Options trading, at its core, is defining risk, leveraging a minimal amount of capital, and maximizing return on investment. Options trading in combination with long equity via broad-based index ETFs and cash-on-hand provides portfolio agility in the face of market corrections and in times of volatility expansion. COVID-19 was the linchpin for the major indices to drop over ~30% in March. Logging the worst sell-off since the Great Depression and inducing extreme market volatility that hasn’t been since the Financial Crisis.

Although options trading provides a margin of downside protection and a statistical edge, no portfolio is immune from the wreckage when hit with a black swan event. Thus proper portfolio construction is essential when engaging in options trading to drive portfolio results. One of the main pillars of building an options-based portfolio is maintaining ample liquidity by holding ~50% of one’s portfolio in cash. This liquidity position provides portfolio agility to adjust when faced with extreme market conditions such as COVID-19 and the September market correction rapidly.

An agile options based portfolio is essential to navigating these pockets of volatility. The COVID-19 induced sell-off and recent September correction are prime examples of why maintaining liquidity is one of the many keys to an effective long term options strategy. In May, June, July, August, and September, 121 trades were placed and closed. Options win rate of 98% was achieved with an average ROI per trade of 7.3% and an overall option premium capture of 90% while outperforming the broader market over the September downturn (Figure 1).

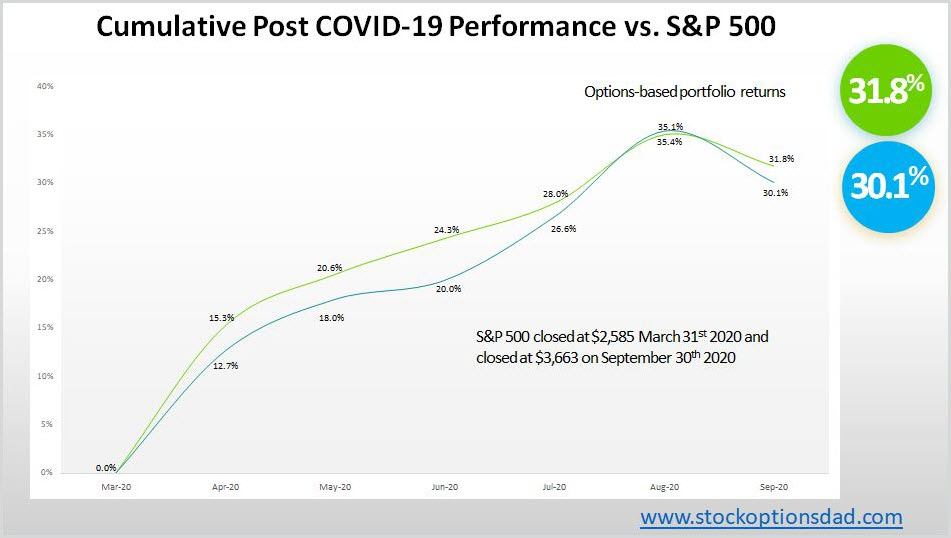

Figure 1 – Smooth and consistent portfolio appreciation while matching the broader market gains and outperforming during the market sell-off in September. An overlay of an options/cash/long equity hybrid portfolio and the S&P 500 post-COVID-19. Even under the most bullish conditions, the hybrid portfolio outperformed the index with ~50% in cash

Positive Return Despite September Sell-Off

Since March, the September sell-off was the worst technology rout, while the Dow and S&P 500 posted four-week losing streaks, their longest losing stretches since August 2019. The Nasdaq had its first weekly gain in four weeks at the tail end of September. All the major indices sold off double-digits and into correction territory throughout September. This recent September correction provides a great opportunity to demonstrate the durability and resiliency of an options-based portfolio.

Learn how to use options to supersize your portfolio returns with Trader Travis’ free training!

Despite the indices being in correction territory for September, following the 10 rules in options trading via leveraging small amounts of capital, defining risk, and maximizing returns have generated a positive return related to the portfolio's options portion. The positive options returns were in sharp contrast to the negative returns for the overall market. Generating consistent income without guessing which way the market will move with the probability of success in your favor has proven successful despite the September correction.

Results

Compared to the broader S&P 500 index, the blended options, long equity, and cash portfolio have outperformed this index. In even the most bullish scenario post-COVID-19 lows where the markets erased all the declines inflicted by the pandemic, this approach has outperformed the S&P 500 by a narrow margin through 30SEP20 (Figure 1).

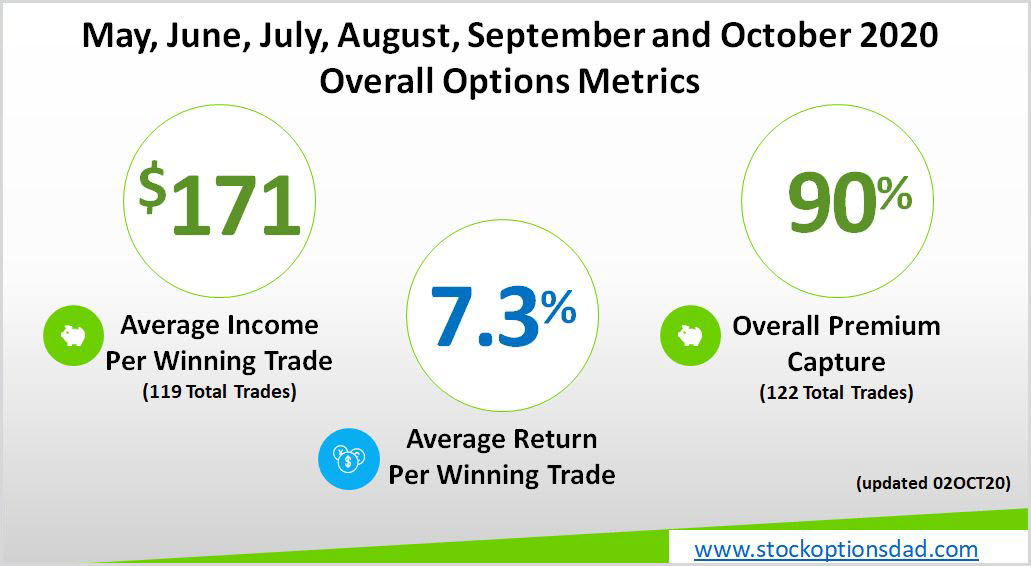

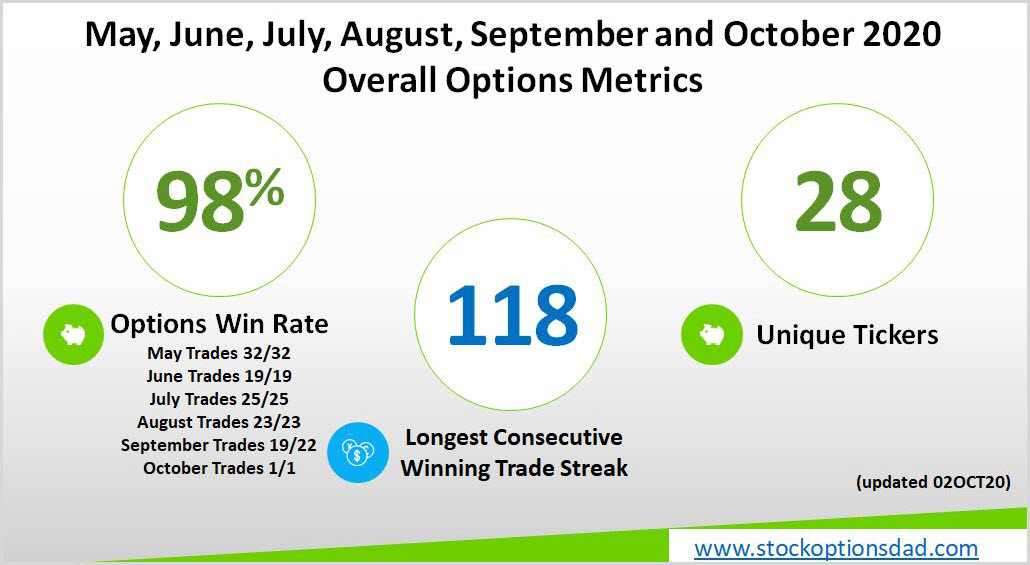

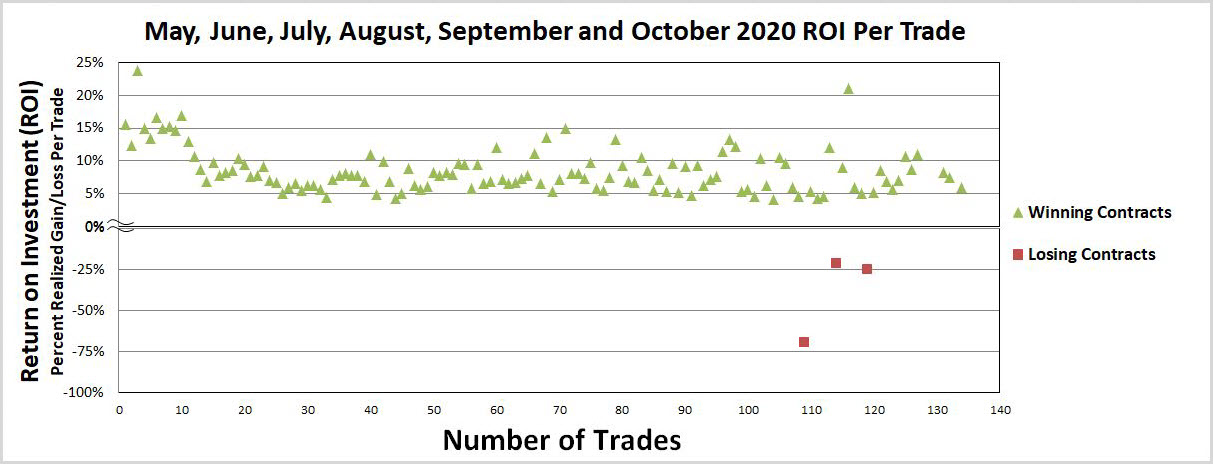

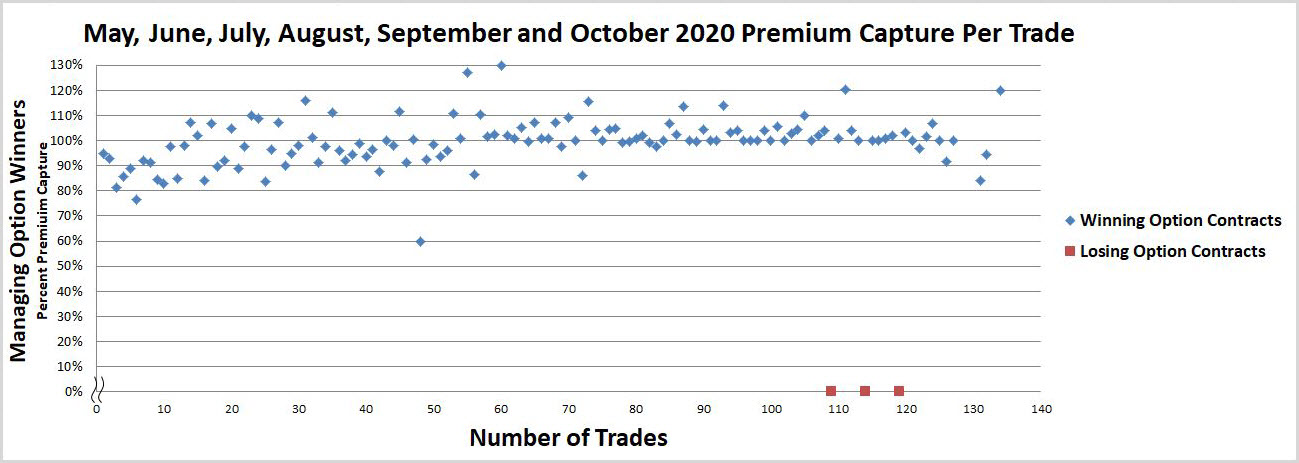

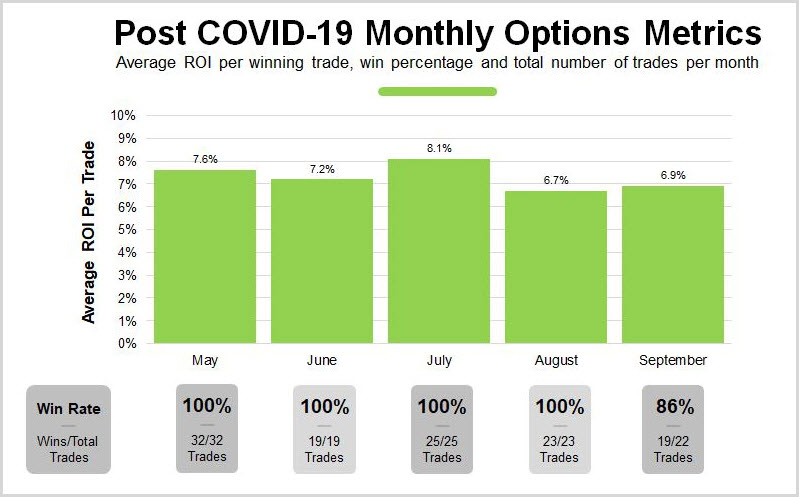

In May, June, July, August, and September, 121 trades were placed and closed. An options win rate of 98% was achieved with an average ROI per trade of 7.3% and an overall option premium capture of 90% while outperforming the broader market over the September downturn (Figures 2, 3, 4, 5, and 6).

Figure 2 – Overall option metrics from May 2020 – September 2020

Figure 3 – Overall option metrics from May 2020 – September 2020

Figure 4 – ROI per trade over the past 121 trades

Figure 5 – Percent premium capture per trade over the last 121 trades

Figure 6 – Average ROI per winning trade during each respective month

An Agile Options Strategy

Risk management is paramount when engaging in options trading. A slew of protective measures should be deployed if options are used to drive portfolio results. When selling options and running an options-based portfolio, the following guidelines are essential:

-

1. Trade across a wide array of uncorrelated tickers

2. Maximize sector diversity

3. Spread option contracts over various expiration dates

4. Sell options in high implied volatility environments

5. Manage winning trades

6. Use defined-risk trades

7. Maintains a ~50% cash level

8. Maximize the number of trades, so the probabilities play out to the expected outcomes

9. Continue to trade through all market environments

10. Appropriate position sizing/trade allocation

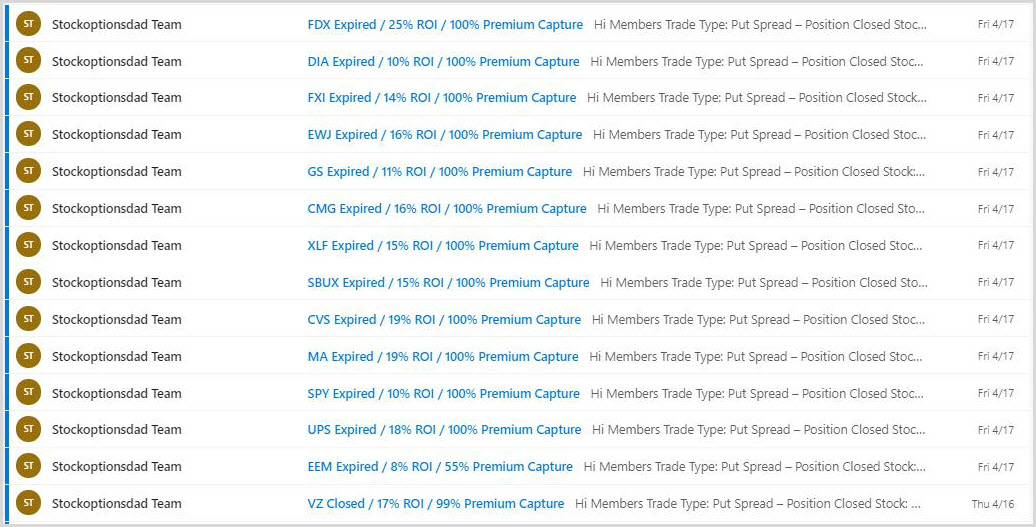

Figure 7 – Example of a trade cluster that expired on a Friday

Basic Options Strategy Framework

Preferably, in high implied volatility environments, options traders can sell options and collect rich premium income in a high probability manner with a statistical edge. This set-up comes with expected and predicable outcomes given enough trade occurrences over time. Furthermore, options can be sold with a defined risk to leverage a minimal amount of capital to maximize investment return. Whether you have a small account or a large account, a defined risk (i.e., put spreads and diagonal put spreads) strategy enables you to leverage a minimal amount of capital, which opens the door to trading virtually any stock on the market.

Cash Flexibility

Holding ~50% cash as a protective measure is essential when faced with unpredictable outlier situations such as COVID-19 or even contending with a sharp double-digit decline observed recently in September across the indices. A cash position this high is possible because options are a leveraged vehicle; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. Even deploying all the protective measures outlined above won’t offer the protection required during a black swan event. During these black swan market meltdowns, all sectors and stocks homogenize and naturally correlate together in a downward spiral. Cash is the safest way to immunize a portfolio from these types of market crashes. This cash position also provides optionality to pivot and go long in high-quality names when faced with extreme sell-offs.

Maximizing Return on Capital

Risk-defined trades (i.e., put spreads, diagonal put spreads, and iron condors) maximizes the return on investment. Often, a double-digit realized gain over the course of a month long contract is possible. The required capital is equal to the maximum loss, while the maximum gain is equal to the option premium income. Since the risk-defined approach has a max loss, the required capital is equivalent to the max loss. If you sell a put spread with strikes at $100 and $95 while receiving $1 per share, then you’ll only need $400 of capital for the trade. You agree to buy shares at $100, and as long as the underlying shares remain above $100 at expiration, then the $100 premium is a realized gain. If the shares fall below $95, then you would be assigned shares at $100 and exercise your right to sell the shares at $95 to limit any losses. Thus, worst case scenario/max loss would be ($100-$95)*100 shares - $100 in premium income received = $400 per contract.

Conclusion

The recent September correction and the COVID-19 black swan event reinforces why appropriate risk management is essential. The overall options-based portfolio strategy is to sell options that enable you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation. This is all done without predicting which way the market will move. Options trading isn’t about whether or not the stock will move up or down. It’s about the probability of the stock not moving up or down more than a specified amount. This options-based approach provides a margin of safety while circumventing the impacts of drastic market moves and contains portfolio volatility.

Sticking to the core fundamentals of options trading, one can leverage small amounts of capital, define risk, and maximize investment return. Keeping an outsized portion of your portfolio in cash is essential to the overall strategy. Although the indices being in correction territory for September, following the 10 rules in options trading has generated a positive return related to the portfolio's options portion. The positive options returns were in sharp contrast to the negative returns for the overall market. This negative backdrop demonstrates an options-based portfolio's durability and resiliency to outperform during pockets of market turbulence.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.