Analysis originally distributed on March 7, 2018 By: Michael Vodicka of Cannabis Stock Trades

The Canadian cannabis sector scored another blockbuster win last week - and it led to a quick 30% gain for one of Canada's most promising young cannabis companies. If you missed the recent pop higher don't worry - I see this same pattern repeating itself at least a few more times in the next three months. Here's what is going on.

Cronos Group (CRON) is one of Canada's largest and most promising cannabis companies. Shares began trading on the Toronto Venture Stock Exchange in December of 2014. Since then, Cronos has delivered huge gains to shareholders, jumping more than 1400% from its IPO price of $.80.

That impressive performance helped Cronos make history last week when it became the first ever Canadian cannabis producer to trade on the US-based NASDAQ stock exchange.

This is a big win for both Cronos and the broader cannabis sector. It shows the young cannabis industry has quickly gained credibility with Wall Street and millions of investors.

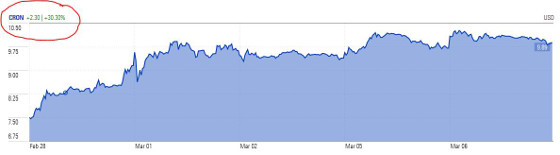

In the short run, the NASDAQ listing gave Cronos a nice boost on the chart. Shares jumped 30% in just the last five days.

However, despite that move higher, I am expecting more.

Cronos Share Price Should Continue To Benefit From The NASDAQ Up Listing

Looking forward, the NASDAQ up listing should be very good for the Cronos share price for two reasons.

1. Larger pool of potential investors:

Being listed on a popular US exchange with trillions of dollars of capital flowing through its systems every day should introduce Cronos to million of potential new investors.

2. Potential inclusion in an index and mutual funds:

Being listed on a US exchange means Cronos could eventually be a holding in an index fund, another factor that could drive additional capital into shares.

These Cannabis Companies Are Likely The Next To Be Up Listed On The NASDAQ

If you missed out on the Cronos bump - don't worry. I see this same pattern repeating itself at least a few times in the next three months.

The success of the Cronos NASDAQ listing has set an important precedent.

It showed Canadian cannabis companies that a NASDAQ listing isn't just possible - it can also be really great for the share price.

That's why I am expecting to see a steady stream of NASDAQ cannabis listings hitting the Street in the next few months.

In fact - it's already happening.

Here are a few companies that are high-probability candidates for an up listing that I will be watching closely.

Canopy Growth Corp (TWMJF) is the largest Canadian cannabis company. That makes Canopy a great candidate for an up listing to NASDAQ. CEO Bruce Linton recently said at a conference that the company is already working on a NASDAQ listing. Although no timeline was given, an announcement is expected within a few months. As we just saw with Cronos, a NASDAQ listing should be very good for Canopy's share price.

Like analysis from Michael Vodicka of Cannabis Stock Trades?

To get the latest analysis as soon as it is released, please subscribe to our free weekly newsletter

Cannabis Stock Trades provides investors reliable information on the cannabis industry and the small group of hidden companies that are cashing in on this explosive trend.

For the time being, Canopy is the only other cannabis company I have seen openly discuss plans to list on the NASDAQ.

However - it's a good bet more are soon to follow.

That includes fellow early industry leaders such as Aphria Corp. (APHQF), Aurora Cannabis (ACBFF), Medreleaf (LEAF) and Cannimed Therapeutics (CMED).

These are companies I will be watching closely for news of a NASDAQ up listing.

Risks To Consider

Some of the potential good news from a NASDAQ up listing has been priced into the cannabis sector. Although I still see plenty of upside on news of an up listing, it may not have quite as big an impact as Cronos saw.

Action To Take

The stock market works in cycles. Right now, I see an early pattern of Canadian cannabis companies rallying on NASDAQ up listings. Keep an eye on these five companies above - they have a high probability of being the next Canadian cannabis company to hit the NASDAQ - and that could be very good for shares.

Enjoy,

|

Michael Vodicka |

The information contained in this post is for informational and educational purposes only. The trading ideas and stock selections represented on the Cannabis Stock Trades website are not tailored to your individual investment needs. Readers and members are advised to consult with their financial advisor before entering into any trade. Cannabis stocks carry a certain level of risk and we accept no responsibility for any potential losses. All trades, patterns, charts, systems, etc. discussed are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.