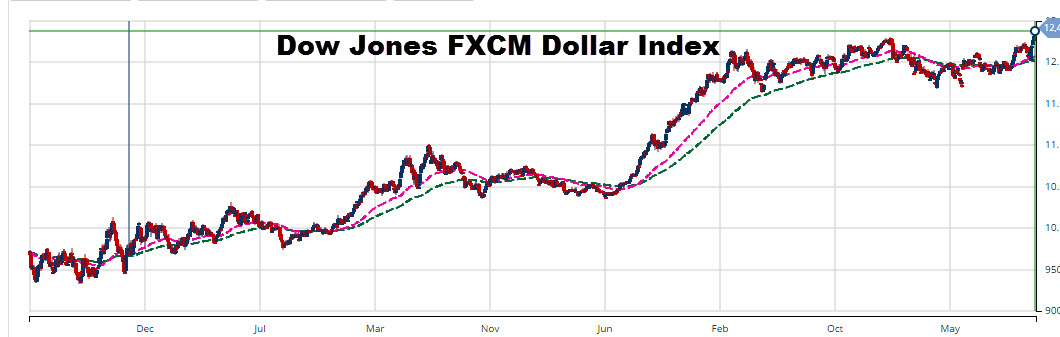

President-elect Donald Trump’s inauguration won’t take place for two more months and yet his proposed economic plan is already sending ripples through markets. Treasury notes and bonds are tanking, stocks are rallying and the Dollar Index has surged to highs not seen in more than 10 years. All of which is in utter contrast to what analysts had expected to occur post-Trump’s election, and which seemingly presents a paradox of sorts. Trump’s two economic focal points are aggressive tax cuts and massive infrastructure investment. Both are expected, according to The Office of Management and Budget, to push the US debt burden by roughly 25% of GDP by 2020. And yet, in conjunction with those expectations, the Dollar is gaining.

Naturally, the most obvious reason would be that higher deficits will lead to inflation and, consequently, would force the Federal Reserve to raise interest rates. But that is a consequence rather than a reason. The real reason is that both the US economy and the US banking system have been ripe for higher rates for a while, and Trump’s plans for the economy, or “Trumponomics” as we like to call it, is merely a catalyst for an already strong economy.

Trumponomics in Brief

Trumponomics is, of course, a play on words derived from the name Trump and economics. However, it’s also an attempt to link Trump’s plan to another US President, namely Ronald Reagan and his Reaganomics. Under President Regan, the US government had cut the federal corporate tax rate by 12%, from 46% to 34%, and propelled the US economy to its longest growth cycle since the end of the second World War.

Trump and his Trumponomics plan offer an even greater change to the corporate tax, suggesting a cut from today’s 35% rate to 15% and it includes tax incentives for corporates to repatriate their funds from tax shelters.

Other dimensions of Trump’s plan include renegotiation of existing US trade agreements, specifically the controversial Trans-Pacific Partnership Agreement. Overall, Trump wants to bring a more protectionist trade policy to America. Finally, he intends to curb immigration to the US, both by laws and by walls.

Yet, from those, the two ideas that seem most likely to materialize is tax cuts (even though such a deep cut to corporate tax seems a bit far-fetched) and infrastructure investment, which is certainly likely and very much needed. That’s not to say that Trump’s other plans could not materialize but those are more controversial and face myriad legal challenges. Trump could face an uphill battle on the execution of those plans. Hence, our focus on the immediate time frame is tax cuts, infrastructure plans and the risk of higher deficits.

Pricing in Trumponomics

So, now the inevitable question is where do we go from here? What can we expect from the Fed, the US bond market and the Dollar?

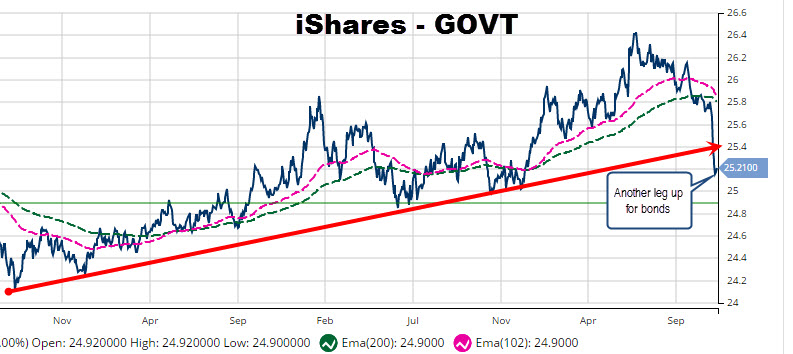

When we examine the iShares US Treasury Bond (PACF:GOVT), which holds a wide range of US notes and bonds from various maturities, we can see the upward trend in bonds is now likely to be over but, still, there needs to be another “leg up.” Another attempted to break higher for bonds is needed before a bearish cycle for bonds could be established and, of course, the Dollar pushed towards new highs. How exactly will that play out? The answer might lay with the Fed.

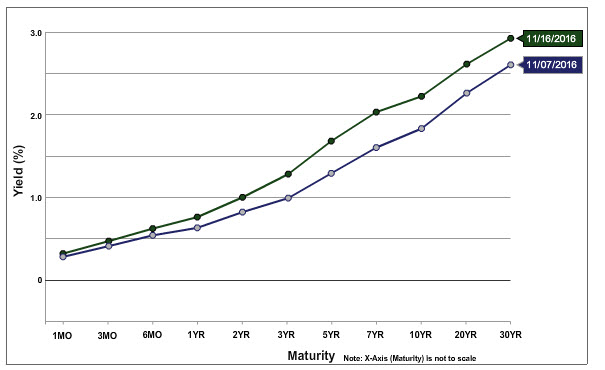

Where is the Fed? The CBOE rate probability tool, which is driven by rate derivatives, which puts the chance for a December rate hike to 0.75% is currently more than 90%. Nevertheless, the real variable is 2017. The CBOE tool, suggest the next rate hike will still come a year from now. This is also reflected when we compare the US Treasury yield curve of today vs. November 7th, the day before the election. Rates on the yield curve are higher, but the steepness hasn’t changed.

Chart courtesy of U.S. Department of Treasury

If we move on to connect the dots, the market is almost certain that a rate hike is coming this December, and that is likely already priced in for the Dollar. But once the Fed raises rates the big question will be when is the one? That is likely to lead to an end of the Dollar rally for the very near term and could bring some profit taking in the Dollar and a rebound for bonds. Put another way, here is our “leg up.”

But once Trumponomics seems closer to materializing, even if only partially fulfilled (and that process could happen as soon as March), then we can finally see the bullish trend in bonds reversing, yields going even higher and, of course, the Dollar resuming its bullish trend.

MarketClub Chart of DJ FXCM Dollar Index (INDEX:USDOLLAR)

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Trump is more considered as a Businessman, rather then Economist or politician, so all possible measures and policies will be a type of "out of Box", and may be shocking, hard and harsh too.

As per my view, he will more emphasizes on both, Employment and Government's Tax revenue generation and try to curb Imports, as specially of consumer goods, some "Made in USA" type campaigns. However his tuning with FED and how will he get support from FED policy makers is a key issue, so on that ground, some obstacles, controversy and conflicts may appear between FED Policy makers and Trump or Government body are quite possible and these are so crucial that it just can't be ruled-out. Social Securities budget will also be a big issue, and may get some cuts or modifications therein.

As far as global politics or US interventions are concerned, to regain or re-establish US identity, Trump will prefer to focus issues like Growth - Economy, business reforms, Tax restructuring so he may prefer either to keep away from that typical "Uncle Sam's Role" or may adopt some soft or soft neutral approach.

Finally, i would like to point-out that it will not surprising for me that being a President, we will find Totally different personality of Trump, which is earlier or currently established from his Election campaign and media drawn picture. Evaluating present US situation as a whole, There is much more chances that after his beginning, and getting some out-come of his policies and actions. US people and media too, will realize that selection of Trump was absolutely proper. Trump may prove himself as the most suitable person to control situation from every "Polyconomic" point-of view.

We should note that the Reagan expansion was driven by unprecedented peace time deficit spending that tripled the federal national debt. In that regard Reagan's growth was like that of George W's and Obama's, false growth that has to be paid back at interest. Trump offers the same thing, wealth redistribution from generations unborn to the present. Unless we think the FR will raise rates dramatically rather than timidly, the dollar will be gutted and commodities will be the plays.

The difference between Dubya's and Rayguns deficit spending and Obama's is that Obama dramatically cut the deficit while the other two, as will Trump, exploded it. Reaganomics was a fraud and Trumponmics will only make things worse for the lower classes in this country going forward. Meanwhile, people like McConnell and Ryan are going orgasmic over the possibility of destroying Social Security and Medicare.

As we could see, the dollar has already appreciated in value due to the positive market sentiment regarding the outcome of the elections and the announced measures for the near future that are going to push the economy forward. Especially important is the huge tax cut which will definitely boost the economic activity. But this current rise in the value of the dollar is initially more the result of post- election euforia, so it may fall a little in the near term before the pronounced economic measures start to take place and effect. Also, in the short term, since the citizens' buying power has increased, they might spend more on imports, which can also cause a slight fall.

In the long term, if the data now available on the forthcoming economic measures are reliable, we may see a considerable rise in the value of the dollar. Once the economic activity gains momentum firms will start to raise more funds by issuing bonds abroad and the dollar value of corporate shares sold abroad is also going to rise. Firms will also be more willing to export, which will cause export revenue to rise, although this effect may be slightly offset by Chinese devaluation. In the long term, a further rise in interest rates is expected, which will also boost the value of the dollar, as more FDI will be flowing into the country.

All in all, the dollar seems to be a good long-term investment if our expectations about the new measures are met.

Your optimism is laudable, Ivana. However, the bond market is crashing and Trump's infrastructure build-out must be paid for ultimately. Seems to me that those are serious problems that can (and will) reprice everything eventually -- the dollar, equities, real estate, and commodities. The world doesn't seem to grasp those points yet.

yes kevin you are right, since long, so many issues remains "Un-Paid" and now there will be a time of payment therefore, even with interest and penalty too, so Globally, economy will face essential situation to redress their economies, and we will find a great "Re-Rating" Re-valuation process for Stocks, Real estate, precious metals, crude oil, currencies and so many other sectors.

We reached to such point that now, Not only "No more free lunch" but No lunch even on credit too, "Pay first and Pay cash only" alike clear scenario.