Cash is a critical component to any portfolio strategy to reduce volatility, seize opportunities, lower cost basis of a long position and avoid full exposure to the equity markets. Controlling portfolio volatility is essential as the broader markets continue to undergo a sea change from high beta/richly valued technology stocks and into value names. The past four-month stretch from September 2021 - January 2022 serves as a prime example of extreme market volatility. The markets pushed to new all-time highs early in September 2021, then suffered a significant selloff in the same month where the Dow Jones was down as much as 6%. October 2021 saw a bounce back into positive territory with new all-time highs set. Then the November/December 2021 stretch saw a sharp dichotomy between the tech-heavy Nasdaq and the Dow Jones, with these indices experiencing relentless selling and heavy buying, respectively.

Amid the bifurcated market, entire sectors have been decimated, and some companies have lost swaths of market capitalizations. Even many well-established, profitable large-cap companies have seen their market capitalizations reduced in a meaningful way. Entire sectors of the market have been wiped out, specifically the fintech space and some pure stay-at-home plays. Given the market backdrop, the cash portion of the portfolio can come in handy to seize unique opportunities to bolster a portfolio. In addition to cash, a conservative options strategy can offer additional mitigation against these pockets of extreme volatility.

A Holistic Approach

Proper portfolio construction and optimal risk management is essential when engaging in options trading to drive portfolio results (Figure 1). Managing a long-term successful options-based portfolio requires a risk tolerance balance between cash, long equity, and options. Ideally, an options-based portfolio should be broken out into the below structure (This is an example breakdown, and percentages can be modified):

-

1. ~50% Cash Position - maintaining ample liquidity provides the ability to rapidly adjust when faced with extreme market conditions such as COVID-19.

2. ~30% Long Equity - exposure to long equity via broad-based ETFs (i.e., DIA, QQQ, SPY, and IWM) allows participation in market movements in areas that are not covered by cash or options. This enables broad market coverage, and it's recommended to reinvest all dividend payouts to lower cost basis over time.

3. ~20% Options - options provide outsized gains; thus, it's not necessary to overleverage one's portfolio to options trading. This is especially important as markets decline and trades become challenged. Balancing option losses with option wins, long equity, and cash is essential.

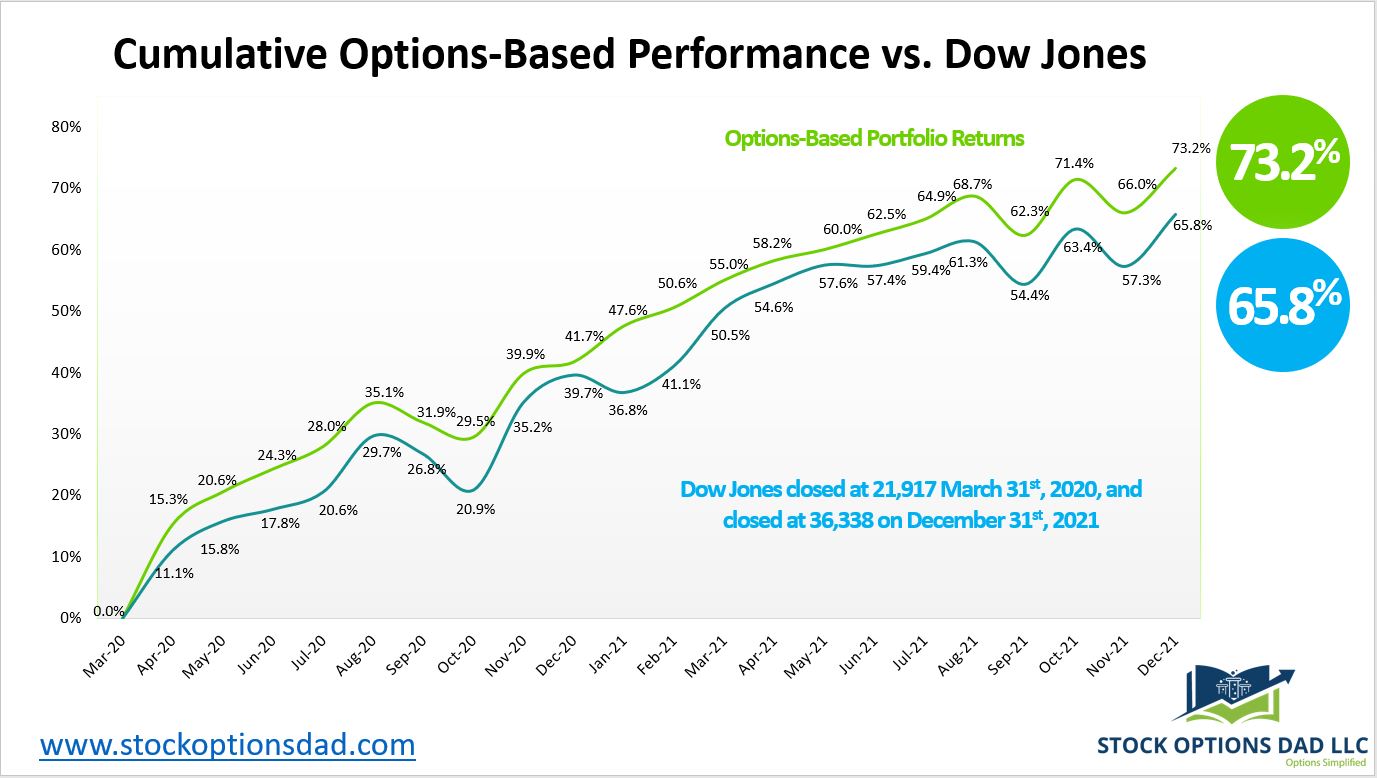

Figure 1 – Portfolio performance comparison between an options-based portfolio approach and the Dow Jones. The performance data over a 21-month period of April 2020 - December 2021 is overlaid. These data demonstrate consistent portfolio appreciation, largely matching and/or outpacing the broader market returns. These results were achieved with a target portfolio mix of ~50% cash, ~30% long equity, and ~20% options in an effort to reduce portfolio risk overall beta. The target portfolio mix is dynamic, may change at any time, and is contingent on market conditions. Options trading services are available via - Trade Notification Service

Options-Based Risk Mitigation

Risk mitigation can be achieved via a blended options-based approach where the portfolio is broken out into three components. Cash, long equity exposure, and an options component are the three pillars of an options-based portfolio strategy. Options alone cannot be the sole driver of portfolio appreciation; however, options can play a critical component in the overall portfolio construction to mitigate volatility and mitigate risk.

In addition to cash, an options component can allow one to define risk, leverage a minimal amount of capital and maximize return on investment. These elements are at the core of an options-based portfolio strategy. Options can enable smooth and consistent portfolio appreciation without guessing which way the market will move. Options allow one to generate income in a high probability manner in various market scenarios. An options-based portfolio provides durability and resiliency in the face of market volatility with substantially less risk.

The Cash Component

Holding ~50% cash as a protective measure is essential when faced with unpredictable outlier situations such as COVID-19. A cash position this high is possible because options are a leveraged vehicle; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. Even deploying all the protective measures outlined above won't offer the protection required during a black swan event. During these black swan market meltdowns, all sectors and stocks homogenize and naturally correlate together in a downward spiral. Cash is the safest way to immunize a portfolio from these types of market crashes. This cash position also provides optionality to go long stock in high-quality names when faced with extreme selloffs.

The Options Component

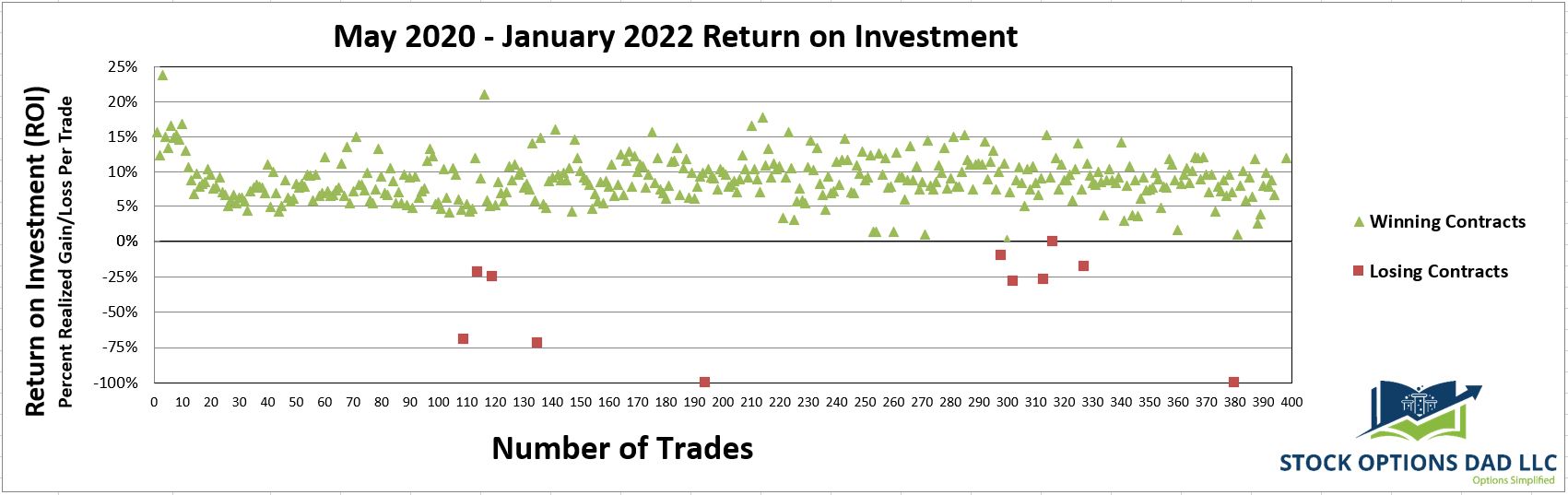

Options are great for defining risk, leveraging a minimal amount of capital, and maximizing return on investment (Figure 2). Options need to be deployed in a responsible manner, via always risk-defining trades and keeping portfolio allocation reasonable. A disciplined approach to an agile options-based portfolio is essential to navigate pockets of volatility and circumvent market declines. A slew of protective measures should be deployed if options are used to drive portfolio results. When selling options and managing an options-based portfolio, the following guidelines are essential.

Figure 2 – May 2020 - January 2022 Return on Investment (ROI) per trade. All options trades are risk-defined in order to leverage a minimal amount of capital to maximize ROI. The ROI target per trade is 5-15% at a delta of ~0.15 or ~85% probability of winning the trade at expiration. Options trades are spread across a wide array of tickers to maximize sector diversity across uncorrelated stocks while maximizing the number of trades. Options trading services are available via - Trade Notification Service

Conclusion

Controlling portfolio volatility is essential as markets and whole sectors are whipsawed. The recent September 2021 – January 2022 stretch is a prime example and reinforces why appropriate risk management is essential. An options-based approach provides a margin of safety while circumventing the impacts of drastic market moves as well as containing portfolio volatility. This is achieved via a blend of long equity, cash, and options with long-term target weighting of 20%, 50%, and 30%, respectively. An options, cash, and long equity hybrid portfolio provide durability and resiliency during pockets of market turbulence. A disciplined approach to an agile options-based portfolio is essential via an array of protective measures that are required to be deployed if options are used to drive portfolio results.

Noah Kiedrowski

INO.com Contributor

Disclosure: Stock Options Dad LLC is a Registered Investment Adviser (RIA) firm specializing in options-based services and education. There are no business relationships with any companies mentioned in this article. This article reflects the opinions of the RIA. Any recommendation contained in this article is subject to change at any time. No recommendation is intended to constitute an entire portfolio. The author encourages all investors to conduct their own research and due diligence prior to investing or taking any actions in options trading. Please feel free to comment and provide feedback; the author values all responses. The author is the founder and Managing Member of Stock Options Dad LLC – A Registered Investment Adviser (RIA) firm www.stockoptionsdad.com defining risk, leveraging a minimal amount of capital and maximizing return on investment. For more engaging, short-duration options-based content, visit Stock Options Dad LLC’s YouTube channel. Please direct all inquires to in**@st*************.com. The author holds shares of AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY, and USO.