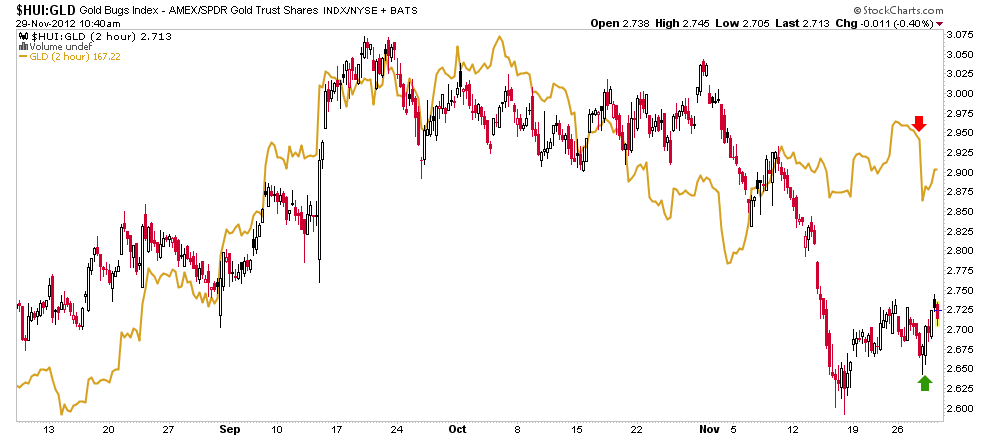

This is just a friendly reminder about how bloody important it is for the HUI-Gold Ratio (HGR) leading indicator (to the precious metals sector) to maintain its higher lows status.

Yesterday the goons apparently attacked ‘paper gold’ (according to sources who stand on guard for this stuff) after the HGR had become weak. A pleasant thing happened however, as the HGR did not buy the take down in nominal gold. 2 Hour chart above. Continue reading "Another Stroll Though Time w/ the HUI-Gold Ratio"