The NASDAQ (NASDAQ:COMP) has hit a number of new all-time highs in 2017. This has many analysts and investors wondering if the market and especially technology stocks are getting over-heated.

The Bulls will tell you that we are entering a new time of economic expansion and that technology is leading us forward. They say the higher than normal P/E ratios are due to the massive growth opportunities these companies still have moving forward.

The Bears, which I spoke about a few weeks ago, disagree and believe we are heading toward the next dot.com bubble. They say the 'Bulls' growth expectations are already built into tech stocks so much so that these companies are priced to perfection, which we all know is unlikely to happen.

Personally, I sit in-between both camps because I do believe some technology stocks will fail to meet expectations but others are completely changing how commerce is done, and because of their disruptive businesses, they will succeed.

Because I believe some tech stocks will perform poorly while others continue to head for the moon, I think the best way for the average investor to own a piece of this important sector is through Exchange Traded Funds. The diversity of an ETF gives investors the ability to buy the whole sector, without worries too much about who will win and who will fail.

So let's take a quick look at a few technology focused investments that will give you exposure to this rapidly growing industry, while also offering single stock risk protection.

As we all know the bulk of the NASDAQ composite is made up of technology stocks, logical thinking would say that if you want reduces risk exposure to technology stocks, just buy a NASDAQ ETF.

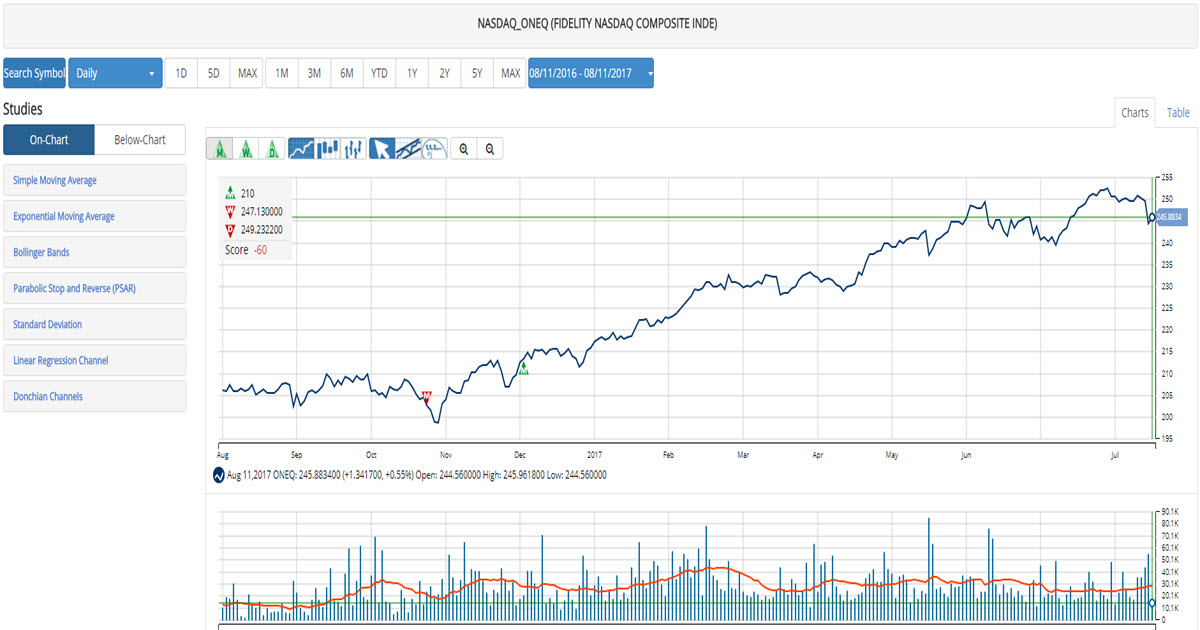

So, while there are a number of options, I would like to point out two that I like. The first is the Fidelity NASDAQ Composite Tracking ETF (NASDAQ:ONEQ) which is market-cap weighted Nasdaq composite tracking ETF. This is an ETF that only tracks Nasdaq-listed stocks and therefore favors technology companies.

ONEQ carriers an expense ratio of 0.21%, a yield of 0.93%, and holds 1900 stocks. It does have a high exposure to the top five holdings, which make up over 26% of the fund, but due to the amount of exposure it offers, it is still a good option.

Chart courtesy of MarketClub

The next is the Technology Select Sector SPDR ETF (PACF:XLK) which offers a wide range amount of exposure to US technology stocks, as it currently holds 71 different companies. This ETF owns all the big tech companies found in the S&P 500, and it is not permitted, per its own guidelines, to hold small and mid-size cap stocks. Due to the fund holding the larger tech stocks, it has been said XLK is more of a 'value' focused ETF which is both good and bad because while this lowers the fund's volatility, it also reduces some of its growth potential.

XLK has an expense ratio of 0.14%, over $17.2 billion in assets under management, and even offers a yield of 1.45%. Largely due to the massive run-up in the big technology stocks this year, XLK is up 20.8% year-to-date and more than 25% over the past 12 months. The biggest downside to XLK is that its top five holdings, Apple, Alphabet, Microsoft, Facebook, and AT&T make up 45% of the fund.

Chart courtesy of MarketClub

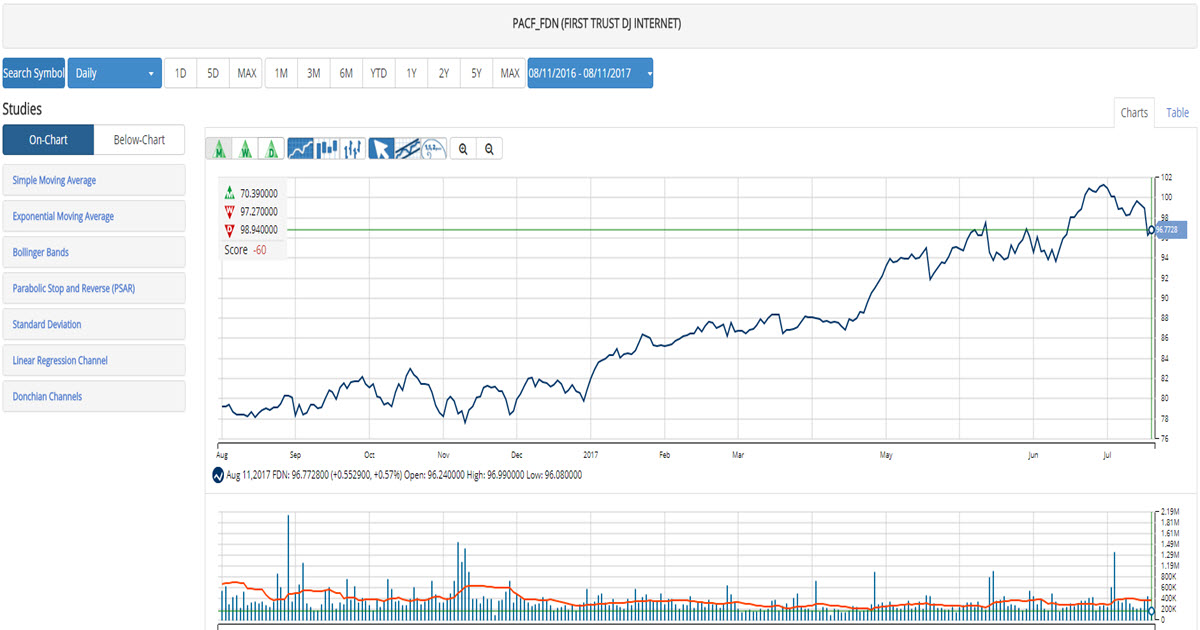

Another, more technology sector specific ETF is the First Trust Dow Jones Internet Index Fund (PACF:FDN) which invests in the largest and most liquid US internet companies. It holds 40 stocks, has $4.5 billion under management, an expense ratio of 0.54%, and an average spread of just 0.05%.The ETF is 100% invested in the US and runs the gambit of internet based companies. The funds top ten holdings include Alphabet, Amazon, Facebook, PayPal, SalesForce, Netflix, eBay, Expedia, TD Ameritrade, and E*Trade and they make up 53% of the fund.

Big names missing in the FDN are companies like Apple, Microsoft, and other technology hardware companies. Some may think that is a bad thing, but separating out the internet and hardware tech companies does make sense since over time hardware becomes commoditized. So as we have seen with Intel and IBM, unless you are the one coming out with the newest, best product every year, the business will struggle.

Chart courtesy of MarketClub

While my list failed to mention leveraged products and some other technology sector specific options such as HACK, the cyber security ETF, and others that I prefer, I want to note that the options I chose were more to help you 'the average' investor understand there is not a one stop shop for investing in specific industries. Each ETF is going to have its pro's and con's, and therefore you need to read the fund prospectus and learn what those are before pulling the trigger on the first one you stumble upon.

Matt Thalman

INO.com Contributor - ETFs

Follow me on Twitter @mthalman5513

Disclosure: This contributor held long positions in Facebook, Apple, Intel, PayPal, eBay, Salesforce, Netflix, Amazon.com, Alphabet, and Microsoft at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.