TD Ameritrade, Fidelity, Charles Schwab, and E-Trade are following in Robinhood's footsteps and offering commission-free trading on all stocks, ETFs, and options trading! This presents an options trader’s paradise and serves as a great time to start trading options as these commissions are no longer cutting into your profit margins. This is vital since maximizing the number of trade occurrences is one of the many reasons why options trading is so effective over the long term. Over the past 14 months, an options-based portfolio demonstrated the effectiveness of this strategy against the traditional stock-picking approach.

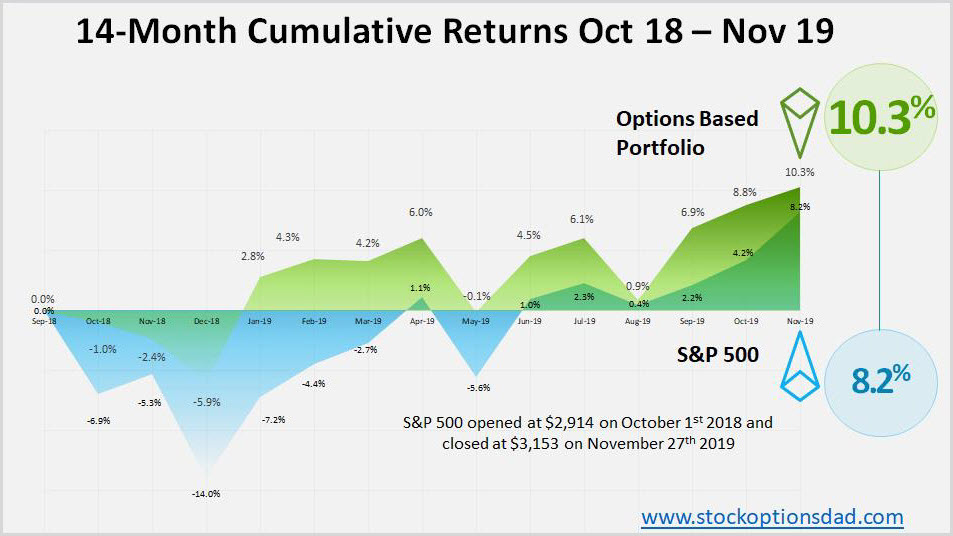

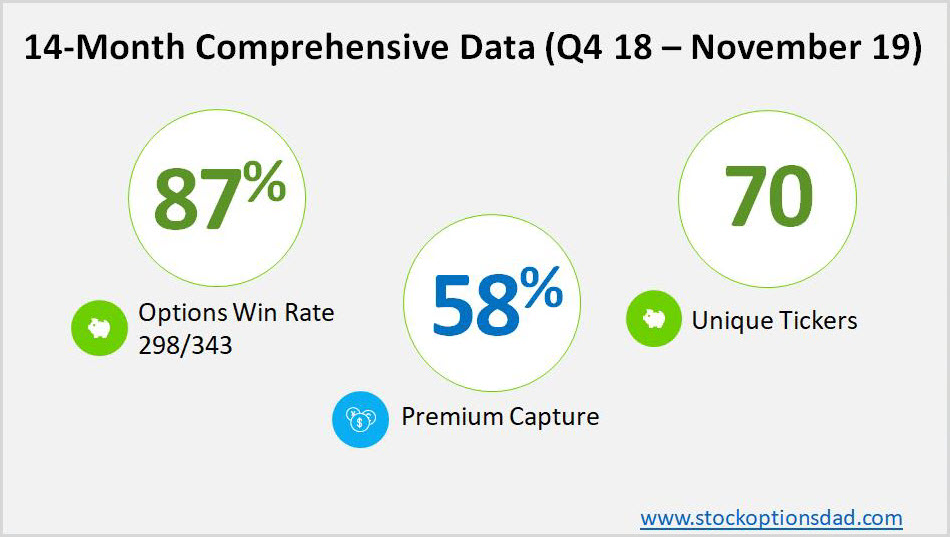

Primarily sticking with dividend-paying large-cap stocks across a diversity of tickers that are liquid in the options market is a great way to generate superior returns with less volatility over the long term. Over the past 14 months, 343 trades have been made with a win rate of 87% and a premium capture of 58% across 70 different tickers. Moreover, when stacked up against the S&P 500, an options strategy generated a return of 10.3% compared to the S&P 500 index, which returned 8.2% over the same period. These returns demonstrate the resilience of these high-risk options trading in both bear and bull markets (Figures 1 and 2).

Figure 1 – 14-month cumulative returns of an options-based strategy compared to the S&P 500 returns over the same time period

Figure 2 – 14-month cumulative metrics of an options-based strategy

Commission-Free Cost Savings

Over the past 14 months, over 300 trades were placed, and commissions were paid on opening and closing these trades (unless I closed the position for less than $0.10 per contract). For a given block of 300 trades, the commissions incurred are $5 per trade, translating into $1,500 to open this block of trades. Worst case scenario, another $1,500 was incurred on closing this block of trades, resulting in $3,000 in commissions being paid. It’s critical to mitigate these commissions when running an options-based portfolio since these costs will erode profit margins. Circumventing $1,500 - $3,000 over the course of 300 trades can make a meaningful difference in any given portfolio while providing flexibility to close trades now that commissions are no longer a deterrent.

Life Insurance and Options Trading?

Insurance companies sell policies based on actuaries and risk factors, then price these policies to their advantage. Insurance companies are betting on probabilities across insurance products and sell overpriced policies above their expected losses. The insurer agrees to pay out a specific amount of money for a specific loss (i.e., death). In return, the insurance company is paid monthly premiums and based on this risk-based revenue model, it’s a very profitable business. Insurance companies sell policies with a premium cost level that maximizes a statistical edge to the insurance company’s benefit. The goal is to collect premiums over the course of the policy and never pay out on the policies they sell to you. So, the probability of paying out on the policy is very low, while the premiums received over the policy lifespan will exceed your total benefit.

In terms of life insurance, it’s the probability that you won’t die before your predicted lifespan, so the insurance won’t have to pay. Instead, the insurance company assumes you’ll die before the model predicts and will charge you more money via premiums upfront. In order to spread the potential payout risk, the insurance company will sell as many policies as possible to collect as much premium income as possible. In short, insurance companies have found a way to statistically place the probability of never paying out on these policies they sell to you in their favor.

Running Your Portfolio Like An Insurance Company

Options trading is much like the insurance example above. I receive premium payments (policy payments) in exchange for selling options (insurance). I sell these options with a statistical edge (underwriting) and a high probability of winning the trade (insurance won’t have to pay). Occasionally, options move against you (death occurred), and you’re assigned stock (insurance is paid out); however, in order to spread the risk of being assigned shares, options (insurance) are sold across a diversity of tickers that include both stocks and ETFs with varying expiration dates and optimal sector exposure. Additionally, risk is mitigated by appropriate capital allocation, position-sizing, and holding cash reserves in the portfolio.

Maximizing Number of Trade Occurrences

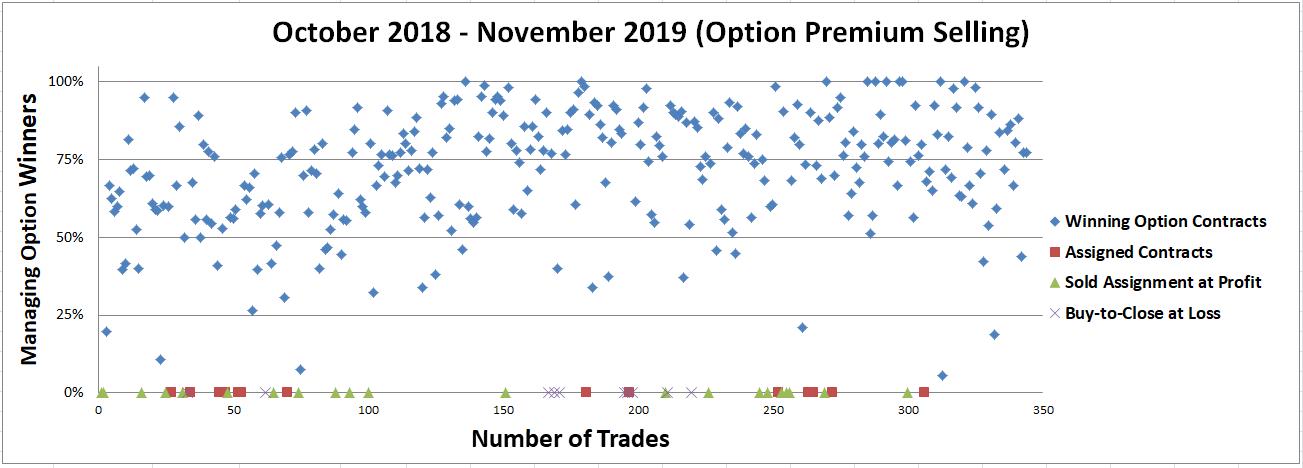

Maximizing the number of trades is essential for any options-based strategy. Placing only 10 trades or 50 trades over a given time period is simply inadequate for an options-based approach. Instead, trading through all market conditions at a specific probability of success level, given enough trades and time, the probabilities will reach their expected outcomes. This maximizes the number of shots on goal. Over a long enough time period, these data will be smoothed out over the various market conditions to reach your expected probability of success. To achieve the expected probability level, hundreds of trades need to be placed and closed before the probabilities really begin to play out. As these trade data grow in size, plotting all of your trades over time, you’ll see the numbers align more and more with your expected probabilities. Taken together, trade as often as you can at your desired probability of success to achieve the win rate of interest (Figure 3).

Figure 3 – Dot plot summarizing ~350 trades over the previous 14-month period highlighting the importance of maximizing trades and trading through all market conditions

Conclusion

Maximizing the number of trade occurrences, position-sizing, diverse sector exposure, trading stocks, and ETFs and managing winning trades is essential for an options-based portfolio to succeed over the long term. In addition, now that all major brokers have transitioned to a commission-free trading model, an options-based portfolio can be even more lucrative. Now that options traders can circumvent all options-related commissions, profit margins can be maximized.

Options trading allows one to profit without predicting which way the stock will move, allowing your portfolio to generate smooth and consistent income month after month since options are a bet on where stocks won’t go, not where they will go. Selling options with a favorable risk profile and a high probability of success is the key. Options provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. For example, I’ve demonstrated an 87% options win rate over the previous 14 months through both bull and bear markets while outperforming the S&P 500 over the same period by a wide margin producing a 10.3% return against an 8.2% for the S&P 500 with a lower risk profile. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions with the probability of success in your favor.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.

If the past 14 months are your baseline, then the strategy has been tested in several, but certainly not all market conditions. All market downturns over this time span occurred in the broader context of a bull market and the market roared back from declines as fast as it went down every time. Assignments from put writing were immediately "bailed out". In a genuine bear market things will be very different.

The greatest risk to the strategy is the rare, but by no means impossible event of a crash. Diversification is not going to help in such a scenario, as intra-market correlations tend to move toward "1" in such sudden bouts of illiquidity and panic. Moreover, buy stops are not going to be of much help either. As an example, consider the 1987 crash. In the week preceding the crash, the market was down on four of five trading days - it was the worst week in years. It also left the market in very "oversold" condition, but the next Monday the DJIA opened with almost a 200 point gap down (equivalent to more than a 2,000 point gap down at today's index levels). The VIX (which at the time referenced OEX rather than SPX options) ended the day at an incredible 176 points. In other words, not only did large numbers of put strikes go "into the money" across the board, but the volatility premiums on puts exploded out of the gate as well.

Such risk can be mitigated with a spreading strategy (selling a closer-to- the money put strike and buying a more out-of-the-money one concurrently), but this lowers potential income commensurately. If the strategy consists of outright put writing only, an event such as the 87 crash will wipe you out (the margins clerks will just close out your positions regardless of how inconvenient and ill-timed it may look in hindsight). Perhaps such an outlier event is not likely to happen anymore, but that is precisely what people thought prior to 1987 as well (at the time the "outlier event" that by general agreement was never going to be repeated again had happened 58 years earlier). Admittedly, these events are so rare that the risk of one occurring looks statistically very small. But it is a bit like a nuclear accident in a way: highly unlikely to happen, but utterly devastating when it does.

Hi Peter

Thanks for the comment, a few things:

1) Cash is a position and right now I'm holding over 50% of my portfolio in cash. Holding cash in a significant percentage of your portfolio is critical for this type of strategy.

2) Covered calls and puts make up this strategy and for high priced equities, I use put spreads to define risk and leverage less capital.

3) Certain positions will be assigned and in those situations, I'll sell covered calls and collect dividends over time until the underlying security recovers to sell the position at a profit on top of all the options premium income and dividend income.

4) If the market drops like it did in 2008/2009 then some assignments will occur however these assignments will typically occur at a 10% discount to where the stock traded when the option was sold.

5) Overall, this strategy will generate smoother portfolio returns and largely circumvent market meltdowns.

Hi Noah

Schwab charges no commissions on stock trades, but they still charge commissions on options.

PS Great article

Hi Luigi

Do they charge a small fee per contract (i.e. $0.10 per contract) or are they charging $5 per option trade? The small fees are negligible so its essentially free. I use Fidelity and they charge small fees but did away with the commissions of $5 per trade.

Thanks for the comment!