Crude oil and Petrochemicals are the building blocks that are essential to making the goods that make modern life possible — from paints to plastics, space suits to solar panels, medicines to mobile phones. All of these things start with just six basic petrochemicals — ethylene, propylene, butylenes, benzene, toluene, xylenes — that are combined with other chemicals and transformed into other materials that make products better.

Petrochemicals do things like:

- Make your phone water-resistant

- Keep food fresher longer

- Make your carpets stain resistant

- Help tires repair themselves

- Keep first-responders safe with fire-retardant clothing

- Extend lives with cutting-edge medical technologies

Source: American Fuel & Petrochemical Manufacturers (AFPM)

According to a recent study, "Wells, Wires and Wheels… EROCI and the Tough Road Ahead for Oil," published by BNP Paribas Asset Management, the author, Mark Lewis, writes:

“Our analysis indicates that for the same capital outlay today, new wind and solar-energy projects in tandem with battery electric vehicles (EVs) will produce 6x-7x more useful energy at the wheels than will oil at $60/bbl for gasoline-powered LDVs, and 3x-4x more than will oil at $60/bbl for LDVs running on diesel. Accordingly, we calculate that the long-term break-even oil price for gasoline to remain competitive as a source of mobility is $9-$10/bbl and for diesel $17-19/ bbl."

Lewis argues that renewable energy can replace 36% of the demand for crude oil for LDV transportation that is susceptible to electrification and a further 5% demand for power generation. Renewables have a marginal cost of almost zero, are much cleaner, and electricity is much cheaper to transport.

“We conclude that the economics of oil for gasoline and diesel vehicles versus wind- and solar-powered EVs are now in relentless and irreversible decline, with far-reaching implications for both policymakers and the oil majors… If all of this sounds far-fetched, then the speed with which the competitive landscape of the European utility industry has been reshaped over the last decade by the rollout of wind and solar power - and the billions of euros of fossil-fuel generation assets that this has stranded - should be a flashing red light on the oil industry's dashboard."

Fatih Birol, the Executive Director of the International Energy Agency, was asked at the 2020 World Economic Forum in Davos when he expected peak demand for global transportation fuels. He estimated that it would come in about five years due to gains in fuel efficiency.

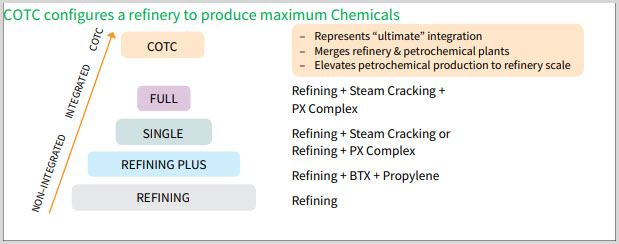

Given this dim long-term outlook for transportation fuels, innovative new process technology has been developed to integrate refinery and petrochemical plants to produce the maximum amount of chemicals directly from crude oil. It is called Crude Oil to Chemicals (“COTC”).

Exxon Mobil (XOM) developed a technology that takes a very light crude to feedstocks directly to a steam cracker at a facility in Singapore. The conversion is estimated at 76%, substantially higher than about 20% of the barrel to petrochemical feedstocks in the state-of-art well-integrated refinery-petrochemical complexes such as those in India and Saudi Arabia.

Source: IHS Markit

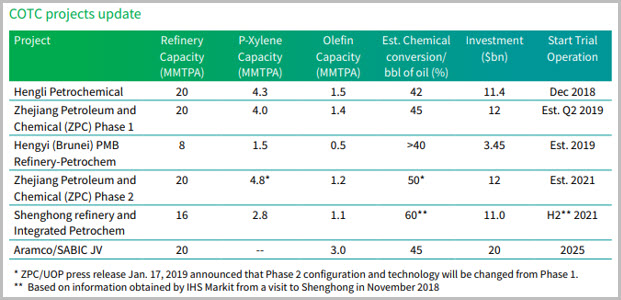

These projects merge a refinery and petrochemical plant into one, returning much higher margins to the refiners relative to transportation fuel products, potentially doubling margins. Several projects have been completed in China and two more are scheduled for completion in 2021.

In 2019, Saudi Aramco (ARMCO) acquired 70 percent of the shares of SABIC, a Saudi diversified manufacturing company, active in petrochemicals, chemicals, industrial polymers, fertilizers, and metals. The Aramco/SABIC JV is projected to start trial operation of a COTC plant in 2025. In addition, according to IHS Markit, Aramco also plans to scale up and commercialize Aramco’s Thermal Crude to Chemicals (TC2C™) technology, which may convert 70-80% per barrel of oil to chemicals.

Source: IHS Markit

The Aramco IPO was launched in December on the domestic stock exchange, the TADAWUL. The enterprise valuation of the IPO was $1.7 trillion and it traded as high as $2 trillion before retreating.

JP Morgan (JPM) initiated coverage and set a target price of 37 SAR, a valuation of $2 trillion. Its rationale is that "Aramco effectively offers minority shareholders 'bond with equity upside' type properties." Aramco promised investors it would pay a dividend of at least $75 billion for the next several years. It also promised that if it cannot afford to pay it all, it would pay the outside investors their pro-rata share nonetheless. “Our bullish view is predicated on its dividend growth outlook, with scope to increase the $75 billion baseline as production scales up,” JPMorgan said. No mention was made of the COTC initiative, which I believe could add substantial value to the crude oil produced by Aramco.

Conclusions

Peak oil demand for transportation fuels may arrive much sooner than generally expected. Furthermore, the evolution of renewables/EV threatens the long-term business viability of traditional refiners who produce mainly transportation fuels.

The transition to COTC provides a promising solution. Petrochemicals provide building blocks for producing a wide variety of products that will be in demand.

Saudi Aramco is positioning itself to be a world leader in this space. The Aramco IPO was open to primarily Saudi investors, but the company has stated that it plans to have an international listing once a venue is selected. I would recommend that investors keep watching for the listing and focus on Aramco’s petrochemical plans.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.