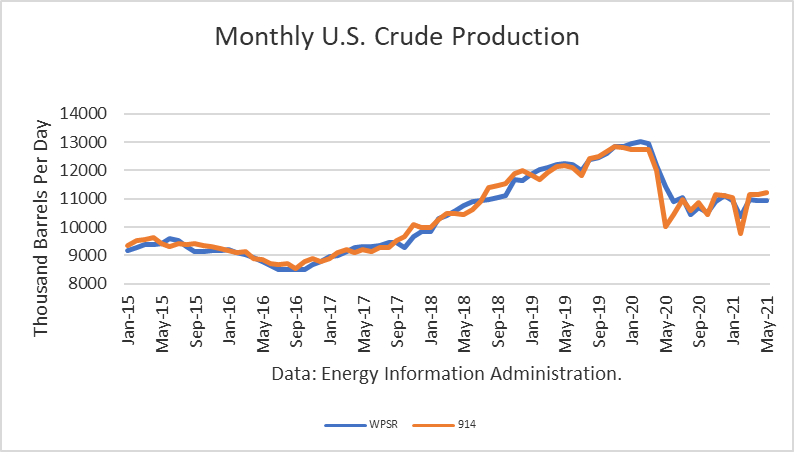

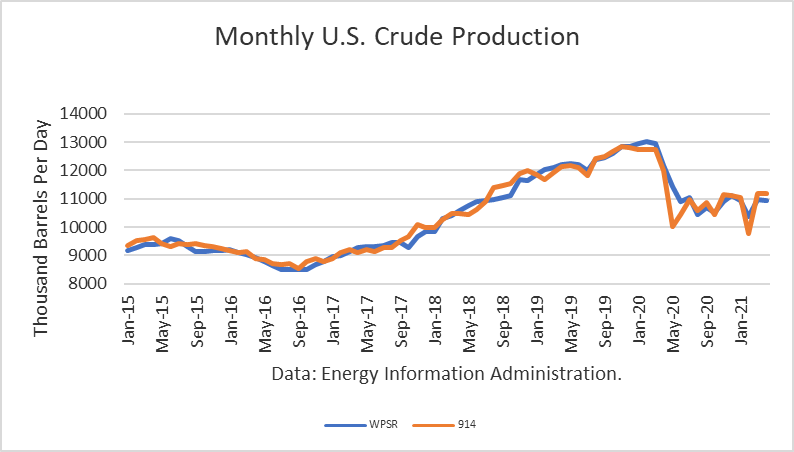

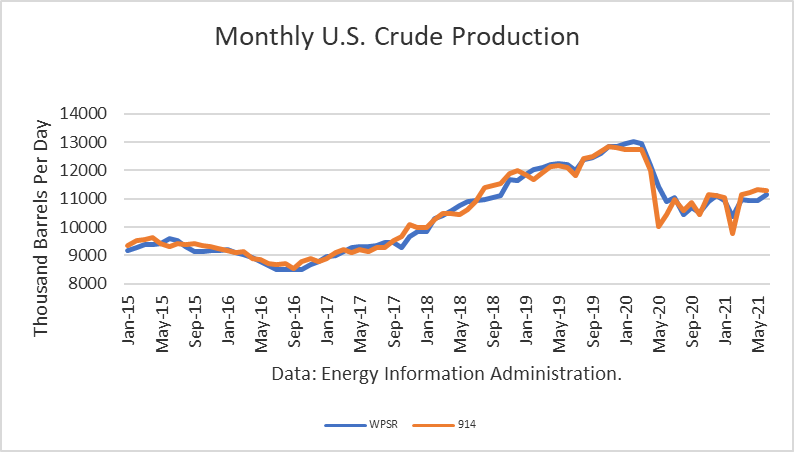

The Energy Information Administration reported that June crude oil production dipped by 5,000 barrels per day, averaging 11.307 mmbd. This follows a modest decline in April. In addition, the June 914 figure compares to the EIA’s weekly estimates (interpolated) of 11.141 mmbd, a figure that was 164,000 lower than the actual 914 monthly estimate.

A largest gain was in New Mexico (43,000 b/d), followed by The Gulf of Mexico (18,000 b/d). On the other hand, production in Texas actually decline by 22,000 b/d.

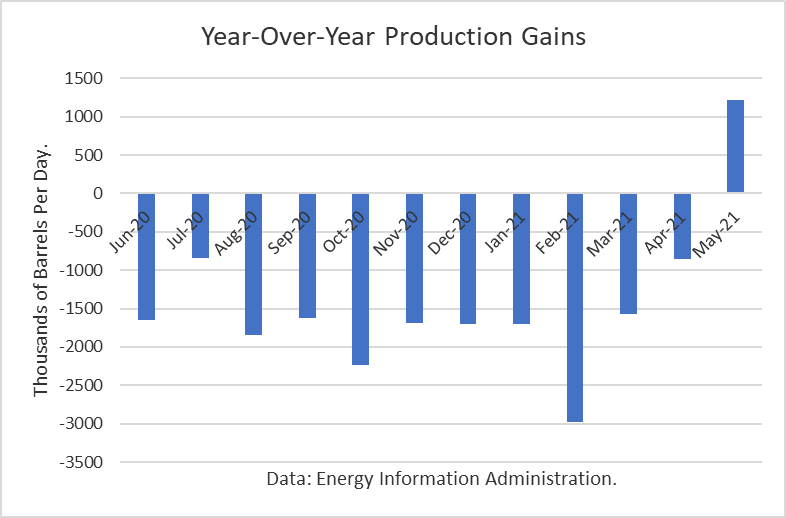

Given the huge reduction in May 2020, production recovered by 865,000 b/d over the past 12 months. This number only includes crude oil. Continue reading "U.S. Crude Oil Production Leveling In June 2021"