Controlling portfolio beta (a measure of volatility or systemic/market risk of a portfolio compared to the market on the whole) while generating the same or superior returns can be achieved with options. A beta-controlled portfolio can be achieved via a blended approach where 50% cash is held in conjunction with long index-based equities and an options component.

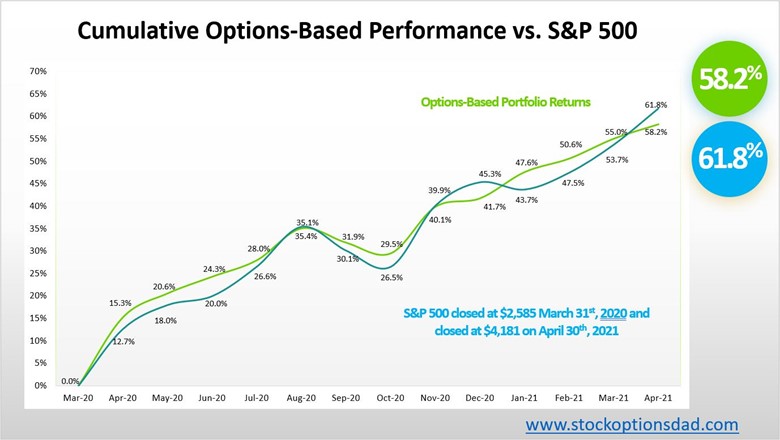

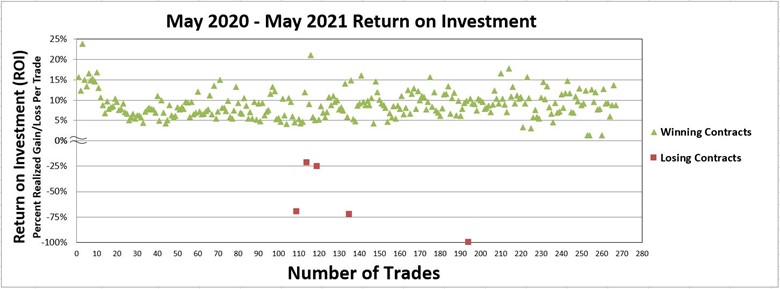

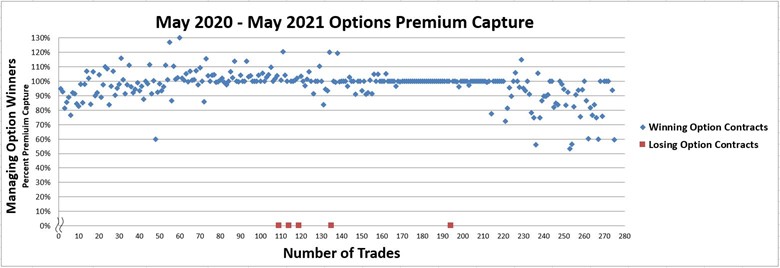

Over the past ~13 months, post COVID-19 induced lows, generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital has been the core of this options-based/beta-controlled portfolio strategy. They enable smooth and consistent portfolio appreciation without guessing which way the market will move and allow one to generate consistent monthly income in a high probability manner in various market scenarios. Over the past 13 months (April 2020 – April 2021), 249 trades were placed and closed. A win rate of 98% was achieved with an average ROI per winning trade of 8.0% and an overall option premium capture of 85% while outperforming the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented the September 2020, October 2020, and January 2021 sell-offs while outperforming/matching the S&P 500 over the 13-month post-pandemic bull run, posting returns of 58.2% and 61.8%, respectively (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from April 2020 – April 2021

Figure 2 – Overall option metrics from May 2020 – May 7th, 2021

Figure 3 – Overall option metrics from May 2020 – May 7th, 2021

Options Results

When compared to the broader S&P 500 index, the blended options, long equity, and cash portfolio has outperformed this index by a small margin. In even the most bullish scenario post-pandemic lows where the markets erased all the declines via V-shaped recovery, this approach has outpaced the S&P 500 returns through March 31st, 2021, with substantially less risk (Figures 4 and 5).

Overall, from May 2020 through March 31st, 2021, 249 trades were placed and closed. An options win rate of 98% was achieved with an average ROI per trade of 8.0% and an overall option premium capture of 85% while outperforming the broader market through the September 2020, October 2020, and January 2021 declines (Figure 1).

Figure 4 – ROI per trade over the past ~260 trades

Figure 5 – Percent premium capture per trade over the last ~260 trades

Consistent Income Despite September 2020, October 2020 and January 2021 Declines

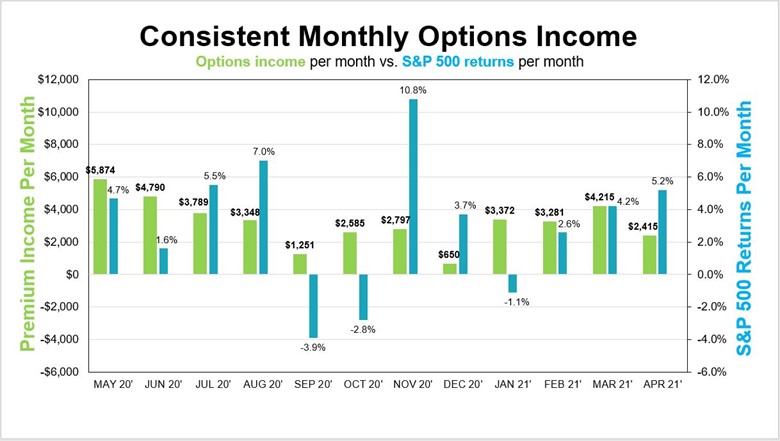

The September 2020, October 2020, and January 2021 declines provide a great opportunity to demonstrate the durability and resiliency of an options-based portfolio. A positive $1,251 return, a positive $2,585 return, and a positive $3,372 return for the options portion of the portfolio was achieved in September 2020, October 2020, and January 2021, respectively (Figure 6).

Figure 6 – Generating consistent income despite negative returns for the S&P 500 index in September 2020, October 2020 and January 2021

The positive returns were in sharp contrast to the negative returns for the overall market during these negative months. Generating consistent income without guessing which way the market will move with the probability of success in your favor is the key to options trading.

10 Rules for an Agile Options Strategy

Throughout 12 months of the post-pandemic rebound, a disciplined approach to an agile options-based portfolio has been essential to navigate pockets of volatility and circumvent market declines. A slew of protective measures should be deployed if options are used to drive portfolio results. When selling options and managing an options-based portfolio, the following guidelines are essential:

-

1. Trade across a wide array of uncorrelated tickers

2. Maximize sector diversity

3. Spread option contracts over various expiration dates

4. Sell options in high implied volatility environments

5. Manage winning trades

6. Use defined-risk trades

7. Maintains a ~50% cash level

8. Maximize the number of trades, so the probabilities play out to the expected outcomes

9. Place probability of success in your favor (delta)

10. Appropriate position sizing/trade allocation

Conclusion

Controlling systemic portfolio risk while generating the same or superior returns can be achieved with a beta-controlled portfolio via a blended options-based approach where 50% cash is held in conjunction with long index-based equities and an options component.

Annualizing the pandemic lows with an options-based strategy has been key during the September 2020, October 2020, and January 2021 declines and reinforces why appropriate risk management is essential. An options-based approach provides a margin of safety while circumventing the impacts of drastic market moves as well as containing portfolio volatility. In the face of volatility, consistent monthly income has been generated while outpacing the S&P 500 with 50% of the portfolio in cash. An options/cash/long equity hybrid portfolio demonstrates its durability even when compared to the most bullish conditions post-pandemic bull market.

Following the 10 rules has generated positive returns in all market conditions for the options segment of the portfolio over the past 13 months. The positive options returns were in sharp contrast to the negative returns for the overall market. This negative backdrop demonstrates the durability and resiliency of an options-based portfolio to outperform during pockets of market turbulence. To this end, cash-on-hand exposure to long positions via broad-based ETFs and options is an ideal mix to achieve the portfolio agility required to mitigate uncertainty and volatility expansion. Despite holding 50% of the portfolio in cash, superior/matching returns have been achieved relative to the S&P 500.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.