Introduction

As corporate America continues to search for creative ways to streamline costs and reduce expenditures pertaining to medical expenses, more companies than ever are offering High Deductible Health Plans (HDHPs) with a companion Health Savings Account (HSA) option. Two-thirds of companies with 1,000 employees or more are offering this HDHP/HSA option. The popularity of the HDHP/HSA combination has increased substantially over the past decade. As of 2014, 17.4 million people were enrolled in HDHP/HSA compared to a mere 3.2 million in 2006, a five-fold increase in just 8 years. In short, an HDHP is a pre-tax medical plan that requires the employee to absorb the cost of medical expenses up front to a defined dollar amount to satisfy a deductible before the traditional medical plan provides coverage. In addition to reducing medical expenses by shifting the cost burden onto the employee, the employer circumvents the 40% excise tax that the Affordable Health Care Act will impose on high-value insurance plans beginning in 2018. These plans may be a win-win for both the employer and employee.

For 2015, a qualified HDHP translates into a medical plan that has a minimum deductible of $1,300 for an individual and $2,600 for a family, which must be met prior to insurance benefits kicking in and providing coverage. HSAs offer many great advantages to address current medical needs while simultaneously providing potential for long-term account accumulation. Leveraging the advantages the HSAs offer via pre-tax contributions, tax-free earnings from interest and investments and tax-free withdrawals for qualified medical expenses is just the beginning. The long-term potential in the fact that unused contributions roll over each year and are not subject to the "use it or lose it" rule and at age 65 withdrawals can be made penalty-free for non-medical reasons can have a very significant impact on retirement. At age 65, the HSA acts in a similar fashion as a traditional IRA and taxed at the individual's effective tax rate, thus over the long-term, HSAs can serve as an invaluable source of retirement income while simultaneously serving as a personalized long-term health care cost containment play.

High-Level Overview

• All HSA contributions belong to you and are deposited into an account in your name

• All HSA contributions and earnings from interest and investments are tax-free

• Withdrawals for qualified medical expenses are tax-free

• Unused contributions roll over each year and are not subject to the "use it or lose it" rule

• At age 65 withdrawals can be made penalty-free for non-medical reasons

• At age 65 one can make withdrawals for non-medical expenses and taxed at his effective tax rate on those distributions

HDHPs and the HSA Component

HDHPs include an HSA that allows employees to save tax-free money for current or future medical needs, even in retirement. Unlike a Flexible Spending Account (FSA), money contributed to an HSA rolls over year after year and is not subject to the "use it or lose it" rule that governs FSAs. The funds deposited by you and your employer into the HSA belong to you forever and are never relinquished under any circumstance except on the account holders' accord. These HSA funds are not limited to the cash deposits from each paycheck and thus funds in excess of a balance threshold amount (typically $2,000, however this is determined by your employer and the HSA provider) are eligible for investing in a variety of mutual funds and other investment products. For 2015, the contribution limits are set at $3,350 and $6,650 for individuals and families, respectively. If over the age of 55, one may contribute an additional $1,000 as catch-up contributions in 2015. These gross amounts are the total amounts deposited into the HSA account between yourself and the employer. Thus leveraging the HSA, one has the year after year potential to benefit from long-term account accumulation, interest and appreciation while saving for future medical needs and most notably retirement.

HDHP and Traditional Medical Plan Premiums

HDHP premiums will cost a fraction of the price when compared to a traditional PPO90 plan and thus put more money in your pocket each paycheck. The trade-off is the financial obligation to shoulder the entire deductible up front prior to your selected medical plan kicking in and potentially paying higher maximum out-of-pocket expenses. For 2015, the maximum out-of-pocket expenses for an individual and family are $6,450 and $12,900, respectively. However, many companies will have much lower maximum out-of-pocket expenses built into their HDHP. Many companies provide corporate wellness programs that incentivize employees to maintain a preventative and healthy lifestyle. These wellness programs typically require an annual biometric screening along with a blood panel and in return the employer will apply discounts to the medical premiums employees pay. In certain situations, factoring in the wellness discount, individual policy holders may pay as low as $0 in premiums and a family will likely pay a nominal premium for access to the HDHP. The maximum contributions to an HSA are $3,350 and $6,650 for individuals and families, respectively. For a family, medical premiums can easily run north of $6,650 annually for a PPO90 plan and instead of paying the ~$6,650 in premiums, you have an opportunity to contribute this amount into an HSA. The potential for long-term account accumulation using the money that normally would have been allocated towards traditional medical premiums and channeling these funds into an HSA instead presents a financially compelling case.

The Deductible and Medical Coverage

Satisfying the predetermined deductible is a prerequisite within HDHPs prior to the medical plan kicking in and providing coverage. Per the IRS guidelines, the minimum deductible is $1,300 and $2,600 for an individual and family, respectively. In an effort to encourage employees to enroll in the HDHPs, typically the employer will make an annual one-time contribution on behalf of the employee to the HSA, thus offsetting the deductible amount. In fact, two-thirds of employers offering the HDHP/HSA option place money into those accounts and in many cases the employer contribution can be significant. Contributions of $500 for individuals and $1,000 for families is commonplace throughout large corporations, thus decreasing your deductible by as much as ~40% and rendering your effective deductible to a much more manageable amount. In terms of medical coverage using the HDHP, the insurance plan usually covers preventative care at 100% and all ancillary medical expenses are billed directly to the insurance company and the policyholder is charged the negotiated rates between the provider and insurance company. The insurance coverage, albeit in the deductible phase, still provides financial benefits in your favor via these negotiated rates. All covered medical expenses are applicable to this deductible, including prescriptions. Once the deductible is satisfied, your selected insurance coverage takes over as a normal plan would. The deductible amount that one must satisfy varies from company to company, but the minimum is set by the IRS.

The Triple-Tax Advantage and Retirement Implications

HSAs provide a triple tax advantage:

1) Contributions are tax-free or pre-tax

2) All earnings from interest and investments are tax-free

3) Withdrawals for qualified medical expenses are tax-free.

Better yet, at age 65 withdrawals can be made on these accumulated funds, penalty free for non-medical reasons, similar to a traditional IRA at the individual's effective tax rate. Lump-sum contributions are permitted. However, one must capture this post-tax HSA contribution action to reduce his adjusted gross income.

Limited Purpose and Dependent Care Flexible Savings Account (FSA) Options

For those that are actively participating in the HDHP accompanied by an HSA who also want to contribute to an FSA for dental and vision expenses have the option via a limited-purpose FSA. You can contribute up to $2,500 pre-tax dollars into this limited purpose FSA each year, in addition to your HSA. You can only use money in your limited purpose FSA to cover dental and vision expenses including orthodontia, contact lens solution and LASIK surgery for yourself and eligible dependents. The Dependent Care FSA is not impacted either. Thus, the employee can contribute up to $5,000 annually into this account. Collectively, the FSA options allow maximum contributions of $7,500 annually in addition to the HSA.

The HSA Flexibility

HSAs have tremendous flexibility with regard to making contributions and paying medical bills on your own terms and circumstances. When electing to enroll in an HDHP, you have the ability to modify your contributions at any time and in fact you're not required to contribute any money at all to the HSA account. If you're single and in good health and don't anticipate utilizing any non-preventative medical treatments you can take the employer contribution and pay next to nothing for the HDHP while saving thousands. In the event a medical situation arises, you can increase your contributions accordingly. Therefore, you can contribute when and how much you want at any time as your medical situation dictates. You can even make a lump sum contribution from an external bank account and make the tax adjustments during filing. You also have the ability to pay medical bills several different ways; using your HSA debit card at the point of sale, reimbursing yourself after paying out-of-pocket or coordinating with the HSA provider to pay the insurance company on your behalf using the funds in your HSA account.

IRS Health Saving Account (HSA) Eligibility

Below are the IRS requirements for opening and contributing to an HSA:

1) Must be covered under a qualified HDHP

2) May not be covered under any health plan that is not qualified

3) Must not be enrolled in Medicare

4) You may not be claimed as a dependent on another individual's tax return

5) Must not have access to dollars in a Flexible Spending Account (FSA)

For further details and plan requirements, refer to: Publication 969 - Main Content

Utilizing the HSA as a Loss of Medical Coverage Hedge

HSAs can provide peace of mind in the face of an unexpected job loss and subsequent loss of medical benefits. The accumulated funds in this account are readily accessible and will likely mitigate the loss of medical insurance since money in this account has been earmarked for medical expenses. Depending on the account balance, this may provide the option to purchase a lower value plan and thus pay much lower premiums in a job loss situation when expenses are particularly important.

Leveraging the HSA as a Second Retirement Account

Here is where the long-term financial benefits of owning an HSA can be realized. The long-term advantages of HSAs and its implications in augmenting your overall retirement strategy can be very meaningful. As mentioned previously, the maximum contributions to an HSA is $3,350 and $6,650 for individuals and families, respectively. The contribution cap is inclusive of both the employer and employee, thus the maximum contributions permitted by the IRS less the employer contribution results in the amount the employee can contribute. For a family, medical premiums can easily run $6,650 annually for a PPO90 plan. Instead of paying the ~$6,650 in premiums, you can allocate this amount into an HSA collectively between the employer and employee contributions. The IRS stipulates that the minimum deductible for a family under the HDHP is $2,600, therefore if anyone in the family receives medical services beyond preventative care they will incur full cost of services until they reach the $2,600 threshold prior to the PPO90 plan kicking in and providing coverage.

Let's use a family as an example and assume that the HDHP requires a $3,100 ($500 higher than the IRS guideline to be conservative) deductible and between you and your employer an aggregate amount of $6,650 is deposited into your account annually. This leaves $3,550 assuming you and your family collectively received $3,000 in non-preventative medical care to satisfy the deductible (again conservative). Once the $3,000 is exhausted from the HSA account the PPO90 kicks in as it normally would have without opting for the HDHP/HSA up front. This leaves you with the same coverage and $3,550 in investable cash. Considering that these funds are intended to cover medical expenses, a conservative HSA portfolio may be the ideal approach in the event these funds need to be accessed in a catastrophic medical situation. Earmarking this investable cash into conservative investments to mitigate risk exposure and maintaining the account cash threshold balance of $2,000 to ensure liquidity may augment your retirement strategy in a meaningful manner.

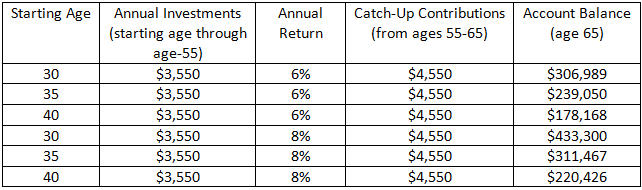

This conservative exercise assumes that there is never an annual increase in contributions (the IRS will allow increases in subsequent years much like 401k maximum contributions are increased) and that the deductible will be reached each and every year. Since there will be years where medical expenses will not exceed and exceed the deductible, as an average, I factored in the deductible being satisfied. I used three different starting ages with two different annual return scenarios to reflect a range of potential account values at retirement.

Starting at age 30 and investing the additional $3,550 annually with a conservative 6% return and allocating the additional catch-up contributions of $1,000 from age 55 to 65 will result in $306,989 at age 65 in current dollars without any increases in the contribution limits. At age 65 HSA funds can be withdrawn without penalty for non-medical reasons. Starting at age 35, this allocation and investment return method results in a net account value of $239,050. Applying an 8% annual return to the above scenario, $433,300 is accumulated for the 30-year-old and $311,467 is accumulated for the 35-year-old. I factored in potential account values based on a starting age of 40 as reflected in the table for more of a comprehensive overview. Based on the above examples, this presents a very compelling retirement and health care cost containment strategy.

Summary

Utilizing funds normally reserved for paying medical premiums can be earmarked to an HSA to augment your long-term retirement goals and contain long-term health care costs. Using a family as an example that normally opts for the PPO90 medical plan and satisfying the deductible each year, one can make a meaningful impact on his retirement. Conservatively, starting at age 30 one can amass an HSA value of greater than $300,000 and potentially greater than $400,000 when a more aggressive annual return is factored into the analysis. These funds can be withdrawn at age 65 without penalty for non-medical reasons at the individual's effective tax rate. This could potentially serve as a dual purpose; 1) additional retirement income and 2) the flexibility to content with current and future medical costs.

Noah Kiedrowski

INO.com Contributor - Biotech

Disclosure: The author utilizes a HDHP/HSA as part of his retirement strategy and long-term medical cost containment. The author has no business relationship with any company that solicits benefit plans. This article reflects his own opinions. I am not a certified financial advisor or tax professional. This is not a recommendation to enroll in an employer sponsored Health Savings Account (HSA). Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses.

Additional References

IRS.gov 26 CFR 601.602: Tax forms and instructions

kff.org - 2014 Employer Health Benefits Survey

Towers Watson/NBGH Employer Survey on Purchasing Value in Health Care

Can a retired person using a non-corporate health insurance plan also qualify for a health savings account?

Hi Richard

If you're enrolled in Medicare and/or you're not utilizing a HDHP, you cannot contribute to an HSA, If you're retired and utilizing a HDHP and have an existing HSA, you can make contributions into the account. HSAs become much more complicated when entering into the retirement age and the interplay between Medicare, Social Security, employment status (whether or not you have access to an employer sponsored HSA) and the type of health plan can be tricky to navigate. Check out the AARP website for useful information regarding FSAs and retirement.

Thanks for the comment, Noah