The Coronavirus has become the black swan event that has materialized into worldwide hysteria. The spread of viruses globally has halted supply chains, commerce, retail, and specifically the travel and leisure sector. The Coronavirus has been the catalyst for the overall indices to drop double digits or ~13% over the course of roughly a one week period in late February. The coronavirus event induced extreme global market volatility that hasn't been seen since Q4 of 2018. This extreme volatility provided options traders with a vast landscape of stocks that possessed rich option premium pricing.

As volatility spikes and stocks sell-off, options traders can sell options and collect rich premium income in a high probability manner with a statistical edge and expected outcomes. Even better, options can be sold with defined risk while leveraging a minimal amount of capital to maximize return on investment (ROI). Whether you have a small account or a large account, a defined risk (put spread) strategy enables you to leverage a minimal amount of capital, which opens the door to trading virtually any stock on the market.

Volatility - Options Trading Edge

The Coronavirus injected volatility across the entire market throughout February and into early March. This volatility resulted in rich option premium pricing, which enabled options to be sold on a wide array of uncorrelated tickers that can be spread over various expiration dates.

Selling put spreads is a great way to leverage a minimal amount of capital while maximizing returns. A put spread is a type of options trade that risk-defines your trades and involves selling and buying an option. These types of trades maximize return on capital; often, a ~10% realized gain over the course of a month-long contract with an ~85% probability of success. The required capital is equal to the maximum loss, while the maximum gain is equal to the option premium income received.

Since volatility is nearly always overestimated, stocks tend to fail to be as volatile as predicted. As volatility spikes, option pricing is bid up as investors expect a big move in the underlying stock. As the stock fails to meet the expected volatility, the options pricing falls, and profits can be realized. Selling options with rich premiums in high implied volatility situations and then realizing profits as volatility decreases is the edge in options trading.

Winning Trades - Empirical Results

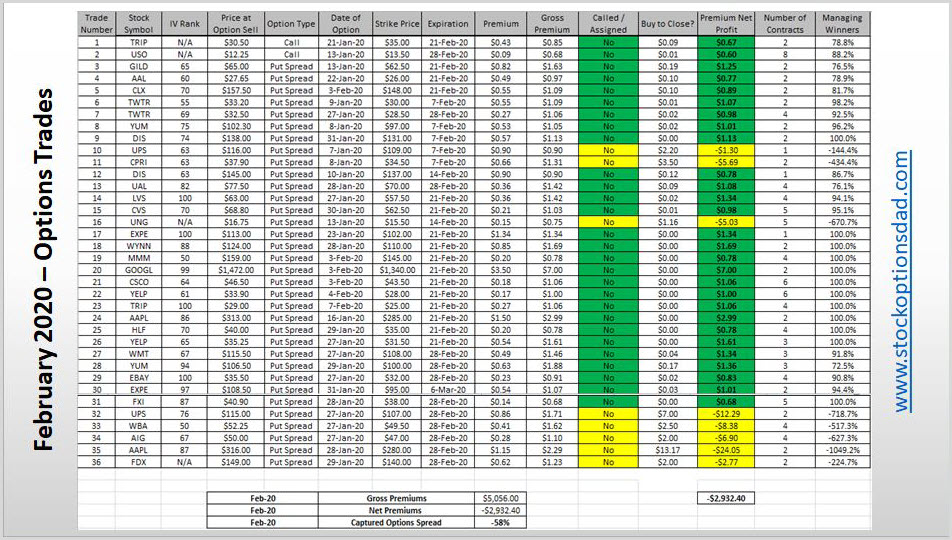

I trade at an expected probability of success of 85% and in high implied volatility environments where rich premium income can be realized for an average of ~10% ROI per trade. Looking at only the 28 winning trades in February, an 11% ROI per trade was achieved and proof of concept established (Figure 1).

Figure 1 – Empirical results for only winning trades demonstrating an 11% ROI and 94% premium capture

Coronavirus Induced Black Swan Event

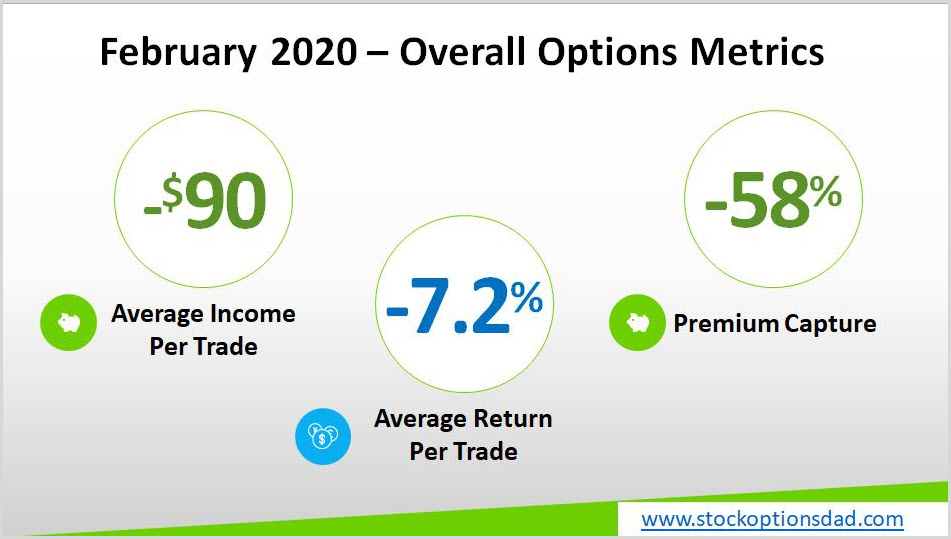

Given enough trade occurrences, the expected outcomes materialize over the course of time and various market conditions. During February, 37 trades were placed on the heels of the initial Coronavirus induced volatility, which in hindsight was very mild compared to the black swan event that occurred in late February. I placed 37 trades in February, and the expected outcome was to win 32 of the 37 trades. However, when the market tumbled by multiple thousand point drops and posted its worse week since the financial crisis, many of my trades that expired during the final week of February were compromised, and I ended up taking down realized losses (Figures 2 and 3).

Figure 2 – All 37 trades for February with the coronavirus black swan event observed for the latter trades that expired on 28FEB20

Figure 3 – Overall results for February when factoring in the heavy losses due to the black swan event during the final week of February

These losses were heavy and often moved far outside the stock's expected range, thus negated my winners and resulted in a net loss for all the options activity for the month. Losses are expected; however, the winners, coupled with effective management of the losers outside of black swan events, will result in consistent gains.

Getting started is easy! Test our tools with a 30-Day Trial.

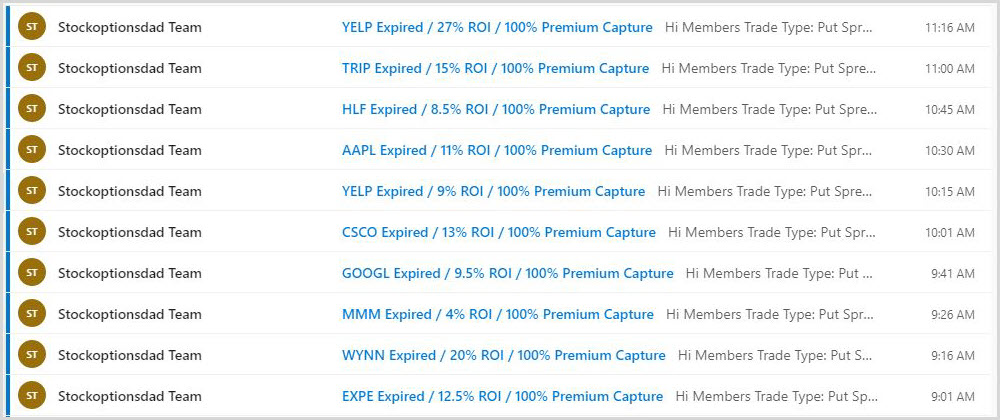

Maximizing Return on Capital

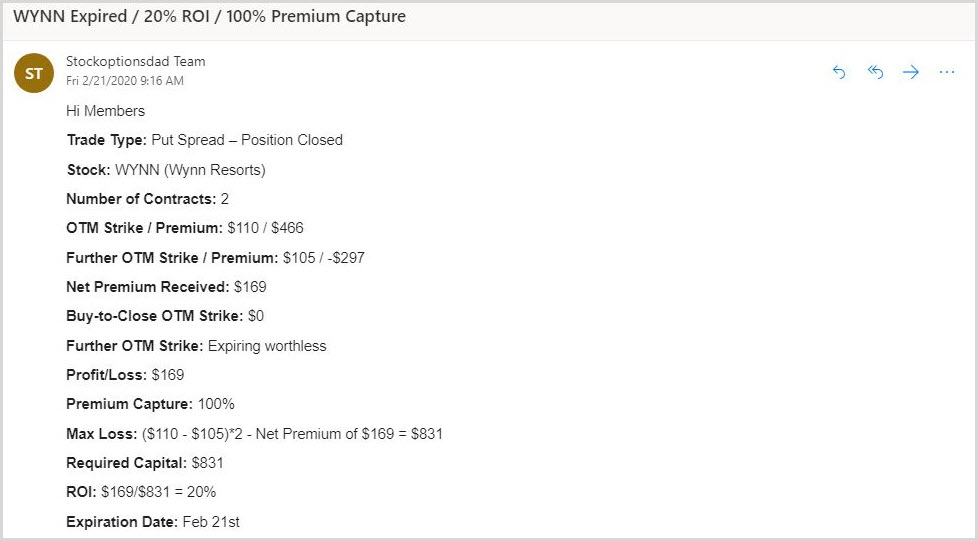

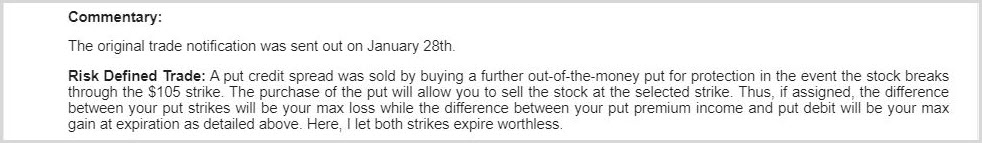

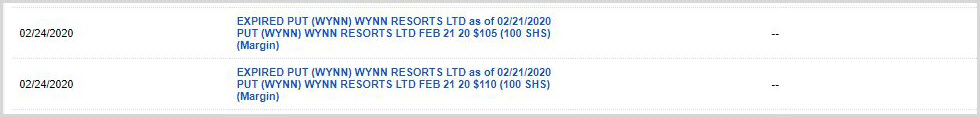

These types of trades maximize return on capital; oftentimes, a ~10% realized gain over the course of a month-long contract. The required capital is equal to the maximum loss, while the maximum gain is equal to the option premium income received. Since the risk-defined approach has a max loss, the required capital is equivalent to the max loss. The maximum loss value only needs to be covered by the available account balance. In the example below, the max loss was $831, and the max gain was $169; thus, return on capital is 20% at expiration if the shares do not trade break through the $110 strike. In this case, I decided to close the contact expire to realize a gain of $169 or a 20% return on capital (Figure 4).

Figure 4 – Trade notification service example of a WYNN put spread and a trade cluster that expired on a Friday

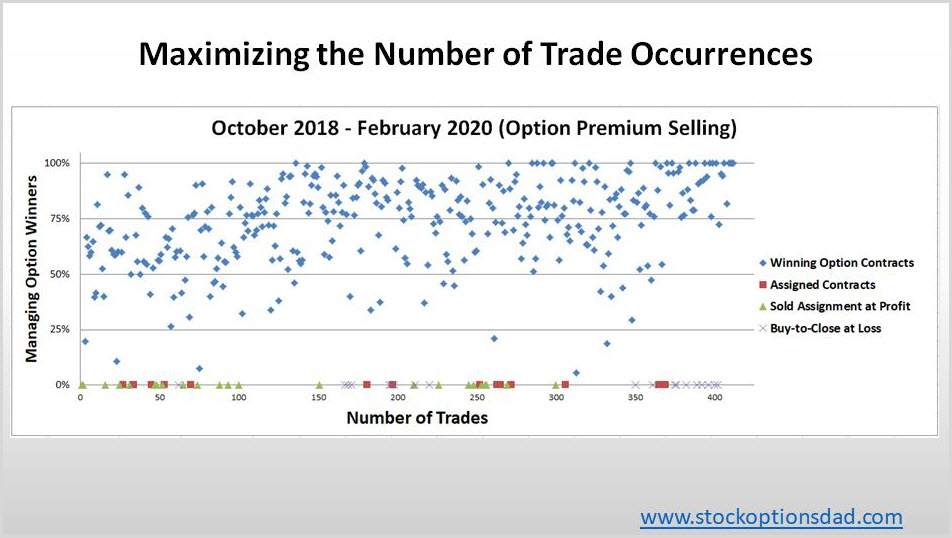

Maximizing Number of Trade Occurrences

Maximizing the number of trades is essential for any options-based strategy. Placing only 10 trades or 50 trades over a given time period is simply inadequate for an options-based approach. Trading through all market conditions at a specific probability of success level, given enough trades and time, the probabilities will reach their expected outcomes. This maximizes the number of shots on goal, and over a long enough time period, these data will be smoothed out over the various market conditions to reach your expected probability of success. To achieve the expected probability level, hundreds of trades need to be placed and closed before the probabilities really begin to play out. As these trade data grow in size, plotting all of your trades over time, you'll see the numbers align more and more with your expected probabilities. Taken together, trade as often as you can at your desired probability of success to achieve the win rate of interest (Figure 5).

Figure 5 – Dot plot summarizing ~415 trades over the previous 17-month period highlighting the importance of maximizing trades and trading through all market conditions. An 86% success rate is demonstrated in the above dot-plot

Black Swan Trading Must Go On

This environment has been ideal for options selling despite having a few trades go against me (only to see them bounce back the next day and mistiming these trades by one trading day). This is why I spread expiration dates, maximize sector exposure, maximize ticker diversity, and continue to sell options into market weakness. Continuing to trade through this market environment is tough but necessary, considering the opportunities that have been presented in many stocks and ETFs.

There continues to be extreme volatility throughout the markets despite the markets being down more than double digits over the course of a week or so. I continue to layer-in trades into this weakness and heightened volatility.

Continuing to stick to the fundamentals throughout this heightened volatility period is key. Defined risk trades while leveraging small amounts of capital to maximize profits is essential. Keeping a significant portion of your portfolio in cash is an essential component of the overall strategy. I expect to take down several losses as March opens up for trading, and stocks have moved far outside their predicted trading ranges. I've recently started to place trades that expire out into April to layer expiration dates and take advantage of the liquidity/volatility.

Conclusion

I trade at an expected probability of success of 85% in high implied volatility environments where rich premium income can be realized for an average of ~10% ROI per trade. The black swan event disrupted this strategy at the end of February. Outside of these black swan events, the overall options-based portfolio strategy is to sell options which enable you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation regardless of market conditions. This is all done without predicting which way the market will move since options are a bet on where stocks won't go, not where they will go. Options trading isn't about whether or not the stock will move up or down; it's about the probability of the stock not moving up or down more than a specified amount. This options-based approach provides a margin of safety, mitigates drastic market moves, and contains portfolio volatility.

This strategy is agnostic to account balance and applies to accounts of all sizes to maximize returns with limited capital exposure. Options trading is a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions. Put simply; an options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates.

Due to the black swan event, spreading expiration dates, maximizing sector exposure, maximizing ticker diversity, and continuing to sell options into market weakness and heightened volatility is essential. Continuing to trade through this market environment is tough but necessary, considering the opportunities that have been presented in many stocks and ETFs. Thus, I continue to layer-in trades into this weakness and heightened volatility.

Continuing to stick to the fundamentals throughout this heightened volatility with defined risk trades while leveraging small amounts of capital to maximize profits is essential. Keeping a significant portion of your portfolio in cash is an essential component of the overall strategy. Overall, an 86% win rate has been demonstrated over the past 17 months across ~415 trades.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.

Just curious - do you have a strategy for cutting your losses if a trade goes against you, or do you let them all go to expiration?

Thanks...