As 2020 unfolds and the markets continue to break through record highs, investors should heed these lofty levels. We’re in the longest bull market in history and the U.S. has started and ended a decade without a recession for the first time in history. By nearly all measures, these markets are overvalued with stretched valuations.

Deploying a put spread strategy is a great way to define your risk while leveraging a minimal amount of capital to maximize returns. Whether you have a small account or a large account, a put spread strategy is an effective way to limit risk with a high probability of success. Trading options on stocks like Expedia (EXPE), Tesla (TSLA), Ulta Beauty (ULTA), Apple (AAPL), Disney (DIS), Facebook (FB), etc., that possess such a high price per share when account balances are limited are no longer an issue with put spreads. Put spreads enable you to leverage a minimal amount of capital, which opens the door to trading virtually any stock all while defining your risk.

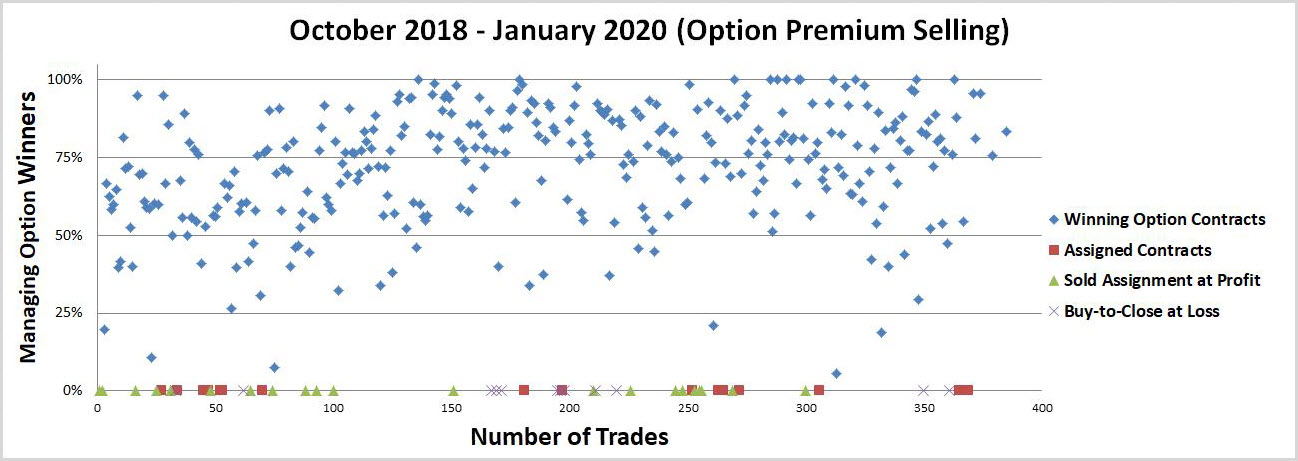

Over the past 13 months, ~315 trades have been made with a win rate of 86% and a premium capture of 57% across 69 different tickers. When stacked up against the S&P 500, an options strategy generated a return of 9.1% compared to the S&P 500 index which returned 3.7% over the same period. These returns demonstrate the resilience of this high probability options trading in both bear and bull markets. These results can be replicated irrespective of account size when following the fundamentals outlined below.

Put Spread and Defining Risk

Options can be used in a leveraged manner hence using small amounts of capital to trade what otherwise would require much greater capital requirements. A put spread is a type of options trade that risk-defines your trades and involves selling and buying an option. Let’s review a put spread below.

The Put Spread:

1. Selling an option, you sell a put option and you agree to buy shares at an agreed-upon price by an agreed-upon date in exchange for premium income.

2. Buying an option, you buy a put option using some of the premium received from selling the option above and you now have the right to sell the shares at an agreed-upon price by the same agreed upon date in exchange for paying out a small premium.

Taken together, a put spread is where you sell an option and also buy a further-out-of-the money option for downside protection. The difference in the premium received and premium paid out is the credit spread income collected. This situation yields a risk-defined trade since you agree to buy shares at a specific price; however, you also have the right to sell those shares at a specific price.

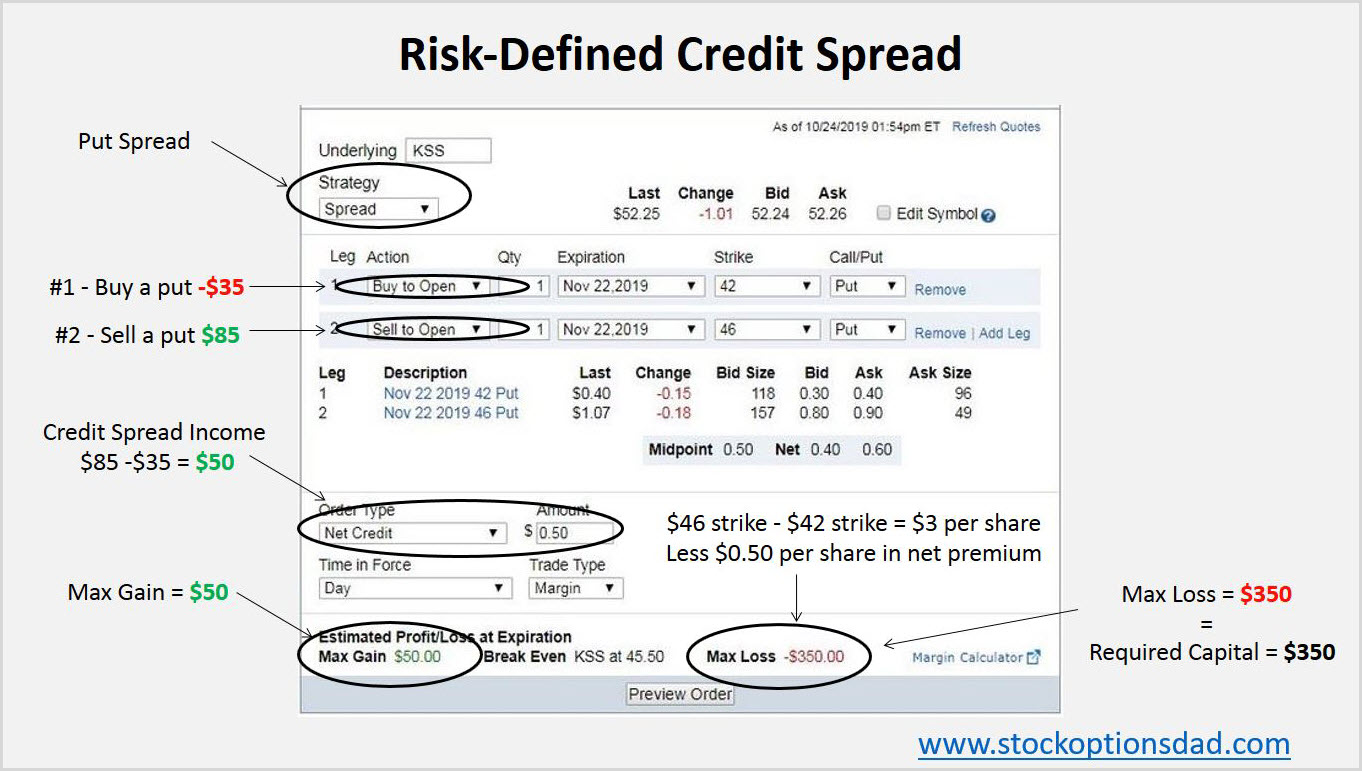

Put Spread Example

If you sell a put option at a strike of $46 in exchange for $0.85 per share in premium, you can use some of that premium income to buy the $42 strike put option for $0.35 per share to net $0.50 per share on the trade ($0.85 - $0.35). Since options trade in blocks of 100 shares, this equates to a net gain of $50 on the trade.

In this manner, you agree to buy shares at $46 and you also have the right to sell shares at $42. This will cap your losses at $350 since the net credit received was $50 in premium and the difference between the two strikes was $4 per share or $400 for the options contract.

If the stock falls significantly and falls below both strikes, you would be assigned at $46 per share and then exercise your right to sell shares at $43 per share. The $400 loss is the max loss you can incur and factor in the $50 of premium income, the net loss is capped at $350. The stock can drop to $0 per share and your loss is still capped at $350 (Figure 1).

Figure 1 – Kohl’s example of a put spread generating $50 in net premium income while only requiring $350 of capital for the trade

Maximizing Return on Capital

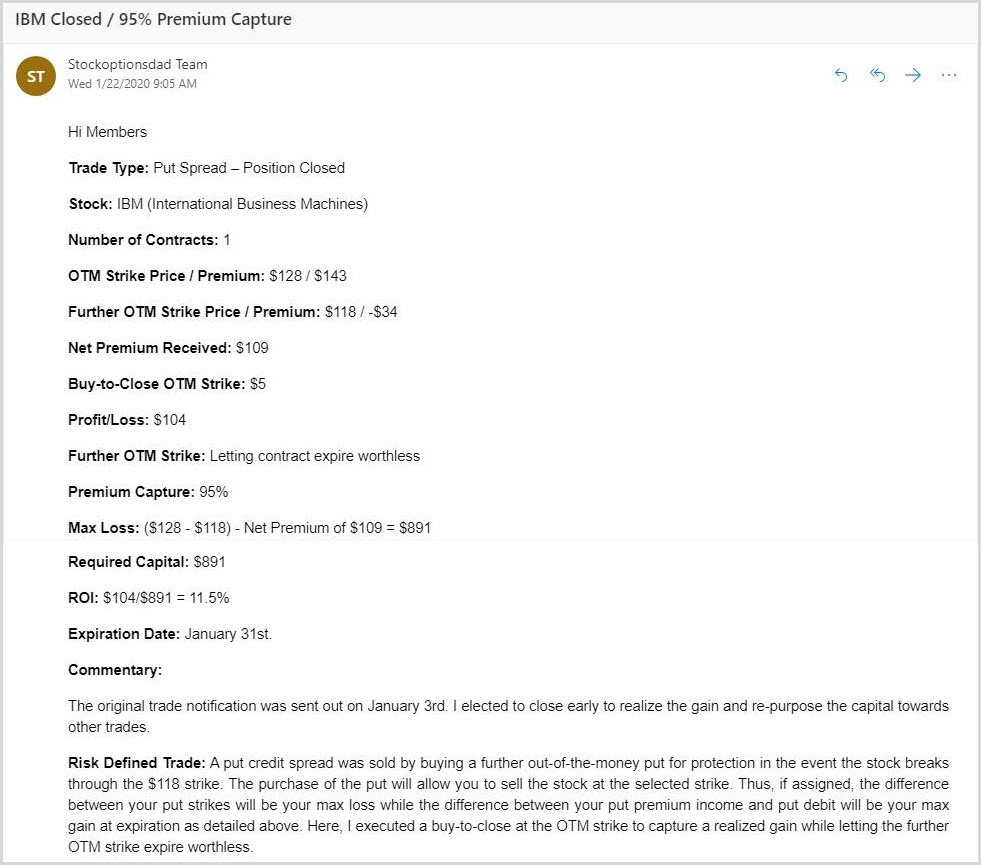

These types of trades maximize return on capital; oftentimes, a ~10% realized gain over the course of a month-long contract. The required capital is equal to the maximum loss while the maximum gain is equal to the option premium income received. Since the risk-defined approach has a max loss, the required capital is equivalent to the max loss. The maximum loss value only needs to be covered by the available account balance. In the example below, the max loss was $891 and the max gain was $109 thus, return on capital is 12% at expiration if the shares do not trade break through the $128 strike. In this case, I decided to close the contact early to realize a gain of $104 or an 11.5% return on capital (Figure 2).

Figure 2 – Example of an IBM put spread

The overall options-based portfolio strategy is to sell options which enable you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation regardless of market conditions. This is all done without predicting which way the market will move since options are a bet on where stocks won’t go, not where they will go. This options-based approach provides a margin of safety, mitigates drastic market moves, and contains portfolio volatility. This strategy is agnostic to account balance and applies to accounts of all sizes to maximize returns and limited capital exposure.

10 Options Trading Rules to Follow

A set of trading fundamentals must be followed to run an options-based portfolio successfully. Specifically, position-sizing, sector diversity, maximizing the number of trade occurrences and risk-defined strategies are some notable areas that traders need to heed for long-term successful options trading not only in small accounts but in accounts of all sizes.

In order to effectively and successfully run an options-based portfolio over the long term, the following option trading fundamentals must be exercised in each and every trade. Violating any of these fundamentals will jeopardize this strategy and possibly negate the effectiveness of this approach on the whole. Below are 10 options trading rules for accounts of all sizes.

1. Be an option seller to collect premium income while taking advantage of time decay

2. Set the probability of success (delta) in your favor (70%, 85%, etc.) to ensure a statistical edge

3. Manage winning trades by closing the trade and realizing profits early in the option lifecycle

4. Sell options in high IV Rank environments to extract rich premiums

5. Sell options on tickers that are liquid in the options market

6. Maximize the number of trades to allow the expected probabilities to play out

7. Appropriate position sizing/portfolio allocation to manage risk exposure

8. Sell options across tickers with ample sector diversity

9. Keeping an adequate amount of cash on hand (~25% - 40%)

10. Risk-defined trades (put spreads, call spreads and iron condors)

Risk-Defined Portfolio Transition

I’ve been making the risk-defined portfolio transition as of recent since previous cash-covered option selling has weighed on my portfolio performance. Previously assigned contacts have an unlimited downside and the poor performance of these assignments has negated some of the options related success. Collecting dividends, selling covered calls and averaging down in share price hasn’t been a successful strategy when it comes to airlines, steel, travel, oil and gas-related stocks (i.e., AAL, X, TRIP, USO and SLB).

Transitioning to a risk-defined trading environment offers optionality.

1. If an assignment occurs between the two strikes, then you can immediately sell the shares

2. Take the assignment and sell covered calls while collecting the dividend

3. Totally avoid any further risk if the underlying stock was to fall below your strike protection

4. Leveraging a minimal amount of capital to maximize realized gains

Maximizing Number of Trade Occurrences

Maximizing the number of trades is essential for any options-based strategy. Placing only 10 trades or 50 trades over a given time period is simply inadequate for an options-based approach. Trading through all market conditions at a specific probability of success level, given enough trades and time, the probabilities will reach their expected outcomes. This maximizes the number of shots on goal and over a long enough time period, these data will be smoothed out over the various market conditions to reach your expected probability of success. To achieve the expected probability level, hundreds of trades need to be placed and closed before the probabilities really begin to play out. As these trade data grow in size, plotting all of your trades over time, you’ll see the numbers align more and more with your expected probabilities. Taken together, trade as often as you can at your desired probability of success to achieve the win rate of interest (Figure 3).

Figure 3 – Dot plot summarizing ~370 trades over the previous 15-month period highlighting the importance of maximizing trades and trading through all market conditions. An 87% success rate is demonstrated in the above dot-plot

The Options Advantage

Options trading allows one to profit without predicting which way the stock will move. Options trading isn’t about whether or not the stock will move up or down; it’s about the probability of the stock not moving up or down more than a specified amount. Options allow your portfolio to generate smooth and consistent income month after month for steady portfolio appreciation. Running an option-based portfolio offers a superior risk profile relative to a stock-based portfolio while providing a statistical edge to optimize favorable trade outcomes. Options trading is a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences and continuing to trade through all market conditions. Put simply; an options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates.

Conclusion

Selling put credit spreads is a great way to leverage a minimal amount of capital while maximizing returns. A put spread is a type of options trade that risk-defines your trades and involves selling and buying an option. These types of trades maximize return on capital; oftentimes, a ~10% realized gain over the course of a month-long contract with an 85% probability of success. The required capital is equal to the maximum loss while the maximum gain is equal to the option premium income received.

Options trading allows one to profit without predicting which way the stock will move to allow your portfolio to generate smooth and consistent income month after month since options are a bet on where stocks won’t go, not where they will go. Selling options with a favorable risk profile and a high probability of success is the key. Options provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. I’ve demonstrated an 87% options win rate over the previous 15 months through both bull and bear markets with a lower risk profile. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences and continuing to trade through all market conditions with the probability of success in your favor.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.