While the Gold Miners Index (GDX) started the year sharply in positive territory and raced ahead of the S&P-500 (SPY) despite its rebound to start 2023, the index has retreated all the way into negative territory as of mid-February, giving up considerable gains.

This has led to considerable underperformance vs. the S&P-500 (SPY), and this isn’t overly surprising given that sentiment was becoming overheated short-term in the miners heading into late January.

However, with the index down more than 15% from its highs, it’s time to start building watchlists for potential buying opportunities.

In this update, we’ll look at two small-cap names with world-class deposits aiming to become 250,000 ounce per annum producers post-2025.

Osisko Mining (OBNNF)

Osisko Mining (OBNNF) is a ~$1.0 billion gold developer based on an estimated ~465 million fully diluted shares, and it’s well known for being the proud owner of one of the highest-grade gold projects globally in Northern Quebec, Canada.

This project, known as Windfall, hosts more than 7.0 million ounces of gold at an average grade of 12.0+ grams per tonne gold, and would be one of North America’s highest-grade mines if it were in production today.

Once in production (2026 estimate), the mine is expected to produce upwards of 270,000 ounces of gold per annum at sub $725/oz all-in-sustaining costs, translating to ~61% margins at an $1,875/oz gold price assumption.

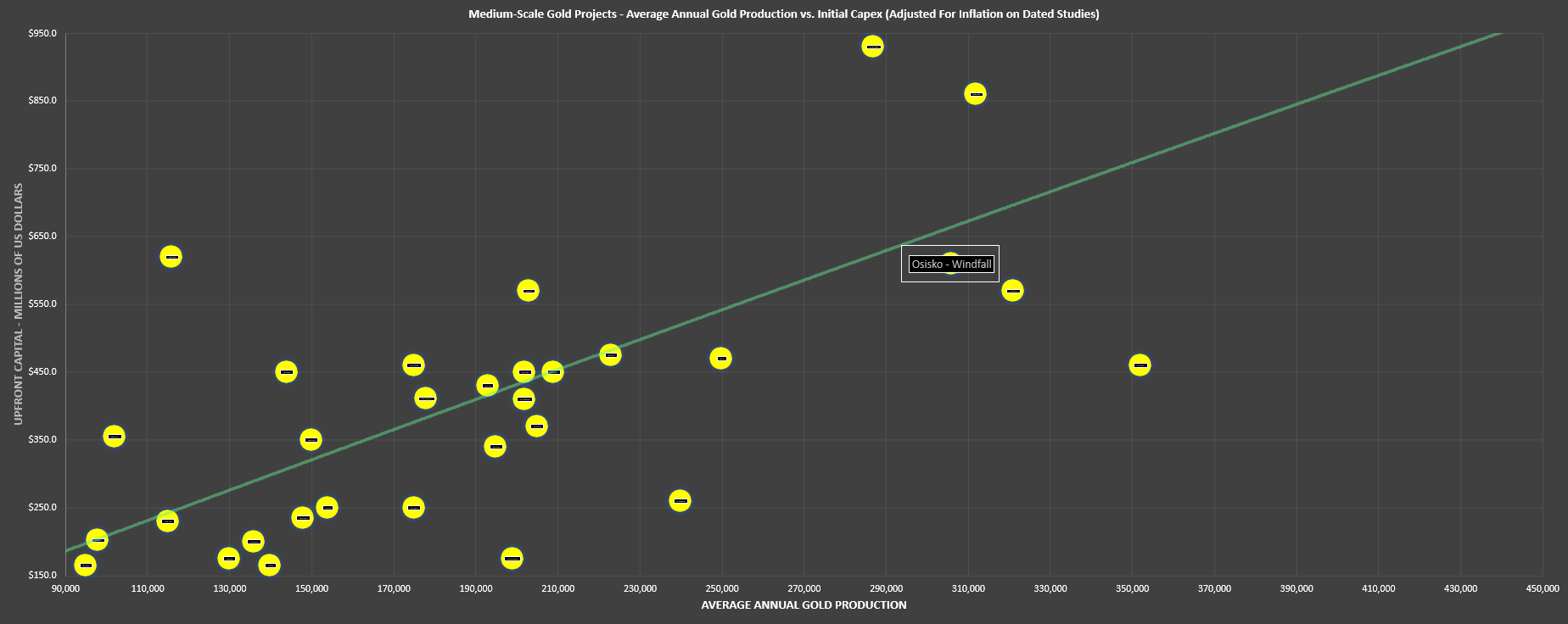

Looking at the chart above to compare Windfall with other undeveloped gold projects, we can see that the project has a much larger production profile than 90% of other undeveloped projects, but its estimated construction costs (~$550 million) are actually well below the average for projects of this size.

Plus, with Osisko sporting a $1.0 billion valuation with over $140 million in cash, the company should have no issue funding this project with a mix of debt and cash on hand.

Today, given that the project is not yet in production nor fully-financed or permitted, the stock trades at a deep discount to fair value, with an estimated NPV (5%) of $1.69 billion when accounting for exploration upside.

However, once in production, mines of this calibre can command valuations of 1.20x P/NAV or greater.

Unfortunately, following a recent financing that the market didn’t expect which led to nearly 10% share dilution, the stock has found itself more than 30% from its recent highs at a share price of US$2.13.

However, based on an NPV (5%) of $1.69 billion and a 1.20x P/NPV multiple, this stock could easily command a valuation of ~$2.03 billion in H2 2025 once it nears its first gold pour, translating to a fair value for the stock of US$4.35 per share (103% upside from current levels).

So, for patient investors interested in more speculative names, I would view any weakness below US$2.05 on Osisko as a buying opportunity.

i-80 Gold (IAUX)

i-80 Gold (IAUX) is a $590 million market cap gold producer that’s focused in Nevada, and it is a spin-out of Premier Gold which was acquired by Equinox Gold in Q4 2021.

Unlike many other gold producers that are sitting within 20% of their September lows after this recent correction, i-80 Gold was one of the few producers to come within a hair of making new all-time highs in Q4 2022, and remains well above its September lows when the GDX bottomed.

This can be attributed to two new discoveries made by the company at two of its four Nevada projects (Granite Creek and Ruby Hill), with the latter being in one of the highest-grade historic polymetallic mining districts near the town of Eureka, Nevada.

So, what is it that makes i-80 Gold so special?

Unlike many gold producers that will struggle to grow production by 25%+ this decade, i-80 Gold has an industry-leading growth profile, set to grow its annual gold-equivalent ounce [GEO] production from ~40,000 ounces in FY2023 to 250,000+ GEOs in FY2026, representing a compound annual growth rate of 84%.

This growth rate dwarfs the low single-digit industry average compound annual growth rate among its peer group (junior and mid-tier producers), and this is just the first phase of growth.

In fact, i-80 Gold has a development pipeline capable of producing 550,000+ GEOs per annum by the end of the decade, and this still doesn’t even include its lower-grade Mineral Point deposit at its Ruby Hill Project.

Historically, the best-performing producers have been those that have steadily grown production at 30%+ per annum given that they have enjoyed consistent cash flow per share growth regardless of whether the gold price cooperated or not.

Some examples include Kirkland Lake Gold (2016-2019) and American Barrick (late 1980s through 1990s), which both enjoyed 500% plus returns in a less than five-year span during the height of their exploration success and production growth (KL actually increased more than 1000% in value).

That does not mean that i-80 Gold has to enjoy similar share-price performance, it certainly helps that it has the same model and that it’s unrivalled among its peer group, meaning that it is the premier pick for those investors looking for growth.

However, while I was previously bullish on the stock based on its new South Pacific Zone discovery at Granite Creek and its polymetallic potential at Ruby Hill, the new Hilltop Zone has proven higher-grade than I expected, and it looks like there could be additional polymetallic zones in the Hilltop corridor.

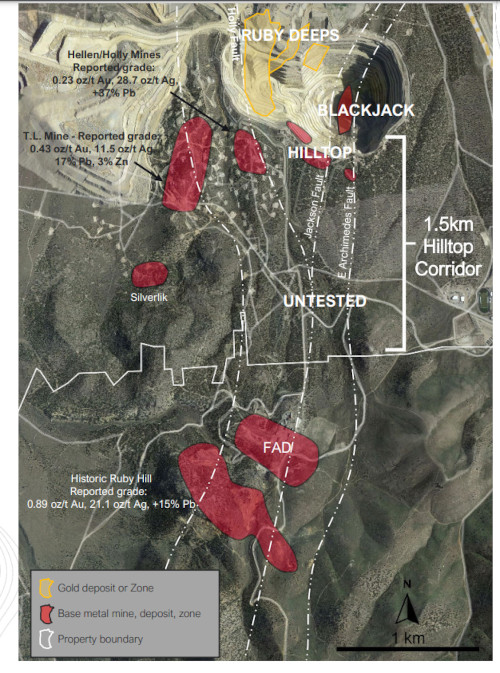

For those unfamiliar, this 1.5 kilometer corridor (shown below) that extends from the recent discovery to the project boundary received limited exploration testing by previous operators due to it being under alluvial cover (unlike other bonanza-grade polymetallic mines that were operated in the 1870s through 1940s that were under limited cover and uncovered by the old-timers).

Given the potential for new discoveries and building on existing ones, i-80 has a path to growing net asset value per share, resources per share, and cash flow per share even in a declining gold price environment, which is the holy grail for sector outperformance.

Based on an estimated net asset value of $1.58 billion, a 1.1x P/NAV multiple (high-grade deposits in a top mining jurisdiction) and 316 million fully diluted shares, I see a 2-year target price for i-80 Gold of US$5.00, representing 108% upside from current levels.

Hence, I see the stock as a Strong Buy at US$2.40 after its recent correction, and I plan to accumulate more shares if the stock heads below US$2.20.

Disclosure: I am long IAUX, OBNNF, SPY

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Hi