Facebook (FB) tanked after announcing its recent quarterly earnings despite beating on both the top and bottom-line numbers. In addition to the strong revenue and income figures, user growth across its platform grew by a robust clip and the company authorized an additional $10 billion for its share repurchase program. The culprit was a sharp rise in spending and expenses to contend with a slew of regulatory, user and legal battles the company is waging on the privacy front. This minor sell-off provides investors with a buying opportunity in top tier large-cap company that continues to grow double digits with a long runway for further growth and monetization of its platforms.

Trillion Dollar Market Capitalization

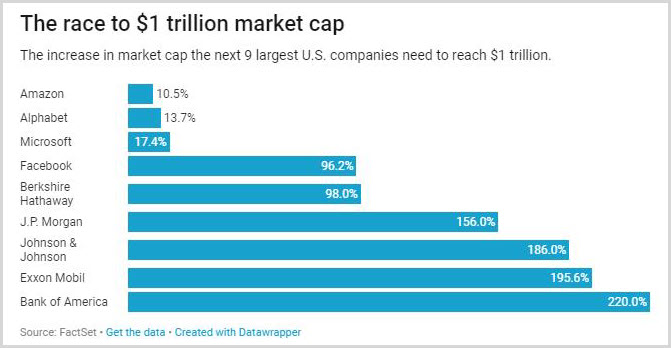

Recently, Google (GOOGL), Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL) have all crossed the psychological threshold of the $1 trillion market capitalization valuation. This is the exclusive Wall Street club of only the select few. Facebook is the next potential company to be crowned a 1 trillion-dollar company and join the prestigious Wall Street club (Figure 1). Facebook’s current market capitalization sits at $611 billion, implying a $389 billion market capitalization gap. Facebook needs to appreciate roughly 64% from these levels to joins the likes of Apple, Amazon, Google, and Microsoft.

Figure 1 – The $1 trillion market cap landscape back in August 2019 with Facebook in close pursuit and even closer to achieving the mark

Facebook’s Unparalleled Growth

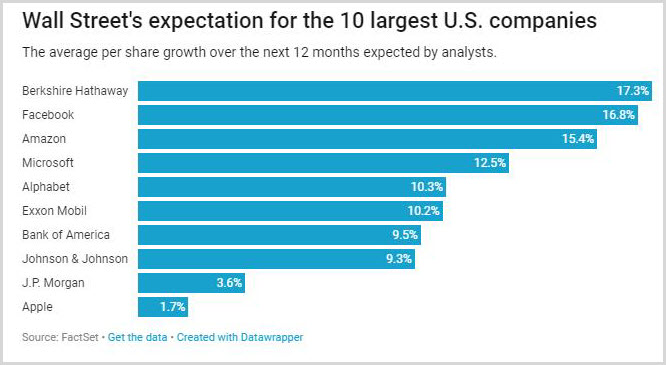

Facebook is now testing its all-time highs with a reasonable price-to-earnings multiple when compared to its tech cohort. Facebook continues to post unparalleled growth for a company of its size, while its platforms are the go-to properties for advertisers and influencers (Figure 2). If the company continues its path forward on the remediating the privacy issues while posting best-in-class revenue growth, the stock will likely continue to elevate higher. Facebook can unlock further growth avenues for years into the future.

Figure 2 Facebook’s projected EPS growth for 2020, ranking as a top tier large-cap growth company

Facebook’s Earnings and Increased Expenses

After reporting its most recent Q4 earnings, Facebook initially tanked on the news that expenses had ballooned out of control. On the surface, earnings were fantastic, coming in with $21.08 billion in revenue, beating estimates by $180 million and EPS of $2.56 per share, beating estimates by $0.03. Revenue grew by 25%, and daily active users grew by 9% to 1.66 billion, and monthly active users rose 8% to 2.5 billion. Operating income rose 13% to $8.86 billion with net income increasing 7% to 7.35 billion.

So what was the issue as to why the stock displayed weakness post-earnings? This sell-off was attributable to sharp increases in expenses and headcount. Costs and expenses rose by a staggering 34% while headcount increased by 26% to 44,942 employees. These expenses are a testament to how serious the company is taking these privacy issues and ensuring that all actions are taken to absolve itself of past mistakes. These increased expenses are necessary to ensure the platforms are compliant and users can trust the company with its data.

Conclusion

Despite the privacy issue and potential regulatory headwinds from past issues, Facebook continues to deliver superior growth while addressing all of its privacy-related issues. Facebook paid a $5 billion fine from the FTC due to being mired in privacy scandals and subsequent public relations mismanagement. Facebook is attempting to put these issues behind the company by spending billions on initiatives to combat fake news, ensure data integrity, implementing stringent guidelines on third party data sharing and overall transparency within its platform. As its recent quarter suggests, sharp increases in costs and expenses demonstrate that the company is serious about tackling these issues head-on and moving forward. Despite these issues, Facebook has grown its revenues by over 25% for 20-plus consecutive quarters and currently sits at $215 per share just below its 52-week high of $225. Facebook presents a compelling buy for long-term investors and I feel Facebook will inevitably reach the $1 trillion market capitalization club.

Noah Kiedrowski

INO.com Contributor

Disclosure: The author holds shares in AAL, AMC, GE, KSS, SLB, TRIP, USO and X. However, he may engage in options trading in any of the underlying securities. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses. The author is the founder of www.stockoptionsdad.com where options are a bet on where stocks won’t go, not where they will. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. For more engaging, short duration options based content, visit stockoptionsdad’s YouTube channel.