I wrote on February 24th about whether the time had come to take profits on oil refining stocks like Tesoro, Valero, and others. (My conclusion was to hold the stocks for the time being, but to keep a close eye on them).

Since then, oil refiners have continued rising (generally), as oil prices have showed continuing weakness – especially in the last 30 days. Crude oil, of course, is the key input for refiners, so refiners benefit when its raw materials prices are low. Nymex crude fell below $50/bbl Wednesday, having fallen from $61 on June 23, 2015, and from $107 on June 20, 2014 (data from eia.gov).

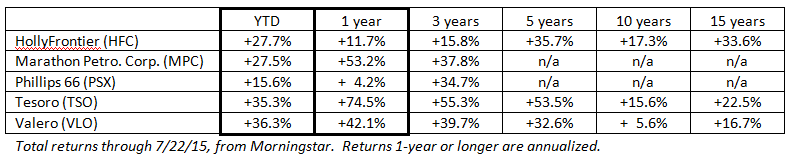

Here's an updated table showing performance of selected refiners through July 22:

On Thursday, July 23rd, oil and refining stocks both fell. But more often recently, it's been…

Oil down, refiners up!

With the largest refiners up anywhere from 15-36% year-to-date, this industry represents one of the very brightest spots – not just in energy, but in the whole stock market. MLPs meanwhile, are down, despite representing another popular energy-sector investment for those wanting exposure that is supposedly less susceptible to falling oil prices.

Of course, the driving reason for refiners' stellar 1-year returns is, once again, that oil refiners actually benefit from being able to pay lower prices for crude oil, which seems to have entered a fresh downturn in the last month. Not that oil prices and refinery stocks always negatively correlate, mind you. In fact, the two often move up and down together. But the past 13 months of declining oil prices has certainly helped refiners' stocks outperform other sectors, and especially the broader energy sector (i.e., funds like XLE and even the aforementioned MLPs).

What to do with these winners if you own them

Right now, refiners' stock charts generally continue to show strength. Technically speaking, all 5 of the aforementioned stocks are showing "green triangles" on their MarketClub charts, have busted through upside resistance levels, and have RSIs below 70. Take a look, but right now, you might just put these on a watch list to sell partial positions when the upside begins to slow down and divergences begin to appear.

Fundamentally, signs also seem positive for refiners. The WSJ's Energy blog on Thursday quoted Credit Suisse as saying refining margins in California are almost $60/bbl, which is "higher than the oil price itself." The blog also quoted energy economist Phil Verleger's March 2015 calculation that the US only had enough gasoline supplies to last 27 days – and an even skimpier 12 days for California, where some refineries have just emerged from unplanned outages in the spring. The blog notes that California is also geographically isolated from refiners elsewhere. Overall, the high margins and short supply of refined products could be anecdotal evidence of a good selling environment for downstream companies.

Even more basic, though, is (of course) crude oil prices. If crude prices stay low, refiners would seem to have smooth operating sailing. How will crude prices behave over the next 6-12 months? It's anyone's guess, as always. Sentiment seems broadly and firmly in the camp that oil prices will remain low and possibly even go lower. Which leads me (as a contrarian) to wonder if sentiment is too dour. Here are some examples of low-oil price prognosticators:

BloombergBusiness quoted Thursday a Moody's higher-up as saying "low oil prices are here to stay"… although the ratings firm's official (perhaps outdated?) prediction remains $60-65 crude prices this year, which would represent healthy upside compared to today's sub-$50 prices.

OilPrice.com last week ran the headline: "Oil Shows No Signs Of A Rebound Amid Ongoing Slump." The article, of course, cites several well-known (read: priced-in) factors like Iran, ongoing production, etc.

Finally, Morgan Stanley analysts, according to Bloomberg, published a report Wednesday projecting the oil slump could last another 3 years or longer – which the analysts arrestingly pointed out would be "far worse than 1986."

The Morgan Stanley piece, before offering its "far worse than 1986" conclusions, reportedly laid the landscape by illustrating where we currently stand in the cycle. The authors write that anyone might have predicted a handful of dynamics that have, in fact, come to pass – as follows:

• Oil demand has, in fact, already responded to low prices by surging about 1.6 million barrels a day over last year's average.

• Energy companies have, in fact, already cut spending. "Since October, the number of rigs actively drilling for new oil around the world has declined about 42 percent. More than 70,000 oil workers have lost their jobs globally, and in 2015 alone, listed oil companies have cut about $129 billion in capital expenditures."

• Oil companies' stocks have, in fact (as anyone might have predicted), already fallen substantially.

And even with those dynamics in place, Morgan's analysts opine, oil is still flailing below $50. Their explanation? Despite the 3 points above, the authors point out that actual oil supply has NOT fallen – even despite what most people would have probably thought would occur. The report says that, in theory, with strong demand for oil and less money for drilling and exploration, the global oil glut should have diminished, allowing a recovery to commence. But in practice? "The opposite has happened. While U.S. production has leveled off since June, OPEC has taken up the role of market spoiler."

Morgan Stanley concludes that since even more supply could be coming online via Iran, Libya, etc., and since even US production could increase again if prices were to begin rising, the slump could last for more than a few years.

My contrarian take? I don't know, for me, all the headlines and sentiment pointing to a long, protracted period of $50-60 oil is a bit much. It's reminiscent of so many other "analyst forecasts," which never seem to stray far from current levels. How many of these analysts called for $50 oil when it was trading over $100? Most were projecting oil between a range of $80-120. Here's a link to another recent article that agrees with my gut feel that projections for oil to stay in the $50-60 range are probably being too unimaginative. The article introduces you to one pundit who says, "Oil markets aren't nearly as oversupplied as many believe and spare capacity is tight since Saudi Arabia is pumping all the crude it can without new drilling."

On the other hand, though (is that my 3rd hand yet?), technical indicators – at the moment – all continue to point to weakness in oil prices in the near term. And since I like to invest with the indicators in my favor, I'm not advocating any big bets that depend on rapidly rising oil prices at this time.

As for refiners, earnings reports are coming soon –adding the likelihood of a good deal of volatility. Here's a list of upcoming earnings report dates:

• HFC: August 5

• MPC: July 30

• VLO: July 30

• TSO: August 5

• PSX: July 31

One other point: VLO announced an additional $2.5 billion share repurchases authorization on July 13th. And that follows over $2 billion in actual stock buybacks since 1/1/2014, according to a company presentation. They're buying! Very interesting!

Conclusion

In summary, like I said in February, I've always believed in riding your winners until you have a reason to exit, such as chart pattern deterioration, a change in your investing thesis, or achieving a price target. As of today, I don't see the first two conditions occurring yet.

If you've achieved your price targets, and if you want to protect against earnings-season volatility, you might consider either sell partial positions, or possibly buying puts (especially if you have a large unrealized gain in a taxable account and don't necessarily want to realize gains, unless necessary to avoid near-term losses).

Good luck!

Best,

Adam Feik

INO.com Contributor - Energies

Disclosure: At the time of post publication, this contributor did not own any stock mentioned. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

ALL of my oil/gas/refiners/pipelines/and oil services companies are taking hits. I hesitate to sell because I own many of them for free after reinvesting profits, but, as a group, they are now worth 50% of what they were a couple months ago. Most of what I have left are not oil companies per se: KMI, PBA, STNG, SDRL, CQP but they're all taking a hit.

Seems to me cheaper oil, means more use, which means more oil being sent to refiners thru pipelines and on tanker ships.

So why do you think those are going down like the rest? And what would be your philosophy about holding/selling stocks you own for free? Thanks!