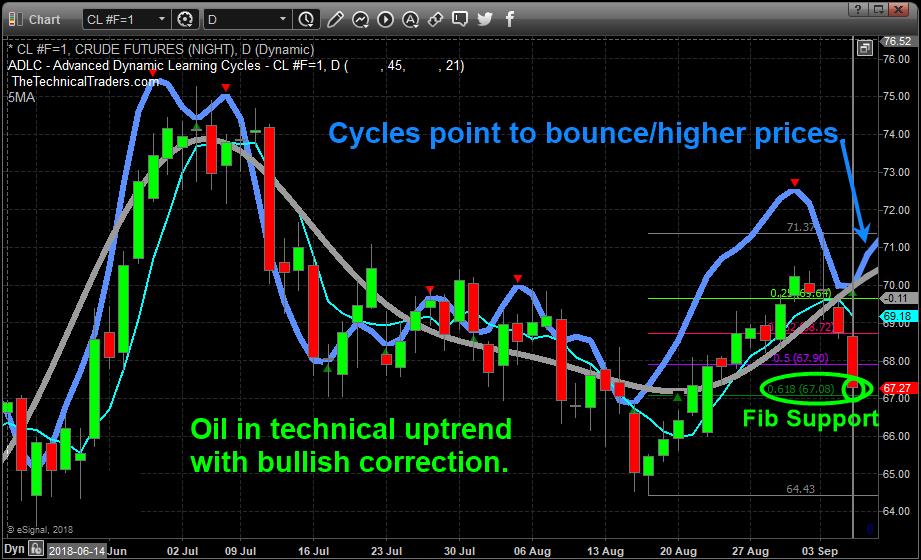

Our research team warned of this move in Crude Oil back on October 7, 2018. At that time, we cautioned that Oil may follow a historical price pattern, moving dramatically lower and that lows near $65 may become the ultimate bottom for that move. Here we are with a price below that level, and many are asking “where will it go from here?”.

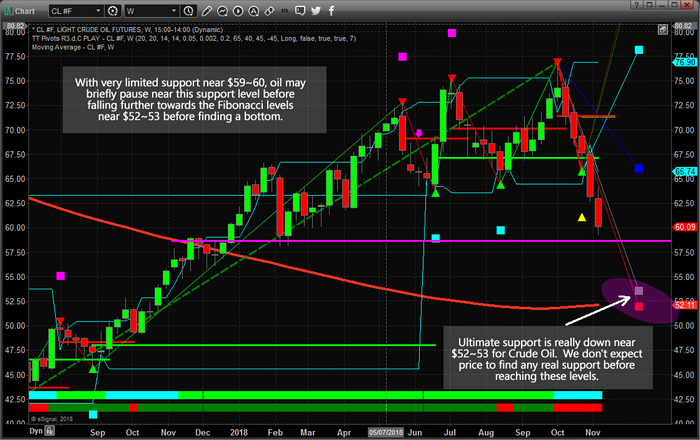

We believe the support near $65, although clearly broken, may eventually become resistance for a future upside price move. Our proprietary Fibonacci price modeling system is suggesting a new target near $52~53, and we believe this downside move in Oil is far from over at this point.

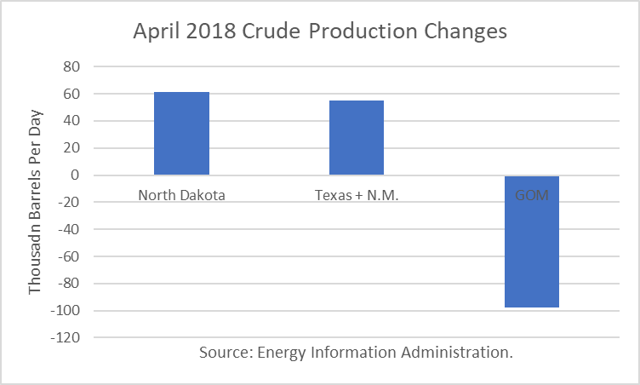

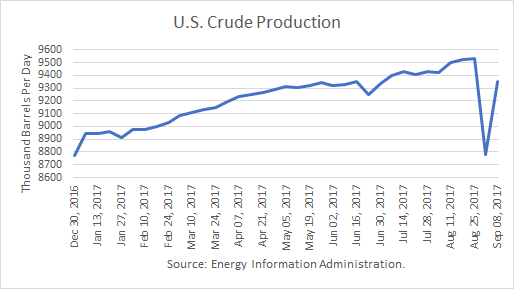

The current global climate for Oil is that suppliers are pumping more and more oil into the market at a time when, historically, prices should continue to decline. One of our research tools includes the ability to identify overall bias models for each week, month or quarter. Traditionally, Oil is dramatically weaker in November and relatively flat for December. Continue reading "Will Oil Find Support Near $60?"