The American Customer Satisfaction ETF (ACSI) is an Exchange Traded Fund that is built around the idea that companies who have high customer satisfaction, will perform well in the long run, and here is a hint, but there is a lot of evidence to prove this thinking right.

Let's review some of this evidence before we go any further.

- According to a 2011 American Express Survey, 78% of consumers have bailed on a transaction or not made an intended purchase because of poor service experience.

- According to a White House Office of Consumer Affairs report, on average, loyal customers are worth up to 10 times as much as their first purchase.

- Marketing Metrics reports tells us that you have a 5-20% probability of selling to a new prospect but a 60-70% probability of selling to an existing customer.

- “Understanding Customers” by Ruby Newell-Legner says it takes 12 positive experiences to make up for one unresolved negative experience.

- According to a White House Office of Consumer Affairs report, It is 6-7 times more expensive to acquire a new customer than it is to keep a current one.

- According to a 2011 American Express Survey, 3 in 5 Americans (59%) would try a new brand or company for the better service experience.

- According to a White House Office of Consumer Affairs report, News of lousy customer service reaches more than twice as many ears as praise for the good customer service experience.

- According to a 2011 American Express Survey, in 2011, 7 in 10 Americans said they were willing to spend more with companies they believe provide excellent customer service.

- According to Lee Resources, 91% of unhappy customers will not willingly do business with you again.

- A report from the Customer Experience Impact Report by Harris Interactive/RightNow, 2010, found almost 9 out of 10 U.S. consumers say they would pay more to ensure a superior customer experience.

The list could go on and on, but I think you are getting the point. Now think about the list above and think about this list of companies; Amazon.com Inc (AMZN), Apple Inc (AAPL), Vonage Holdings Corp (VG), Alphabet Inc (GOOG), Humana Inc (HUM), FedEx Corp (FDX), JetBlue Airways Corp (JBLU), The Hershey Co (HSY), Coca-Cola Co (KO).

These nine companies represent the type of organizations that consumer considers to have excellent customer service. Think about your own experiences with the companies mentioned. How many “bad” customer services experiences have you had when eating a Hershey’s chocolate bar? Or drinking a Coca-Cola? While FedEx has had a few late packages during the Christmas holiday, not many people have multiple bad stories about the company. As for Google, Apple and Amazon, well they all three changed their industries for the better, so again not too many people complaining other than maybe their competitors.

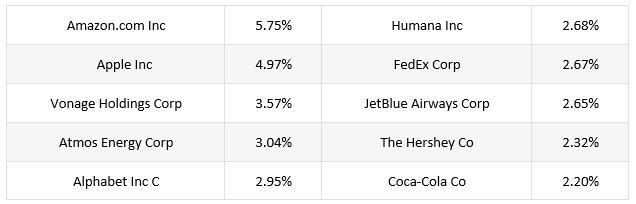

The top ten holdings in the American Satisfaction ETF are the nine companies listed above and one you may not have heard of, Atmos Energy Corp (ATO). Atmos is an energy company based in Dallas, Texas, so don’t feel bad not knowing the name.

ACSI tracks an index of US-listed large-cap stocks and is weighted toward those who have the higher customer satisfaction scores, meaning these ten stocks are the top ten companies regarding customer satisfaction. These companies are all based on the idea that the customer is the key to success, just look-up some old Steve Job or Jeff Bezos quotes on the importance of customer satisfaction.

If these companies continue to do what they have been doing in the future, it is hard to see how their future performance wouldn’t continue to be solid. Despite ACSI only being around for a few years, back-tested results show that the fund would have produced annualized ten-year returns of 14.41%, compared to the S&P 500’s annualized return over the same timeframe of just 9.49%.

American Customer Satisfaction ETF (ACSI) also pays investors a dividend of 1.17%, which more than covers the rather high expense ratio of 0.66%. Furthermore, the fund holds 445 stocks, but the top ten represent 32% of assets. So, while the fund is very diversified, the top performing customer satisfaction companies make up the bulk of the fund. Lastly, investors need to remember that ACSI is a long-term buy and hold ETF which has the potential to be not only market-beating but possibly market-crushing over the course of a decade or more.

Matt Thalman

INO.com Contributor - ETFs

Follow me on Twitter @mthalman5513

Disclosure: This contributor held long positions in Amazon.com, Apple, and Alphabet at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.