Unless you've been incommunicado this past week, you've surely noticed that the FX arena has been dominated by one trade. That, of course, is short Sterling, because Britain appears on the verge of leaving the European Union (EU).

The black swan event that brought about this situation was the surprise announcement by Boris Johnson, the incumbent Mayor of London. Johnson, a rising star of the Tories, is campaigning for Britain to leave the EU. That, of course, was a bit of a game changer. Investors got spooked by the thought of the financial Armageddon that could be visited upon Britain if a Brexit (British Exit) does occur.

Luckily, such panic creates an ideal situation for the rational investor. It's time to exploit and buy the Sterling low and sell it high later on when Brexit fears fade.

Why A Brexit Is Unlikely

One might presume that investors are thinking rationally. After all, if a political heavyweight like Boris Johnson supports Brexit there must be a strong base for it, right? The fact is there's not.

Eventually, it won't matter which politician is campaigning for a Brexit. Britain's citizens must be in distress. They must believe they have no other option except to risk a Brexit and possible financial catastrophe. And that is simply not the case.

Most of the British business community, from small businesses to corporates, depend on Britain being part of the European Union. Voting against the status quo in the upcoming referendum will be the equivalent of shooting one's own foot. Either they employ immigrants from Eastern Europe to operate their business, restaurants, etc., or they export to the EU. In fact, the majority of clients from London's banking sector come from the European Union.

All of that is in jeopardy if Britain chooses a Brexit and that is why it's simply not logical. Unemployment is low, growth is stable and overall the UK is doing fine. This is not the typical Greece-like cauldron that can cook a Brexit. Britons are just not desperate enough. Prime Minister David Cameron's compromise of negotiating a better deal is much more appealing, even without aggressive campaigning.

In fact, one does not have to go too far back to draw a comparison. Scotland, despite the high appeal of leaving the UK, last year voted to stay and avoid the risk of a financial meltdown. And that is exactly the same scenario we are facing now. Ultimately, logic will prevail.

The Sterling Play

Taking a closer look, we can see the Pound Sterling looks strong as compared to most peers, e.g. the Yen and the Euro (but not the Dollar). Growth is at an annual pace of 1.9%, unemployment is at 5.1%, and despite low inflation, wages are on the rise. All of which means that when the panic fades the FX market will return to price the Sterling for its fundamentals. That, of course, means much higher than its current lows, which presents a convenient opportunity to buy the Sterling on the dip.

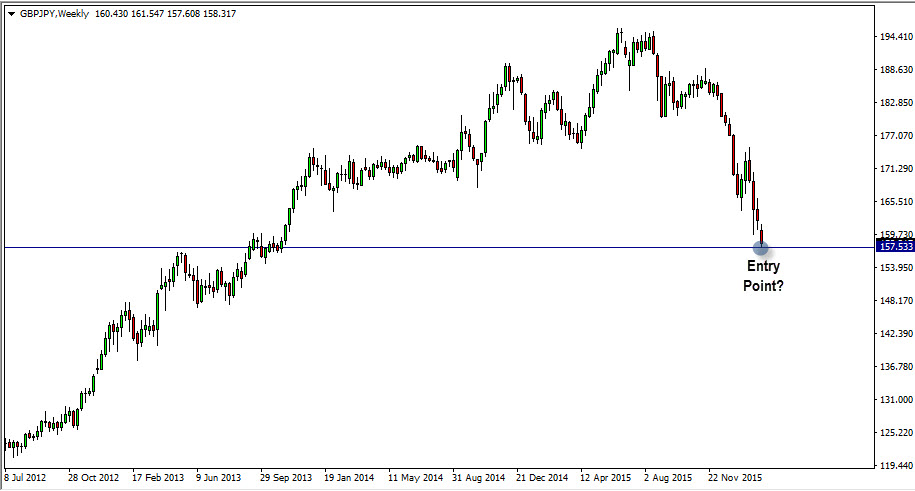

However, buying on the dip (in our case, the GBP/JPY) doesn't mean timing your entry is immaterial. One possible way is to wait for a level of support to emerge. In this way, we increase our chances of riding the rebound back above 170 rather than having to catch a falling knife. In other words, the prudent Sterling buyer must wait for the panic to ease but enter before the appetite for Sterling resumes in full throttle.

Chart courtesy of Metaquotes

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Thanks for the article, I appreciate the overall analysis and numbers in it. Britain is not part of the Eurozone though. The "Eurozone" is the area of select EU member countries using the Euro currency, some ten or eleven EU member countries do not one of which is Britain.

Little wonder there's so much confusion, this is partly caused by the "euro's" utterly brainless name. Here are a few key terms off the top of my head for clarification:

"euro"=common paper currency, replacing ECU (Europ. Currency Unit) at Rates of Exchange of 01/01/2002;

Europe=geographic continent extending beyond the EU (European Union);

EEA=European Economic Area including all of the EU plus Switzerland, Liechtenstein, Iceland, Norway;

EFTA= Europ. Free Trade Agreement covering Liechtenstein, Iceland, Norway and EU as a "group member";

EEC=European Economic Community, initially consisting of FR, IT, DE, BE, NL, LUX and later joined by Denmark/Ireland/UK (1975), Greece (1081), Austria/Finland/Sweden (1994), Portugal/Spain (1998), and the rest (The Baltics, Slovenia, Czech Rep, and rest of SE Europ countries in the run/up to establishing the infamous EU as a precursor to that undemocratic superstate that thing is moving towards now) was one of three "specialist" organisations aimed at "harmonising" some aspects of trade and establishing the initially hailed "basic freedoms" (of worker movement, settling for business, free movement of goods/trade without tariffs) which have proven little more than a con game luring the electorate into "supporting European integration" which is not what people really want if it comes at such a large cost to democracy, legal rights, and overall freedom to everyone;

"EU" does not mean *Europe* but only "Europ Union" excluding large areas of Europe (such as CH, RU, BR, ML, AB)

"Eurozone"=area of 19 countries having killed their currencies to squander taxpayer wealth in "euro" experiment

The article would have been so much better if the author had, at least, researched the term "Eurozone" prior to writing it.

Regards,

Mark

Dear Mark,

Thank you for writing so extensively and bringing to my attention that error.

That is indeed a human error , my intention was to refer to the European Union.

I also want to thank you for the feedback , I do believe there is some truth in that the overwhelming amount of different economic packs in the region is not merely technical but reflects a much wider disharmony.

All the best.

Lior.

Dear Lior,

thanks for commenting back. You are spot on when it comes to the overall disharmony in the region (and beyond the immediate one, if we take future developments like "CETA" and "TTIP" into account). It will be up to the electorate to fix the problem and prevent those future ones from growing on top in all countries affected -- which then even includes Canada and the U. S.

Best wishes and keep up the good work,

Mark

Someone yells fire in a crowded theater.

There actually is no fire.

Nevertheless, people are trampled.

Lesson? Invest in fundamentals at your peril.

Dear Lior

Brexit means Britain (and therefore, Sterling) is leaving the European Union, not the Eurozone. The Eurozone is 19 countries within the European Union (excluding Britain) which have the Euro as their sole currency.

Regards, Ziad

...but, with "knowledge" like that, they are giving us (fundamental) advice (and fundamentals include knowing what the EU and what the Eurozone would be)!

Also, Brexit is not a "fear" but would rather be a chance for both Britain, all of Europe and the rest of the OECD and IMF-infested world (to finally wake up from their wet dreams).

Apart from the above, that trading potential may be a correct observation for a Brexit would, indeed, be bullish for sterling because of freeing the country's economy from EU shackles and all kinds of associated costs and red tape including, but not at all limited to, EU contributions (in excess of £50m PER DAY) and similar waste of money.

Little wonder, then, that sterling's RoE is responding favourably.

Hi Ziad,

Thank you for your comment.

My sincerest apology, this is a human error the intention was European Union.

Thank for bringing it to my attention.

Best regards!

Lior.

Britain is not in the Eurozone but in the EU...

Dear Petros,

Thank you for noticing.

This is indeed a human error, my intention was to refer to the EU.

I highly appreciate you notifying me on this error .

Thank you.

Dear Lior,

Thanks for your article. This concept of taking reverse to the bad news. At which level of support you think it will be the support ? Previous bottom nearly 148 ?

Hi Max,

I think its best to wait for technical signs of a trend fatigue before jumping in.

But since Brexit in my eyes at least seems remote, I am waiting for that bottom to emerge sooner rather than later.

Hope this helps.

Thank you.