Tech stocks are having a great year as evidenced by the NASDAQ's gain of 7.2% year-to-date. Fueling the growth is the emerging trend with the "Internet of Things" (IoT). This fast growing segment in the technology industry is situated around big data, cloud computing, semiconductors, and wireless interconnectivity.

The landscape is a rich one for companies involved in the IoT field. The entire IoT industry will grow from $1.9 trillion in 2013 to $7.1 trillion by 2020 according to estimates made by the market research firm IDC. The increased strain on existing hardware and software infrastructures means that a more advanced form of storage will become necessary to handle the workload.

Big data is the answer. SNS Research's new report expects big data to be a $40 billion industry by the end of this year. Investments in this growing technology are estimated to grow at a CAGR of 14% over the next 5 years in fields ranging from mobile devices to scientific research to fraud detection. And with so much potential in big data, one company has emerged as the de facto leader in the industry.

A disruptive innovator with huge growth opportunities ahead

EMC Corporation (EMC) is a $52 billion company and stands out as the world's largest provider of data storage systems. The company provides data storage, information security, cloud computing, and other services that enable companies to store, manage, analyze, and protect information.

Despite the potential in big data, EMC's stock hasn't really performed well this year – down nearly 9% YTD. The company missed earnings for the first quarter reporting $0.31 per share as opposed to the analysts consensus of $0.36 per share. The miss was partially due to managements miscalculations however and not entirely attributed to a declining product line which could mean that the stock could be on sale at its current price.

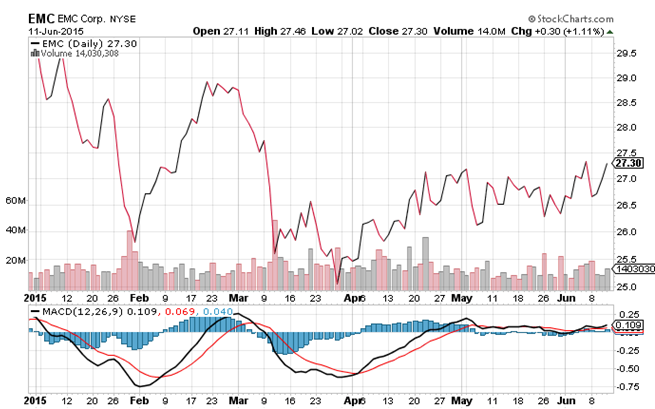

Chart courtesy of StockCharts.com

Based on EMC's chart, positive momentum appears to be building up in the stock. The stock should be in breakout territory once it crosses $27.50 while the downside appears to have already been priced into the stock price.

The stock looks cheap from a valuation perspective trading at just 14.2 times earnings in an industry where 16.7 is the average. The balance sheet looks strong with long term debt obligations of around $5.5 billion while cash holdings currently stand at about $4.4 billion. Last year, EMC increased its dividend which now pays out $0.46 per share annually for a total yield of 1.7% while keeping the payout ratio to a low 37%. The company also has plans to buy back $3 billion worth of stock for 2015 providing a floor for investors in the stock.

EMC's recent announcement to acquire Virtustream for $1.2 billion in an all-cash deal should be a positive catalyst for the stock. The global cloud service provider will add depth to EMC's cloud data storage portfolio and give customers the capability to move their entire application portfolio into a cloud environment.

Given full year earnings estimates of $1.91, the stock should be fairly valued at $33 per share – a 22% discount from its current price. The second quarter results will be a better indication of whether the weakness seen in the first quarter was temporary as management claimed or indicative of a deeper problem.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

I bet you one share of coke, one share of Exxon, one share of walmart, and one share of Procter & Gamble, that the Internet of Things ends up being an Internet of Nothing

As both a techie - former engineer turned businessman - and current investor, the internet of things (IOT) is actually very important and it looms large. All it means is that "things" i.e. people, cars, appliances, lights, boats, oil rigs, airplanes, dogs, and you name it are connected through the internet to smart apps or other devices which enable them to be controlled and information communicated and used in some manner. The key is not the communications but the devices and the applications that are available for people and businesses to use to their advantage.

Now it could turn out that many companies involved in the IOT turn out to be losers But think about this, by 2020 there will be more than 50 BILLION things connected via the internet according to Forbes (and even if they are off by 20% that is a large number.) For investors who will be able to take advantage of the IOT in some manner. Those that provide infrastructure, chips, software services, and of course, security through virus and malware protection.

Interestingly the concept of IOT is not new as many of us have been working in this type of business of "connectivity" for years. So while the term may be new, and maybe that term will morph over time, those smart investors who jump on the RIGHT application or bandwagon will be rewarded. Check out the Periodic Table of IOT published by CB Insights for more info. Also check out IBD for articles written in their Technology section. It's actually very interesting.

Just my two cents from a successful businessman and successful investor.

Duly noted. Except that the market has already bid Internet of Things "expected" participants to the moon on Internet of Things growth unfolding as expected / projected. Ben Graham taught that basing capital allocation decisions on projections is about as useful as selling earplugs to someone who's already deaf.

I'll stick to coca cola, Pepsi, Hershey, Walmart, JNJ and Procter and Gamble, and I'll compound my capital at 6% before dividends, 8% after. No guesswork involved, and no trying to front-run last man standing in the IoT race. What will eventually happen in terms of the IoT unfolding is the truly unexpected, not what's already discounted into ridiculous names like Ambarella, NXPI, etc.

Dan:

Certainly that is fair and I agree that some of the valuations are crazy. But as an angel investor as well as a stock investor and as a technologist who has been involved in many new product concepts surrounding the internet over the years, I see the potential in connectivity tied to applications. Witness NEST which was bought by Google. As they say, you should trade what you know and what you are comfortable in.

Good luck in trading.

David

David, obviously there are 1m + ways to skin a cat. Not everyone who frequents trading blogs has access to VC / private equity pools. Typical retail Joe needs to have realistic expectations about compounding capital and building wealth. For every nest, there's got to be "X" "un-nest's". And you're right, every individual investor needs to a) identify their circle of competence, and b) stick within it. The easiest way to compound wealth is to not trade. Buy SPY in equal $ increments over time and let compounding work.

Funny how after decades, you can build a nice nest egg by actually not doing much, which is the antithesis of trading.