“The following is an excerpt from Tim Snyder’s “Weekly Quick Facts” newsletter. Tim is an accomplished economist with a deep understanding of applied economics in energy. We encourage you to visit Matador Economics and learn more about Tim. While there, you can sign up for his completely free Daily Energy Briefs and Weekly Quick Facts newsletters.”

When the macros make the market in energy and stay way out ahead of the U.S. Fed!

This week’s attention has been almost entirely on the U.S. Federal Reserve and raising the Discount Rate by 50 basis points. The Fed’s charge is to bring inflation back in line with the goals of a stable market. The problem is this, when the actions of the FED are either too weak or too late, when they finally do act, it may be ill-timed at the very least, if not outright wrong.

Over the last few weeks, we have seen the GDP turn negative at -1.4%. We saw the Consumer Price Index come in at an 8.5% rate, year over year, and we got the Producer Price Index came in at a 40-year high of +11.2%.

These macros alone showed the markets just how far U.S. inflation had gotten out of control. No matter how much the Fed, or the Treasury Secretary, said the word “Transitory,” they just couldn’t fool markets back into line. It takes action. The macros tell us the FED action is “too little and too late.”

Today, as the minutes are read to an anxious but empty press gallery, we will hear a very reluctant Fed Chairman, Jerome Powell, try and explain why the FED finally decided to get into the game.

Now, even as we watch the U.S. markets squirm, the price of most commodities is spiking, hard. Cotton, wheat, corn, and especially crude oil, natural gas, and refined products.

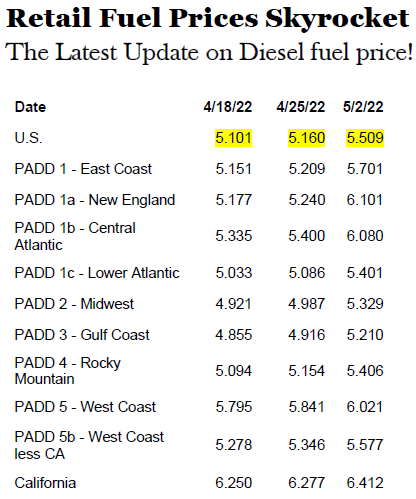

Monday’s Energy Information Administration showed a record jump in diesel fuel prices at the pump, right at .40 cents per gallon. Natural Gas has tripled since the beginning of the year, and Gasoline prices have risen over 50% this year as well.

So, what is driving these prices so much higher? Was it Big Oil Company greed, or was it OPEC+ trying to steal market share from the US by manipulating prices. Like Montgomery Brewster, it was none of the above. Markets ran out of control when the new administration took over. They completely ignored the economy in favor of social changes and a dogged focus on reallocating the value of the fossil fuels industry to their “Climate Change Pirate” friends in D.C.

Today’s gasoline and diesel prices show us that with increasing demand, the price for refined products will continue to rise, even with a somewhat stalling crude oil price. Today’s EIA posting for On-Highway Retail Gasoline price was $4.107 per gallon. Remember, 18 states began the Summer Blends on Saturday, as the US EPA mandated the more expensive “Summer Blend” of gasoline. This blend of gasoline will stay in place until Mid-September, as demand remains strong and the temperatures are warmer this time of year.

And last week, I wrote, “Diesel prices look to be outpacing gasoline and the changes in crude oil prices as well. Monday’s EIA posting for On-Highway Retail Diesel price was $5.16 per gallon. Today’s posting for the national average for Diesel Fuel was $5.509 per gallon and has outpaced gasoline and Natural Gas in the spike column. We’re still wondering how far these prices can run. Today, farmers and business owners across the country are feeling this pain!

Timothy S. Snyder, Economist

Matador Economics