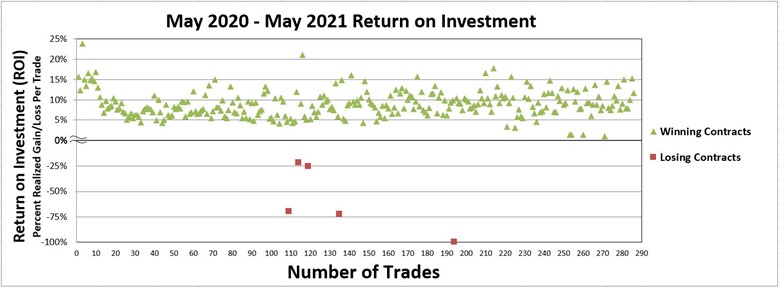

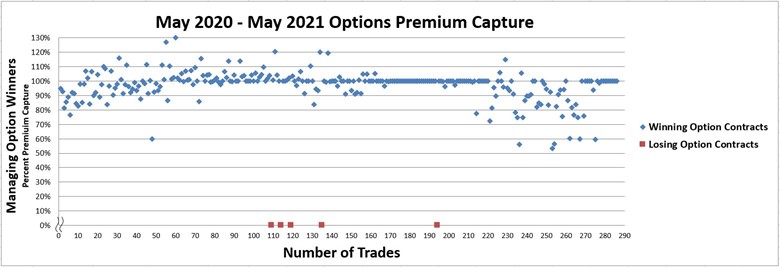

Deploying skill and caution when engaging in options trading can generate consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on investment. Options can augment portfolio appreciation across an array of different market scenarios. Over the past 13 months (May 2020 – May 2021) and 275 trades, a win rate of 98% was achieved with an average ROI per winning trade of 8.0% and an overall option premium capture of 85%.

The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented the September 2020, October 2020, and January 2021 sell-offs while outperforming/matching the S&P 500 over the 13-month post-pandemic bull run, posting returns of 58.2% and 61.8%, respectively (Figures 1-5).

Despite these results over the past 13-plus months and 275 trades, limitations and challenges come with any trading system. Specifically, acts of nature, legislative and regulatory actions can jeopardize option trades. Here, I will walk through the five trades that resulted in losses and the underlying reasons as to why these were beyond any remediation efforts. Legislative and regulatory risks are two areas that pose some of the greatest company-specific and/or sector-specific challenges.

Figure 1 – Overall option tickers used from April 2020 – May 2021

Figure 2 – Overall option metrics from May 2020 – May 31st, 2021

Figure 3 – Overall option metrics from May 2020 – May 31st, 2021

Figure 4 – ROI per trade over the past ~275 trades

Figure 5 – Percent premium capture per trade over the last ~275 trades

BABA, C, CVS and FB

Over the past 275 trades, 5 losses have been suffered due to legislative and regulatory issues. Alibaba (BABA), Citigroup (C) – (twice), CVS Health (CVS), and Facebook (FB) were all targets of some form of legislative and/or regulatory risks. Alibaba was subject to Chinese regulatory threats, Citigroup was fined by the regulators with increasing oversight, CVS Health was in the crosshairs of the pharmaceutical drug pricing debate and Affordable Care Act while Facebook has constantly been threatened with regulations around its business model.

Options Basics Boot Camp - Free

Learn how to use options to supersize your portfolio returns with Trader Travis' free training!

All these scenarios yielded non-optimal alternatives when stuck in an options contract. Often these threats are causes for shape moves to the downside and cause stocks to move far beyond their expected range. When faced with these exogenous events, absorbing the loss and moving on to the next trade is prudent. No one knows how long these challenges can persist and weigh on the underlying stock of interest. Rolling these trades may not be your best course of action, so I decided to take the losses and move on to other trades.

10 Rules for an Agile Options Strategy

Throughout 13 months of the post-pandemic rebound, a disciplined approach to an agile options-based portfolio has been essential to navigate pockets of volatility and circumvent market declines. A slew of protective measures should be deployed if options are used to drive portfolio results. When selling options and managing an options-based portfolio, the following guidelines are essential:

-

1. Trade across a wide array of uncorrelated tickers

2. Maximize sector diversity

3. Spread option contracts over various expiration dates

4. Sell options in high implied volatility environments

5. Manage winning trades

6. Use defined-risk trades

7. Maintains a ~50% cash level

8. Maximize the number of trades, so the probabilities play out to the expected outcomes

9. Place probability of success in your favor (delta)

10. Appropriate position sizing/trade allocation

In addition to the 10 rules outlined above, other general guidelines that are recommended are as follows:

-

• Avoid earnings-related events

• Avoid concurrent option trades on the same underlying ticker (if concurrent trades are placed, ensure adequate time between expiration dates and use different strikes)

• Avoid strike widths wider than ~$5 (rolling trades becomes more feasible and will allow better opportunities for closing trades)

• Leverage technical analysis to assist in trade selection such as RSI and Bollinger bands (this can help identify the ideal trade type to select such as iron condors, put spreads and call spreads)

Conclusion

Controlling systemic portfolio risk while generating the same or superior returns can be achieved in a beta-controlled manner via a blended options-based approach where 50% cash is held in conjunction with long index-based equities and an options component. It is the unsystematic, company-specific risk that presents a big challenge when using options to drive portfolio returns. Often these threats are causes for shape moves to the downside and cause stocks to move far beyond their expected range. When faced with these exogenous events, absorbing the loss and moving on to the next trade is prudent. No one knows how long these challenges can persist and weigh on the underlying stock of interest.

Annualizing the pandemic lows with an options-based strategy has been key during the September 2020, October 2020, and January 2021 declines and reinforces why appropriate risk management is essential. An options-based approach provides a margin of safety while circumventing the impacts of drastic market moves as well as containing portfolio volatility.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.