In February 2023, the US economy produced 311,000 jobs, surpassing market expectations of 205,000, and revised down from 504,000 in January. This indicates a labor market that remains tight, with an average of 343,000 jobs added per month over the previous six months.

This is another upbeat NFP report following last month's even stronger data. The Fed now has more ammunition to potentially raise rates by 0.5% at their next meeting.

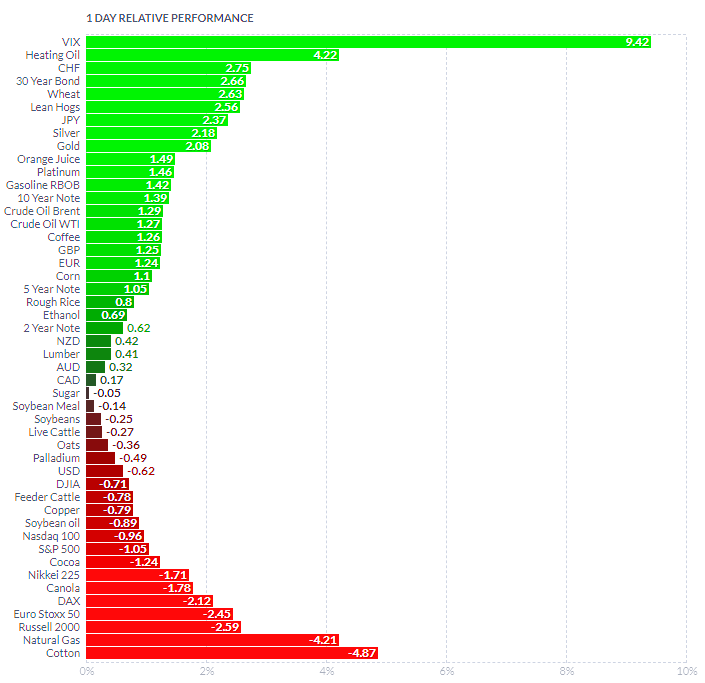

Let's take a look at how the market reacted to this report.

The top three winners last Friday, when the jobs report was published, were VIX, which gained +9.42% in just one day, heating oil futures, which rose by +4.22%, and the Swiss franc, which increased by +2.75%. Continue reading ""50 Cent" Profits From 3-Letter Acronyms"