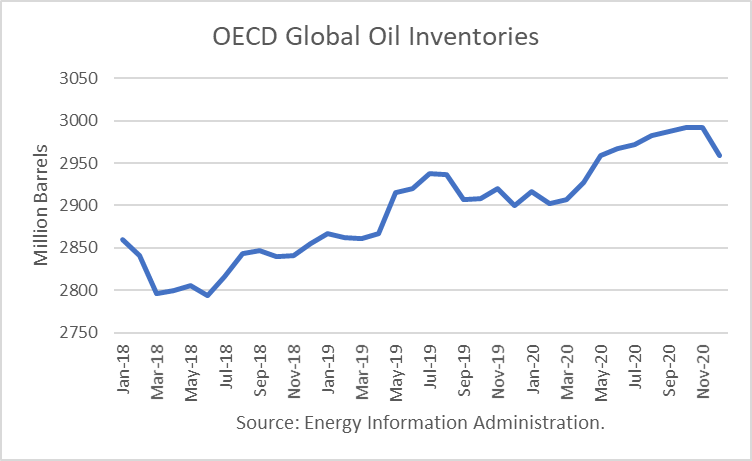

The Energy Information Administration released its Short-Term Energy Outlook for November, and it shows that OECD oil inventories likely bottomed last June 2018 at 2.794 billion barrels. It estimated stocks rose by 1 million barrels in October to 2.909 billion, 69 million barrels higher than a year ago.

For the balance of 2019, OECD inventories are projected to stabilize at 2.900 billion, 55 million higher than end-2018. For 2020, EIA projects that stocks will build by 59 million barrels to end the year at 2.959 billion.

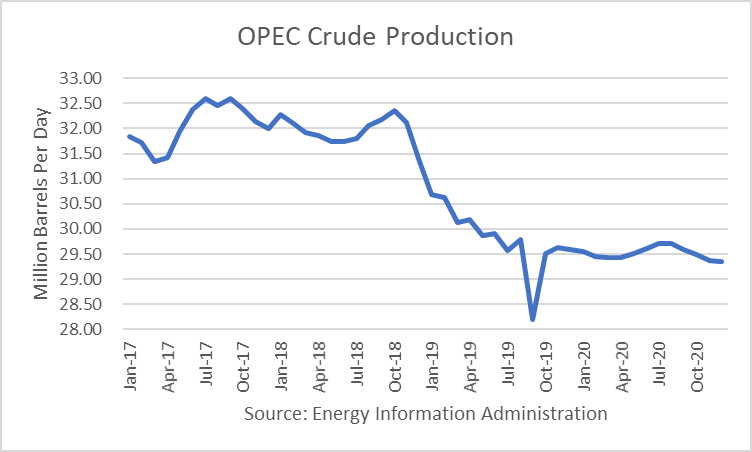

The EIA estimated that OPEC production rose by 1.325 million barrels per day in October, 1.3 of which was in Saudi Arabia due to the recovery from the attack on its oil facilities. It is estimating that OPEC production averaged about 29.52 million in October. For 2020, it estimates that OPEC production will average about 29.52 million, about 160,000 b/d above the call (demand) for OPEC oil in 2020.

Oil Price Implications

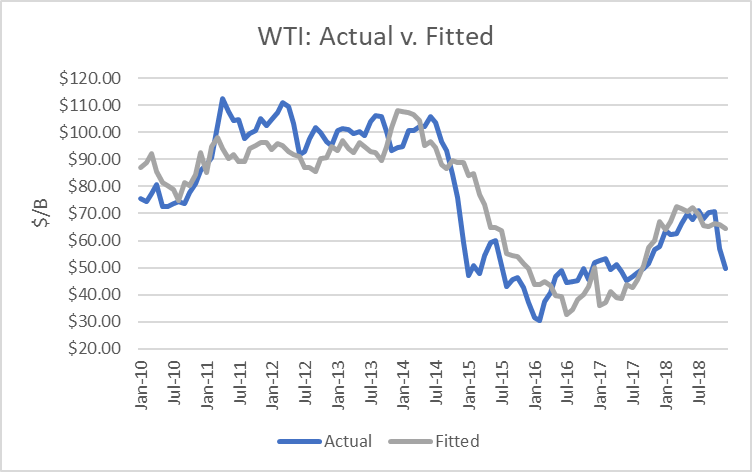

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2018. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 80 percent.

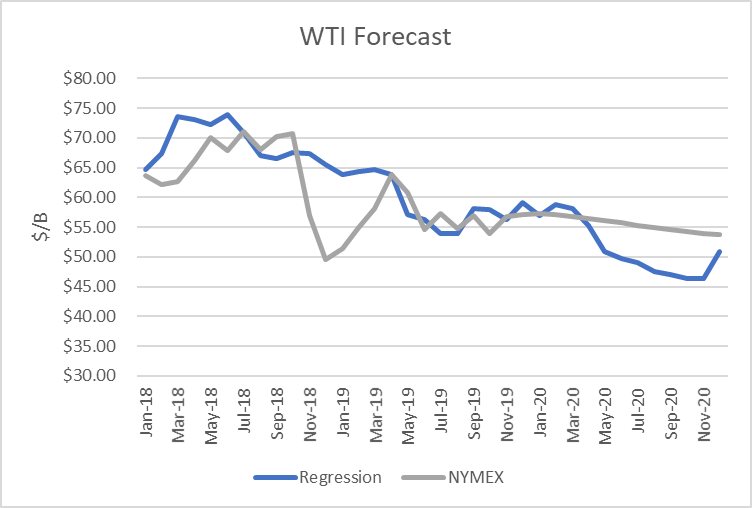

I used the model to assess WTI oil prices for the EIA forecast period through 2019 and 2020 and compared the regression equation forecast to actual NYMEX futures prices as of November 13th. The result is that oil futures prices are presently overvalued for much of the forecast horizon beginning May 2020.

After June 2020, it shows the valuations dropping down to where NYMEX futures prices are below $50/b.

Uncertainties

The 4Q18 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. The attack on Aramco’s oil facilities also proves they can rise above the model-derived price.

Non-OPEC production is projected to increase by more than 2.4 million barrels per day in 2020. In addition to U.S. production gains, higher production is expected in Norway, Brazil, Canada, and Guyana. These gains will pressure OPEC+ to cut back further, and their willingness to do so is a major uncertainty.

In addition, the ending of Iran sanctions and return of their 1.7 million barrels per day of exports is another major unknown. As the U.S. presidential election nears, there will be pressure on President Trump to make a new deal to justify his actions. It could also be a strategy to reduce U.S. gasoline prices to help consumers and farmers.

Another key uncertainty playing out is the trade war with China. A phase one deal is reportedly likely in December. It is important for Trump to get a deal that will help agricultural exports to China during the election cycle. This factor could also boost oil demand marginally.

Finally, Venezuela remains a key uncertainty. PDVSA reportedly budgeted for a 650,000 b/d increase in 2020. It had been reported that a Chinese firm has agreed to help the country restore its refinery operations in a trade for oil.

Conclusions

Based purely on the model, oil prices are about fairly-valued for the next six months but then are overvalued thereafter, based on futures as of November 13th. The key uncertainty is a new deal with Iran, which could lead to the reduction or end of sanctions, flooding the market, and it appears traders are pricing in some downside risk but not collapse as would be likely if that were to occur.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.