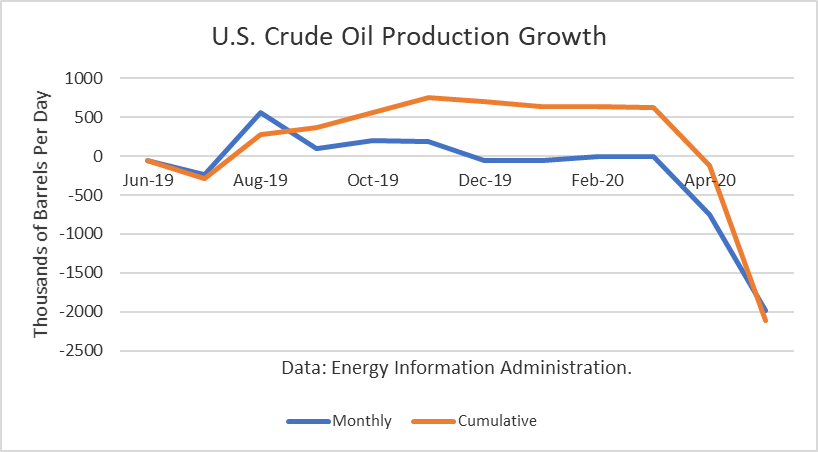

The Energy Information Administration reported that May crude oil production collapsed by 1.989 million barrels per day (mmbd), averaging 10.001 mmbd. That compares to the EIA’s weekly estimates (interpolated) of 11.419 mmbd, a figure that was 1.418 mmbd higher.

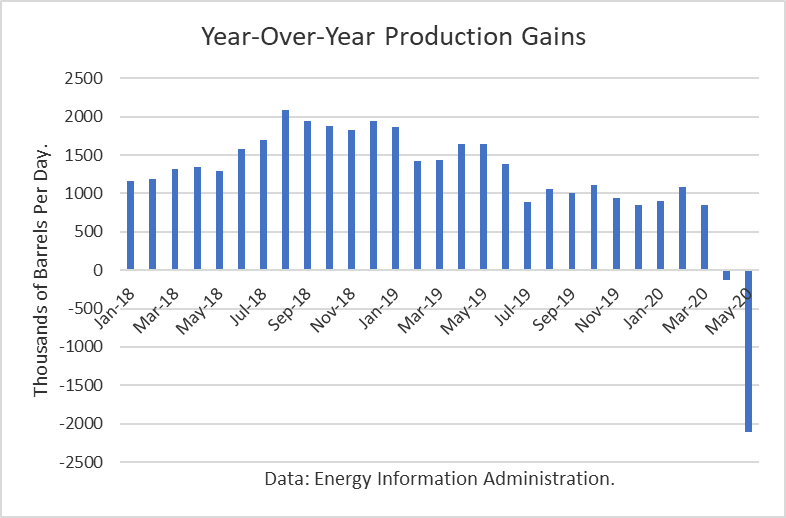

Reductions were largest in Texas (764,000), North Dakota (353,000) and the Gulf of Mexico (300,000) and New Mexico (168,000). Given the huge reduction in May, production dropped by 2.112 mmb/d over the past 12 months. This number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply fell by an additional 680,000 b/d from a year ago.

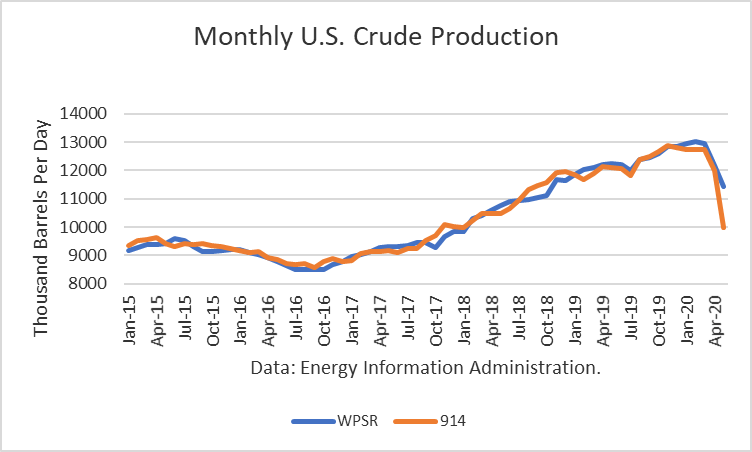

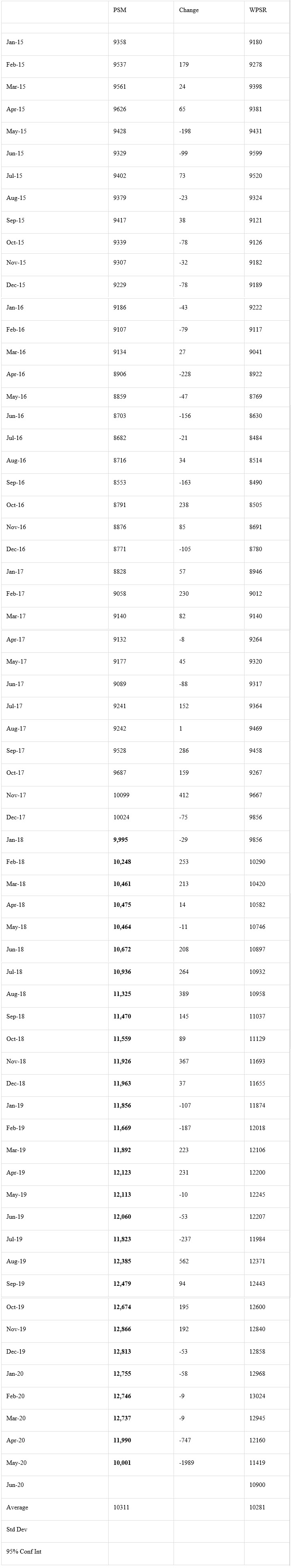

The EIA-914 Petroleum Supply Monthly (PSM) figure was the largest deviation between the weekly data reported by EIA in the Weekly Petroleum Supply Report (WPSR) for any month by far.

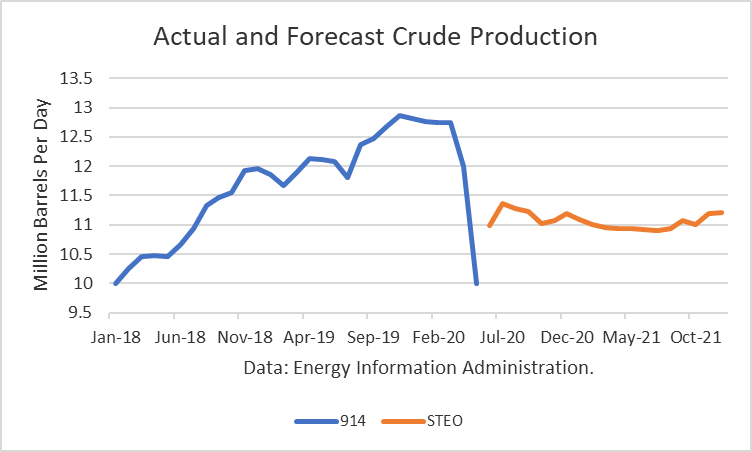

The May figure was about 1.2 mmb/d lower than the 11.2 mmbd estimate for that month in the July Short-Term Outlook. This difference is almost certain to trigger a “rebenchmarking” to EIA’s model in future production levels at this time.

The EIA is projecting that 2020 production will exit the year at 11.2 mmbd. And for 2021, it projects an exit at 11.20 mmbd. These rebounds from the May level as a result of the price collapse are in doubt unless oil prices rise through the forecast horizon.

Conclusions

The actual crude oil production based on the EIA-914 survey data for May shows a much lower figure than the EIA’s model has assessed and makes its current estimates and future forecasts look highly suspect. This development implies that the August STEO forecast is going to be much lower than indicated above.

However, in a survey in June by the Dallas Federal Reserve, E&P executives indicated that they would begin restarting wells that they had shut-in. And so the outlook is highly uncertain, given the price collapse and unknowns regarding the pandemic and future oil prices.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.