We have had a very good run in the stock of Netflix (NASDAQ:NFLX) and the question now is, has Netflix topped out?

There is increasing evidence that Netflix is having problems over the $300-$310 area. With a lower close in this stock today, it will confirm that it has put in an intermediate top.

There is increasing evidence that Netflix is having problems over the $300-$310 area. With a lower close in this stock today, it will confirm that it has put in an intermediate top.

Yesterday, Netflix (NASDAQ:NFLX) put in a Japanese candlestick pattern known as "a dark cloud cover." This is confirmed as a top if the market closes lower today, September 17th. Candlestick patterns can be very powerful. This is not to say that Netflix has put in an all-time top, but rather in the interim the market has stopped going up and is probably going to see a pullback.

Pullbacks are always interesting and I like to use our Fibonacci retracement tool to measure them. In 2013, most of the pullbacks were in $30-$40 range. Measuring from the recent high of $314.18 on September 11th and subtracting $40, takes us down to $274 area. Coincidentally this is very close to a 50% Fibonacci retracement if we measure from the recent high on September 11th to the low seen on July 25th at $239.91.

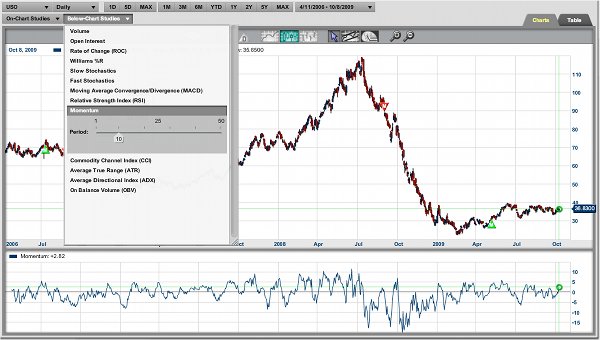

I have two other concerns with Netflix (NASDAQ:NFLX). We are at a cyclic high and the MACD is beginning to roll over, which is similar to what happened in the May and July periods.

Please be aware I am not recommending shorting Netflix, as the longer-term trend for Netflix remains positive and I can see this market doing well longer term as it dominates the space of streaming video and home entertainment.

Let's watch today's close in Netflix very carefully. A close below the $301.13 level will represent a new 5-day low close for this stock.

This is just a heads up that Netflix may be running into some headwinds and profit taking.

Please feel free to leave a comment or your own view on the stock.

Have a great trading day,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Adam and Jeremy are back with another episode of MarketClub TV today at 4pm EST.

Adam and Jeremy are back with another episode of MarketClub TV today at 4pm EST.