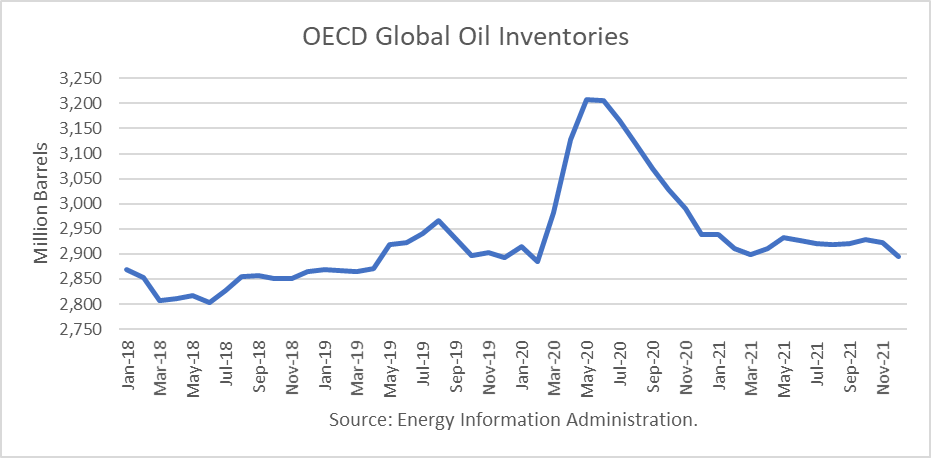

The Energy Information Administration released its Short-Term Energy Outlook for September, and it shows that OECD oil inventories likely bottomed in this cycle in June 2018 at 2.804 billion barrels. It estimated stocks dropped by 45 million barrels in August to end at 3.120 billion, 179 million barrels higher than a year ago. It estimates that inventories peaked in May 2020 at 3.209 billion.

The EIA estimated global oil production at 91.55 million barrels per day (mmbd) for August, compared to global oil consumption of 94.31 mmbd. That implies an undersupply of 2.76 mmbd or 85 million barrels for the month. About 32 million barrels of the draw for August is attributable to non-OECD stocks.

For 2020, OECD inventories are now projected to build by a net 46 million barrels to 2.939 billion. For 2021 it forecasts that stocks will draw by 44 million barrels to end the year at 2.895 billion.

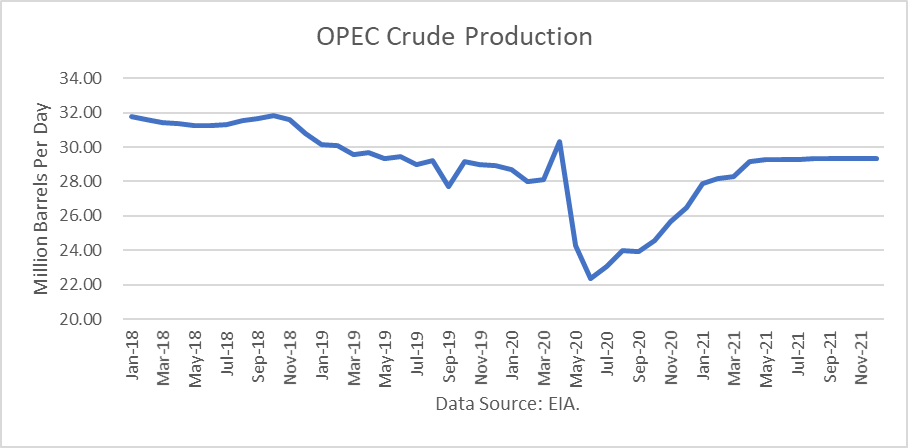

The EIA forecast was made incorporates the OPEC+ decision to cut production and exports. According to OPEC’s press release:

“Adjust downwards their overall crude oil production by 9.7 mb/d, starting on May 1st, 2020, for an initial period of two months that concludes on June 30th, 2020. For the subsequent period of 6 months, from July 1st, 2020 to December 31st, 2020, the total adjustment agreed will be 7.7 mb/d. It will be followed by a 5.8 mb/d adjustment for a period of 16 months, from January 1st, 2021, to April 30th, 2022. The baseline for the calculation of the adjustments is the oil production of October 2018, except for the Kingdom of Saudi Arabia and The Russian Federation, both with the same baseline level of 11.0 mb/d. The agreement will be valid until April 30th, 2022, however, the extension of this agreement will be reviewed during December 2021.”

Oil Price Implications

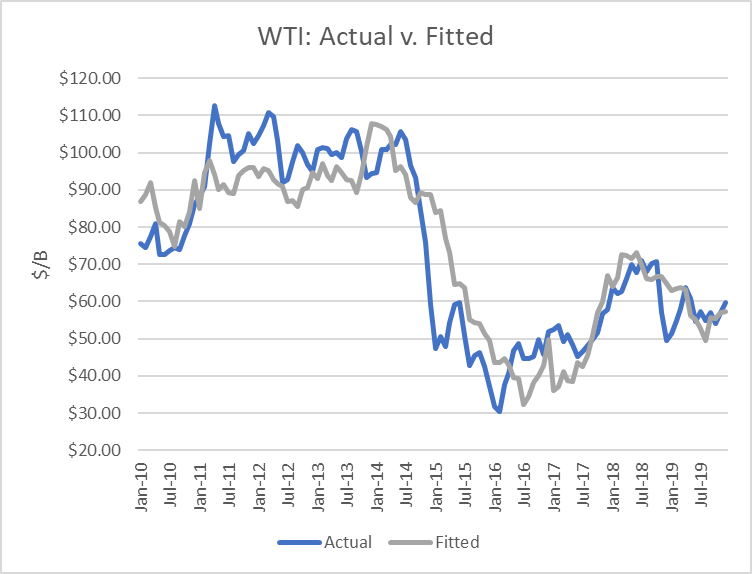

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2019. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 79 percent.

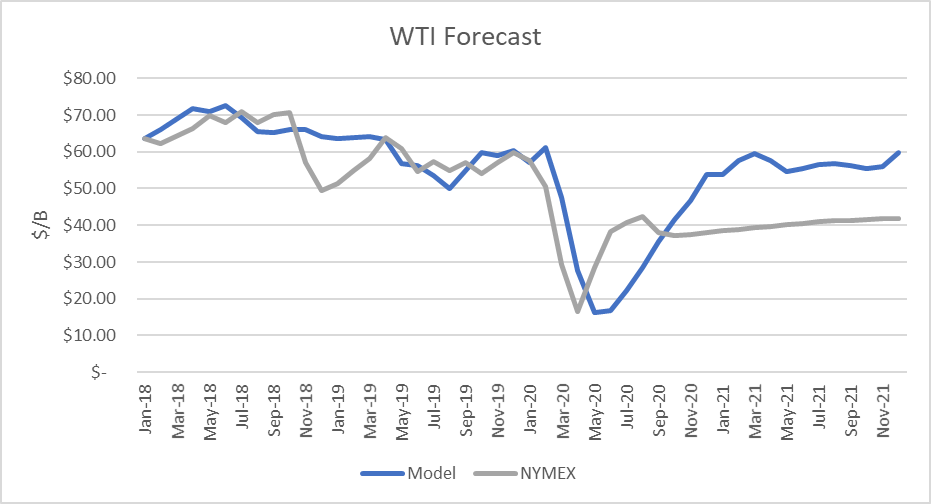

I used the model to assess WTI oil prices for the EIA forecast period through 2020 and 2021 and compared the regression equation forecast to actual NYMEX futures prices as of September 9th. The result is that oil futures prices are presently overvalued through September 2020. However, futures prices are undervalued starting in October 2020 through the forecast horizon in 2021.

Uncertainties

April 2020 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. In contrast, prices in May through July proved that the market factors in future expectations beyond current inventory levels.

The most important uncertainty is how deeply and how long the coronavirus will disrupt the U.S. economy. The U.S. has become the epi-center of the pandemic and is the largest economy and oil consumer globally.

The most recent supply/demand data from the U.S. appear to show that the recovery in demand has stalled with demand off 15.9 % v. last year. A recent report showed U.S. job growth slowed further in August, as financial assistance from the government ran out. U.S. airport travel data show that throughput is still more than 60 percent lower than last year, as of September 5th.

All three of the primary oil forecasting agencies, the International Energy Agency, the U.S. Energy Information Administration, and the Organization of Petroleum Exporting Countries, have published forecasts through 2021. None foresee global demand returning to pre-COVID levels before 2022.

It is also unknown how much, if any, of the demand destruction will be permanent due to changes in business, such as online meetings instead of face-to-face meetings, work-at-home, and concerns about flying with infected people.

WTI crude oil futures have dropped below $40/b for the first time since June. The market is becoming less bullish about the recovery in oil demand.

Conclusions

This pandemic is the biggest market-moving event in the modern history of the oil market. The uncertainties over if and when a safe and effective vaccine will become available are significant.

EIA’s September inventory forecast implies oil prices may rise by 50% by the end of 2021, based on their supply/demand forecasts. However, forecasts, given the unique uncertainties of a global pandemic, are highly risky.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.