Hello MarketClub members and friends of MarketClub everywhere! Today, I have a brief market update on the general market and an in-depth analysis on gold.

2015 has not started off too well for the US equity markets, while the reverse seems to be true for the action in gold (FOREX:XAUUSDO). What's going on? Oil continues to slip, which most economists thought would be good for the economy, but it does not seem to be helping the market. This brings me to my next thought...

Do you know about the "January Barometer"? Since World War II, if the market closes down in January, the average price change was usually flat in the remaining 11 months. So while certain stocks may do very well overall if the market closes down this month, look for a less than stellar year.

As you can see, while stocks have been swooning, gold has actually been on the move to the upside. As I write this, gold is up almost 3% and we are only 6 days into January!

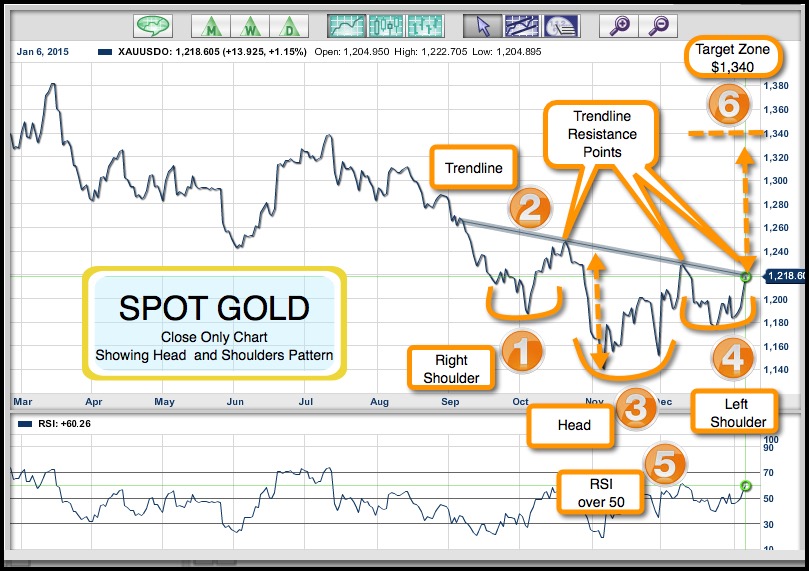

Take a look at the chart and you can see that gold has almost completed an important technical formation known as a "head and shoulders bottom", one of the most reliable formations in your technical arsenal.

A higher close today clearly breaks over the the all important "neckline" resistance level. Once over the "neckline," I can see gold moving based on the head-to-neckline measurement up to the $1,330 to $1,340 level.

Wishing you all the very best in 2015.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

I have Posted some charts of Gold to reveal key level's to watch.

These levels are $1358, $1257 , $1175 , $1144 and $1088.

We, currently are trading in between $1257 and $1175. In November, Switzerland rejected increasing their 'Gold Reserves'. In History, whenever Countries dumped Gold reserves the price of Gold increased substantially over a period of time.

Therefore, in this case I do not really expect any increase in Gold prices beyond $2300 in the near term.

Moving onto Technical Analysis,

If you click on the following links, you will be able to view important levels drawn here.

The line drawn in Blue over the chart represents the Buy/Sell zone. And, so we buy if price moves above the blue line and sell if it moves below.

The current market price is below the plotted average, in this case we are still in the "Sell Zone".

We have near term resistance at $1257-$1263 which is crucial resistance on Gold. Breaking above, it should test $1358.We,

also have offers looking to be filled at the $1255 and $1257 handle.

Click here or copy and paste into the browser http://prntscr.com/5pzofi

supporting the head and shoulder pattern, we have a very interesting formation of a "Bullish Butterfly" Pattern if some of you are aware of harmonic trading patterns, have a look at this --> http://prntscr.com/5q0ad2

Price of gold has basically been unchanged since October, whereas USD and Oil have move considerably in opposite directions. Something is out of wack here, and I don't think its the price of gold...

Historically, the gold price should corrolate the number of USD in scirculation. Since the printing press went into high gear back in 2008, the divergence is at an extreme. Price of gold should be above $15,000 at this time...

People have tried to Co-relate with Crude Oil, Silver Ratio, even with Groundnut or Wheat price and also so many such other things or in other context, however, none of them proven proper, time tested or relative by any mean, simply because equations are changing constantly, and it is all most or quite impossible to fix any such standards.

You can't tell any market what it is supposed to do. It does what it does.

Adam were you listening at the 2011 top, when miners started seriously diverging from the gold price, and then even what should have been very bullish catalysts were met with metals fallung instead? Seems like you have been bullish on metals all the way down, so as the Adens would say by that you have revoked your right to continue to do the same and especially come back and claim credit when your broken clock inevitably comes back around showing the "correct" time again.

Old WestHistory,

I would respectfully disagree as we adhere to our Trade Triangles which have been bearish and are now bullish on gold. Our trading results for our World Cup Portfolio in gold stands which was responsible for producing a return of $7,793 for every contract traded. Were you aware of those results?

No problem if you were not aware of those results, you can find all our gold signals at MarketClub.

All the best,

Adam

Dear Adam,

Very first, i would like to draw your attention towards "Neck-line" for the HS pattern, which should be flat, rather then dis ending, as shown in chart above.

Second thing, there are probabilities for Gold to touch any upper levels like $ 1246, $ 1288 and Even up to 1320+++ too, however, that should must be treated just as Technical Bounce, unless above level sustained atlist for 3 to 5 continues trading periods, also with additional confirmation in Weakly Data too, and if this will not possible, movement towards $ 800 or even lower levels will be continued as per my earlier prediction.

Again i warn, in accordance with available data, it is too early stage to predict any Trend Change Formation.

Necklines do not have to be flat!

Thanks for feedback.

yes you are right, neckline is not essentially required flat, and either ascending or descending also valid, however, HS pattern with flat neckline provides more precised and reliable projection, that's while i express such view.

It will be my pleasure to get some related additional details in this issue, you have if any, which can help me to fine tune my studies.

With regards,

Rasesh Shukla

Adam provides us with a pure technical analysis. He doesn't really try to read the 'fundamental' thinking behind Mr Market when he shows his hand. Trying to second guess the market's intention easily leads to misinterpretation and poor trade choices. The market can remain irrational longer than .... as we know! When the market shows it hand clearly, it's not necessary to know why it does what it does! As Adam says gold is at a decision point and we may now soon what Mr Market will decide. Lets watch!

Article from Market Watch. Lawrence G. McDonald.

The Dollar, on a 'hurricane path of destruction,' is set to fall.

Read it..

My opinion: Dollar is set to hit the pre-Lehman crisis that is 93.3 in 2005, which is quite near.

Respectfully disagree. Yes, we are seeing some strength in gold and without question a more "vibrant" buy-on-dip market environment. My take is simply and only that some modest numbers of oil hedgies (who are commodity-oriented) have been forced off their oil positions and have just moved into gold. I acknowledge the int'l worry about economic things in general; but if we say that energy is the dominant factor in gold extraction/production, then gold should be down on lower oil. I believe there is a flood of money into US stocks, certainly bonds, and USD-denominated items. Especially since all other currencies are acting so poorly. If you owned rubles and saw successive 7% overnight devaluations and could throw your money into *anything* measured in USDs, the perceived risk would be really small.

I don't rule out a 10-12% bump in gold nor stock prices. I just think this is kind of normal money movement.

Among the major international commodities gold is about the only one with a supply problem, so can go its own way somewhat free from the strengthening dollar, but only somewhat. It has broken historical ratios with oil and silver and is, to my mind, still in a bubble. I like the dollar, oil, and silver better at the moment.

All the major industrial commodities but especially oil are down, indicating the onset of deflationary compression in the global economy. Gold is an exception because it becomes a more attractive investment to an investor-class that's starting to worry about how things are playing out.