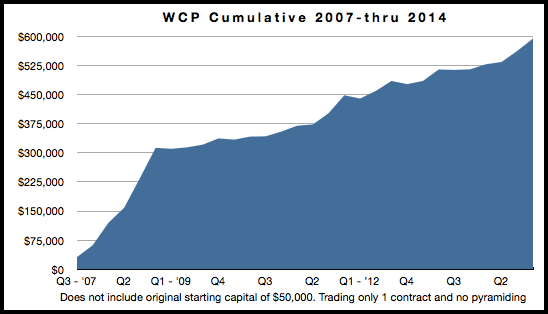

As Trader's, we've experienced a lot of uncertainty recently around a pending global trade war. In fact, I have read that economists believe a full-blown trade war could cost the global economy $470 billion. Now that's a significant number, and it certainly could negatively impact your portfolio if you're not careful.

So how do you protect your portfolio and preserve capital?

The answer may have come from your Grandma; it certainly did from mine. She used to say this simple phrase to me on what seemed like a weekly basis, "don't put all of your eggs in one basket!"

Well, it turns out Grandma was right! Grandma knew a great deal about the power of diversification and how it reduces risk in different aspects of your life, and we can relate that directly to trading and investing.

It just doesn’t make sense to trade only one market. There is just too much risk and too little opportunity. A trader needs to stay flexible, and at the same time be diversified. Before we get into the meat and potatoes of market diversification, let's take a look at how the dictionary defines "diversification." Continue reading "One Word Can Protect Against A Trade War"