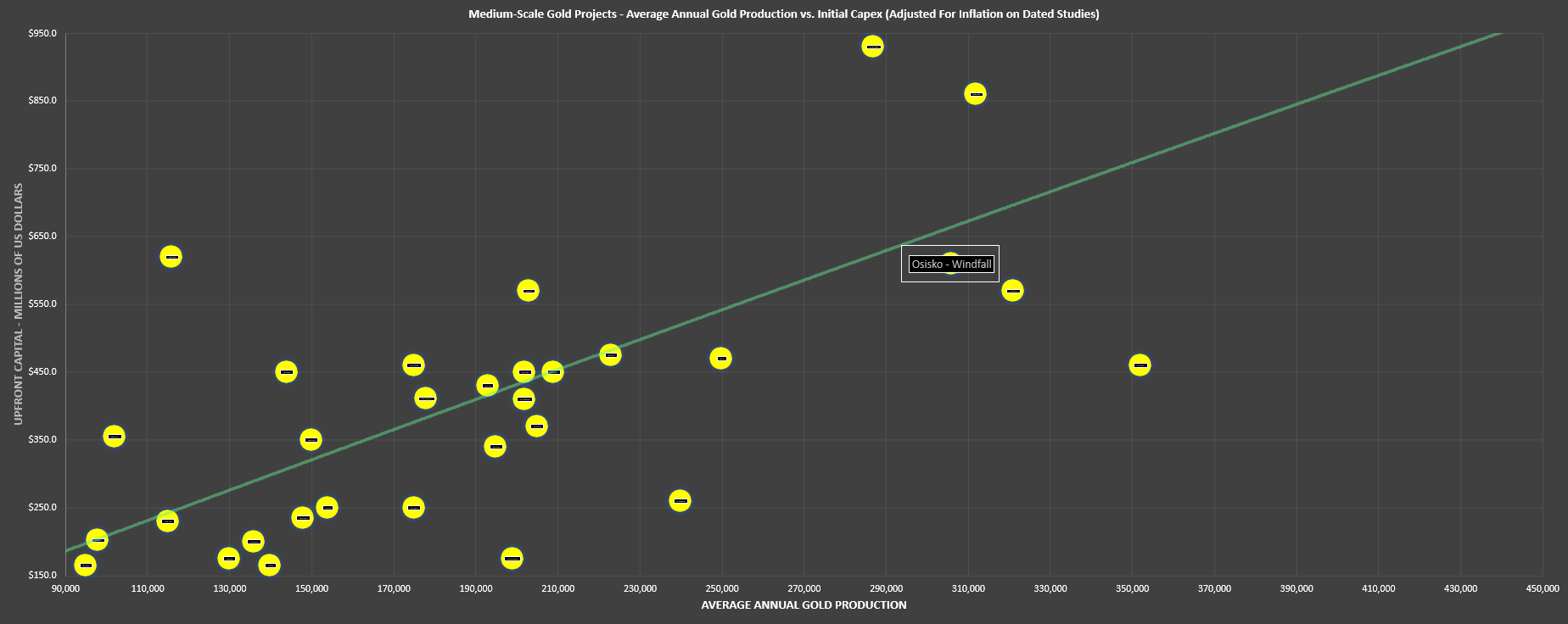

The company differentiates itself from its peer group for several reasons, with the main one being that it has the #1 growth profile sector-wide, with a plan to grow its production profile from ~30,000 ounces in FY2023 to ~250,000 ounces by H2 2026, with the potential to grow to 400,000 to 450,000 ounces long-term. Continue reading "Gold Developers At A Discount"