Does it sound strange to even think about "taking profits" on anything related to energy?

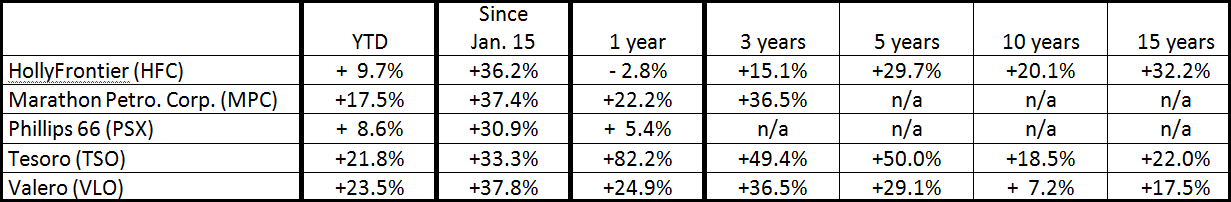

Well, oil refining companies' stocks have enjoyed quite a run this year. Check out this table summarizing recent returns for 5 selected stocks (total returns through 2/20/15, from Morningstar; returns longer than 1 year are annualized; "since Jan. 15" data from Yahoo! Finance):

If you haven't paid attention to this group, how surprised are you to see a group of oil-related stocks with positive returns over the past 12 months – let alone Tesoro's +82% performance?!!

I've also included the 3-, 5-, 10, and 15-year returns, just because they're so remarkable.

Oil down, refiners up!

Of course, the driving reason for this group's stellar 1-year returns is that oil refiners actually benefit from being able to pay lower prices for crude oil, which is the primary raw material used to make their refined products, such as gasoline. Not that oil prices and refinery stocks always negatively correlate, mind you. In fact, the two often move up and down together. But the past 8 months of declining oil prices has certainly helped refiners' stocks outperform the broader energy sector (i.e., funds like XLE) – and by a wide margin.

In fact, as I write this, Monday looks like it will be yet another day in which these stocks finish higher – despite XLE, SPY, and crude oil all trading lower.

In recent days, cold weather and a United Steel Workers (USW) union strike have crimped refineries' production. The effect has been that less crude is being refined, which only exacerbates the crude oil surplus, pushing crude prices even lower than they would otherwise be… once again, helping refiners' margins!

What to do with these winners if you own them

Right now, the stock charts generally continue to show strength.

Technically speaking, MPC, TSO, and VLO are showing "green triangles" on their MarketClub charts and have long since busted through upside resistance levels. They may, in fact, already be reaching your upside price targets. Even so, the upside movements continue to look strong in terms of relative strength, rate of change, etc. Take a look. Right now, I'd just put these on a watch list to sell partial positions when the upside begins to slow down, and divergences begin to appear.

PSX is a little different. PSX has "green triangles" for daily and weekly, but remains stuck on a red monthly triangle… although perhaps not for long. On Monday, PSX busted through its 200-day moving average, and looks poised for continued upside if it can break a double-top at $80. The stock is approaching $79 now, which is above its shorter-term moving averages. If that happens, and if the monthly triangle should flip to green, those are actually buy signals, not sell signals.

Finally, HFC has been the underperformer of the group over the last year, and currently trades above its 30- and 60-day moving average, but below its 200-day MA. Like PSX, HFC has green short-term triangles, but currently exhibits a red monthly triangle.

Oh, by the way… if you consider any of these to be long-term holds, they also each sport a dividend yield north of 1.2%.

Conclusion

In summary, I've always believed in riding your winners until you have a reason to exit, such as chart pattern deterioration, a change in your investing thesis, or achieving a price target. As of today, I don't see the first two conditions occurring yet; but again, in cases like MPC, TSO, and VLO, I'd keep a close eye and look to possibly sell partial positions soon, since your price targets may already have been achieved.

Best,

Adam Feik

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.