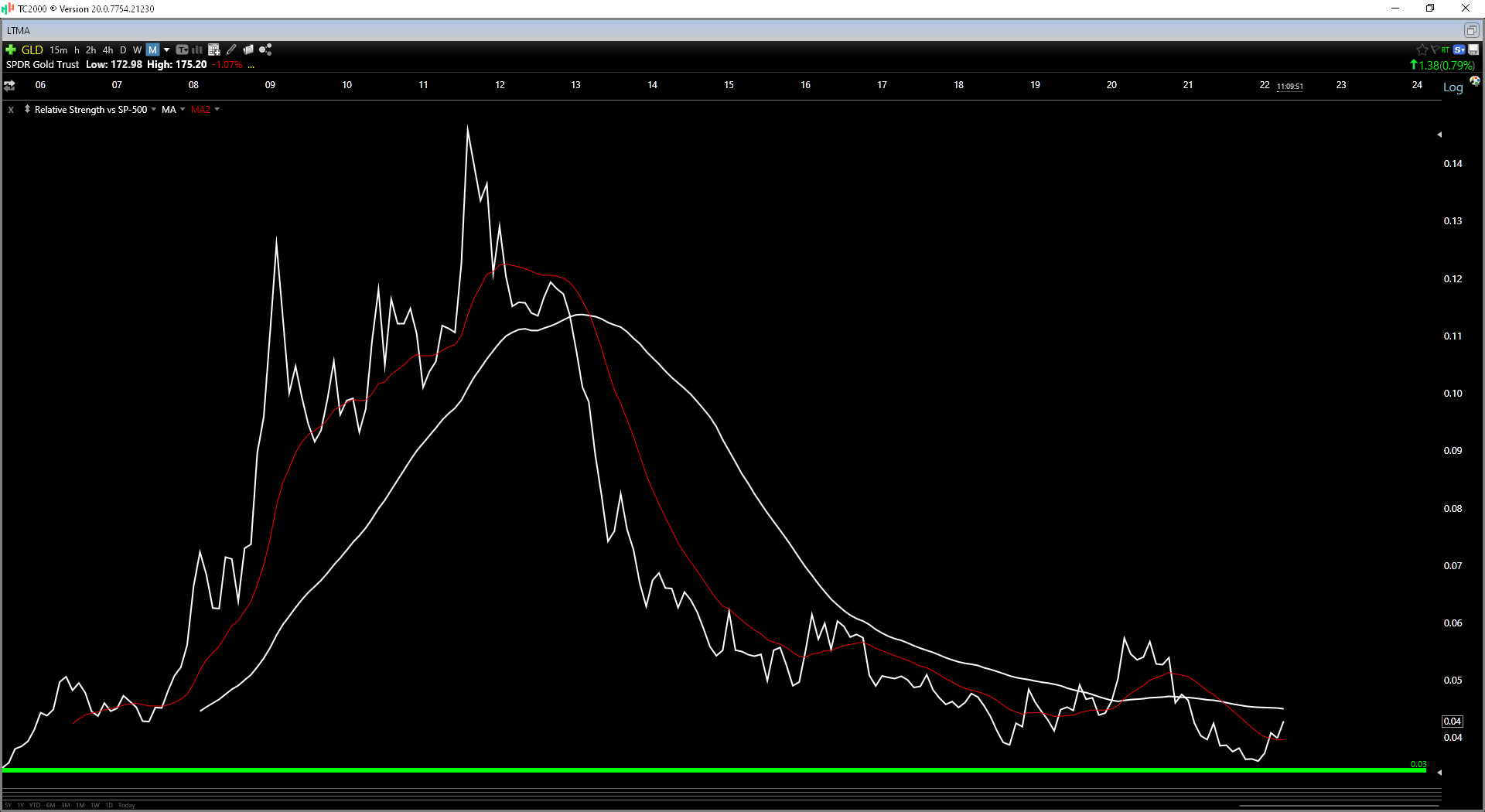

It's been a volatile start to the year for the major market averages, but one sector that's managed to hold up well among the carnage is the Gold Miners Index (GDX). In fact, the index is up 10% year-to-date on the back of higher gold prices. While some investors might fear that they've already missed the move and it's too late to chase, it's important to note that gold has begun to outperform the S&P 500 (SPY) after a multi-year downtrend, which typically suggests we're in the early innings of the move for the GDX. In addition, while a few names are outside of low-risk buy zones, several are dirt-cheap, even after the sharp rally in Q1. Let's take a closer look below:

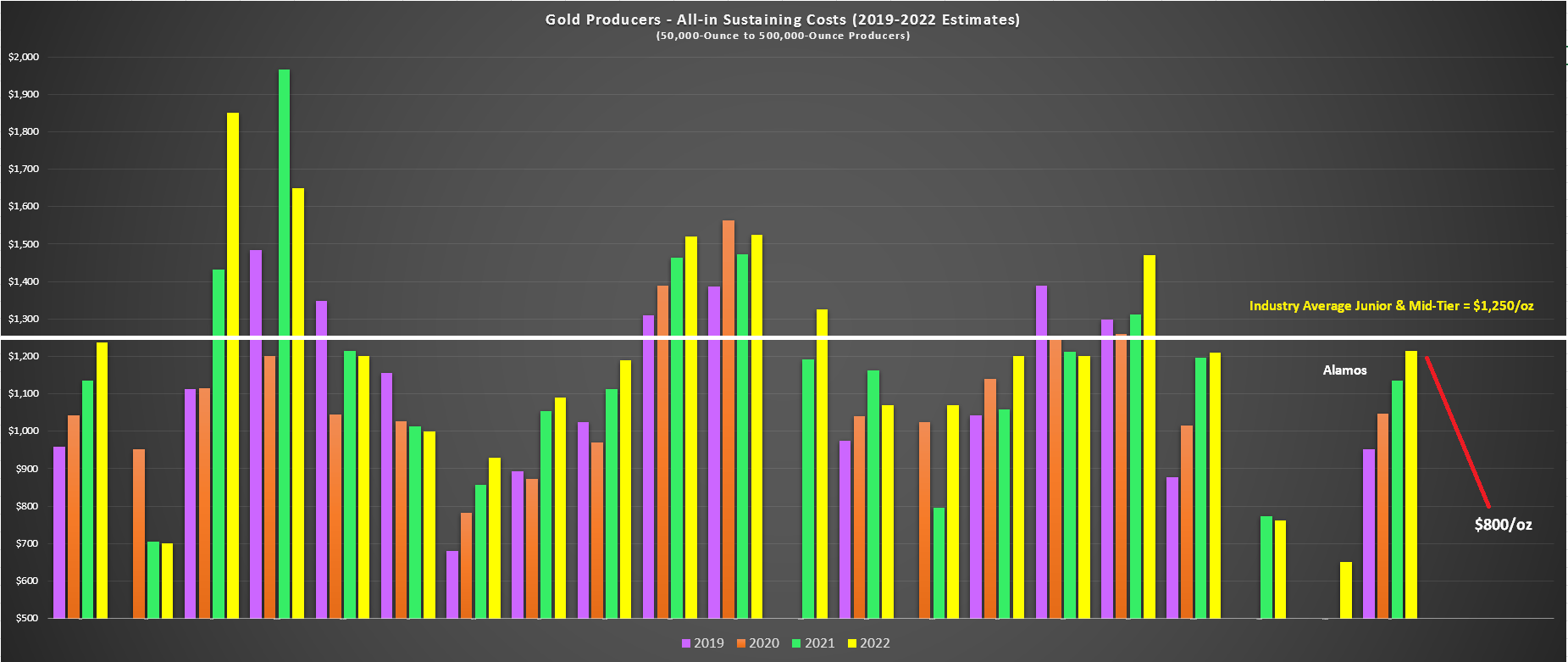

When it comes to getting exposure to gold, the Gold Miners Index is typically the vehicle of choice for investors. However, the issue with the GDX is that it's made up of more than 50 names, with many having weaker balance sheets, a poor track record operationally, and razor-thin margins. Unfortunately, the latter has been exacerbated by inflationary pressures. Therefore, by owning the index, one is diluting their returns with the laggards. For this reason, I prefer playing the sector by owning the highest-quality names when they go on sale.

When it comes to quality, there are several names to choose from, but three that stand out currently and trade at a deep discount are Osisko Gold Royalties (OR), Agnico Eagle Mines (AEM), and Alamos Gold (AGI). While they range from mid to large-cap and have different production profiles, they share two key similarities: growth and value. These traits position them to be outperformers, especially when combined with their strong management teams with a track record of success.

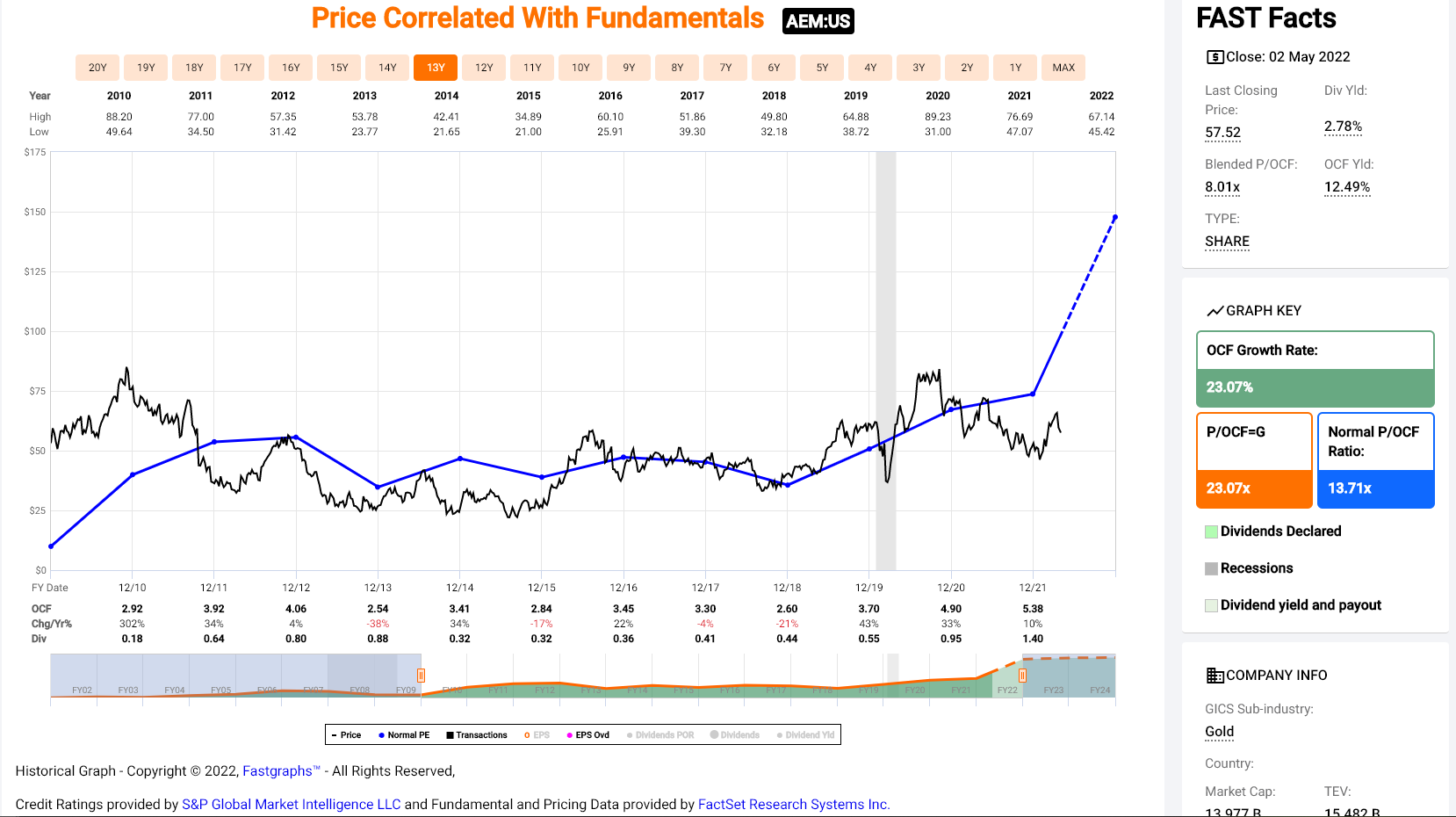

Beginning with Agnico Eagle Mines (AEM), the company is a ~3.3 million-ounce per annum producer and has the pipeline to grow production to 4.3 million ounces by 2029. While this may not seem like significant growth, this growth rate is triple that of its peers in the 2.5+ million-ounce producer space. On top of this differentiator, the company benefits from having more than 90% of its production from top-ranked jurisdictions, including Australia, Canada, and Finland. This provides investors with peace of mind vs. other companies in less favorable jurisdictions like Mali and Russia.

However, despite AEM's position as a growth story with industry-leading margins in safe jurisdictions, the stock has lagged behind its peers. This is a gift for investors new to the story, with the stock trading at less than 1.20 Price to Net Asset Value (P/NAV). Based on my belief that the stock should trade at 1.65x P/NAV and 13x cash flow, in line with its historical multiple, I see the stock as a Buy at current levels, with a fair value closer to $78.00 per share.

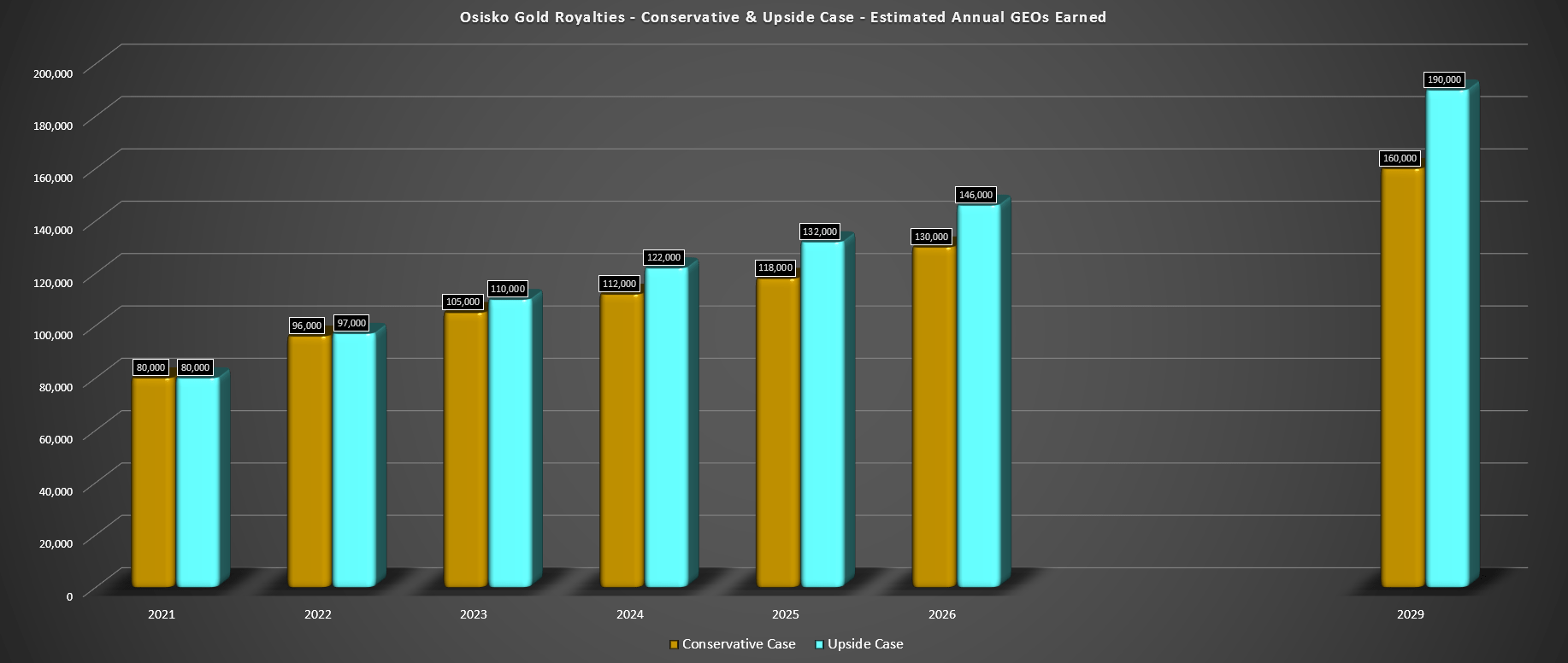

The second name worth highlighting is Osisko Gold Royalties (OR). For those unfamiliar, royalty companies provide an upfront payment to development stage gold companies and gold producers to help finance their project's initial construction or future expansions. In exchange, royalty companies receive a portion of production over the life of the asset. This allows companies like OR to be insulated from inflationary pressure because they are not constantly spending on sustaining capital for the mine or day-to-day operating costs. In my view, this is by far the most attractive model in the gold space, especially for those that are more conservative investors.

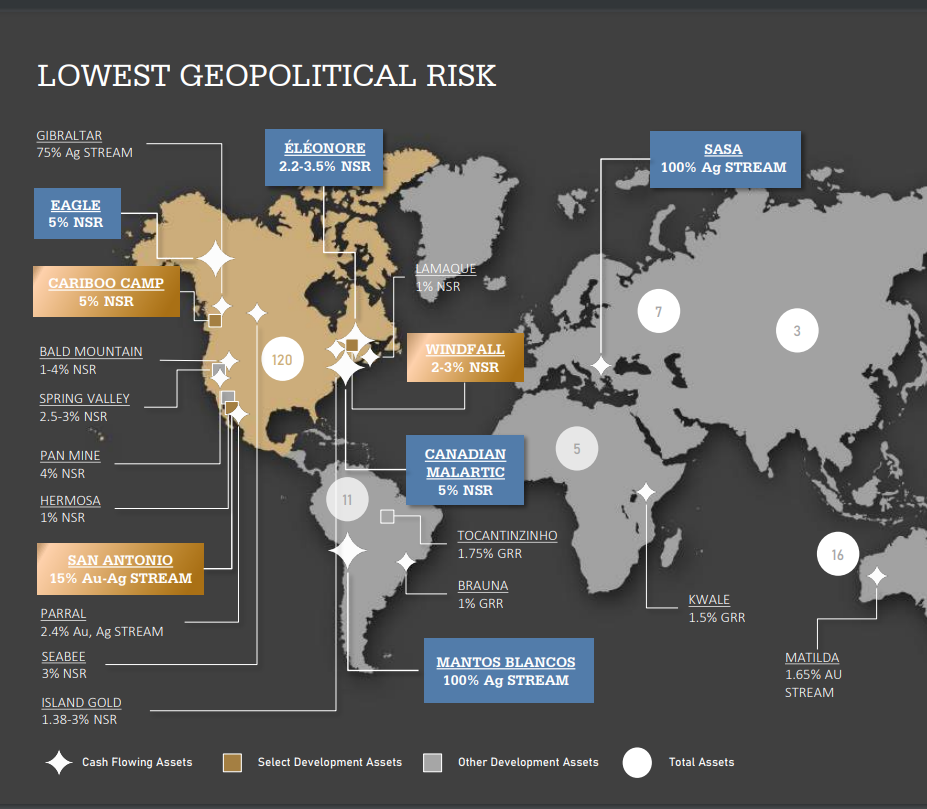

However, while the larger royalty companies like Franco Nevada (FNV) trade at 2.0x P/NAV, OR trades at a massive discount (1.0x P/NAV). This is even though OR aims to grow its attributable production from ~95,000 gold-equivalent ounces in FY2023 to 140,000+ GEOs in FY2026, a growth rate that makes it the second highest-growth name sector-wide. This discount is related to the company's portfolio being less diversified than its peers, which is the case for all earlier-stage royalty names. Still, given that OR is partnered with some of the best operators, its growth path is de-risked, and I have high confidence in its guidance. Additionally, the company has the best jurisdictional profile sector-wide. Given its jurisdictional safety and industry-leading growth, I see this steep discount as unjustified, and the stock looks like a steal at $12.40.

The final name on the list is Alamos Gold (AGI), a 500,000-ounce per annum producer operating out of Canada and Mexico. As it stands, Alamos is on track to produce 470,000 ounces this year at all-in sustaining costs of $1,250/oz, slightly above the industry average. However, the company recently broke ground for a massive expansion at its Island Gold Mine with plans to increase production to 240,000 ounces per annum in 2025 (~130,000 ounces currently). Meanwhile, it's rapidly advancing its Lynn Lake Project in Manitoba, which can produce 170,000+ ounces per annum at industry-leading costs.

Assuming the company can execute successfully on its growth plans, we should see Alamos' production increase by 50% by 2026. At the same time, it will be more diversified (4 mines vs. 3) and see its operating costs slide below $825/oz, making it one of the lowest-cost miners sector-wide. This should lead to meaningful multiple expansion, with its P/NAV multiple likely to improve to 1.15 (0.85 currently). So, with the stock trading below $8.00 with a fair value of $11.50 at its higher multiple, I see this post-earnings sell-off as a buying opportunity.

While the GDX remains out of favor after dismal returns over the past decade, I believe this is the time to be open-minded to building positions in the sector. In my view, AEM, AGI, and OR are three of the highest-quality names for conservative investors, and I believe they can be accumulated on weakness.

Taylor Dart

INO.com Contributor

Disclosure: This contributor held long positions in GLD, AEM, AGI, and OR at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.