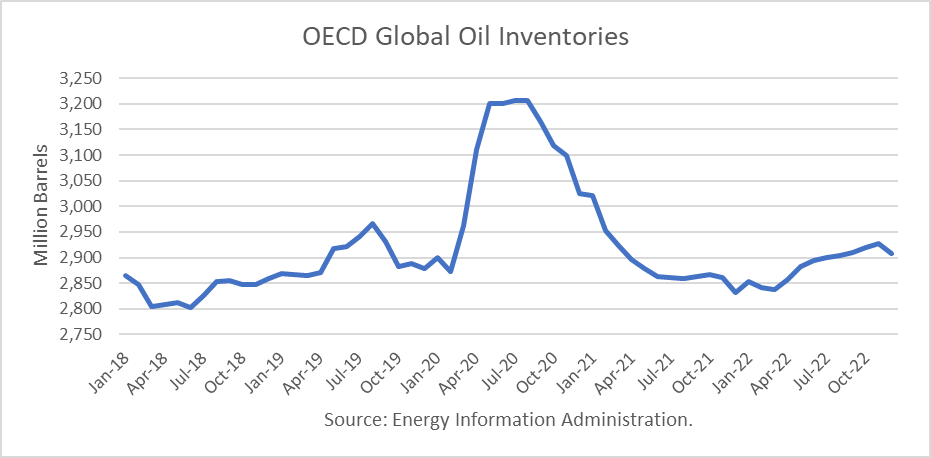

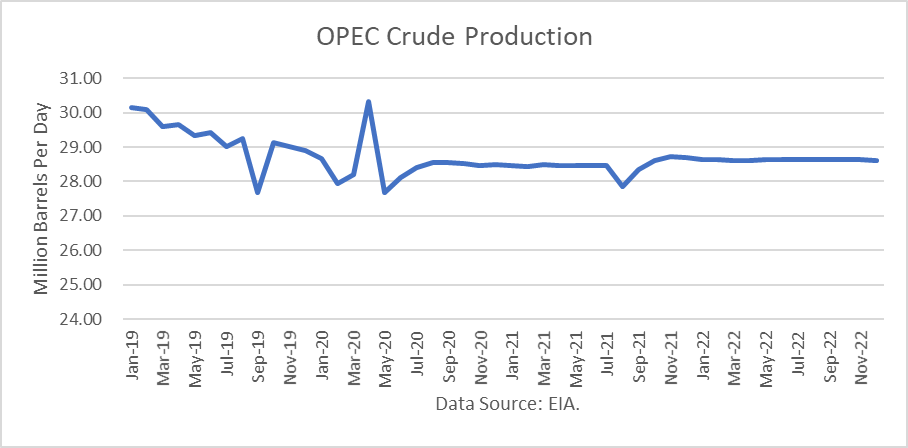

The Energy Information Administration released its Short-Term Energy Outlook for July, and it shows that OECD oil inventories likely peaked at 3.207 billion in July 2020. In June 2021, it estimated stocks fell by 12 million barrels to end at 2.864 billion, 337 million barrels lower than a year ago.

The EIA estimated global oil production at 96.75 million barrels per day (mmbd) for June, compared to global oil consumption of 97.90 mmbd. That implies an undersupply of 1.15 mmb/d, or 34 million barrels for the month. Given the decrease in OECD stocks, non-OECD stocks are implied to have increased by 20 million barrels.

For 2021, OECD inventories are now projected to draw by net 194 million barrels to 2.832 billion. For 2022 it forecasts that stocks will build by 76 million barrels to end the year at 2.908 billion.

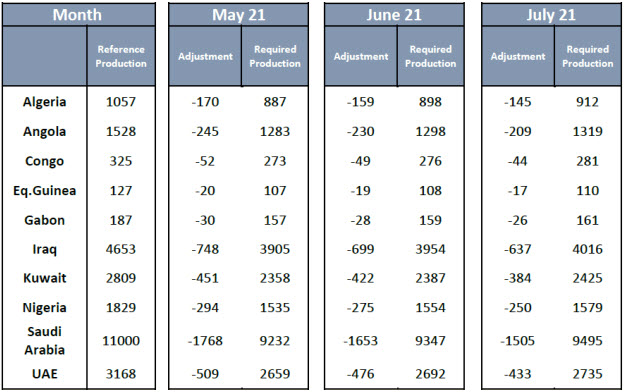

The EIA forecast does not incorporate the OPEC+ plan to increase production by 400,000 b/d each month from August to December. The plan was not formally put into place because of an objection by the UAE to obtain a higher quota. All OPEC decisions must be unanimous. However, UAE's energy ministry said on July 14th that there had been significant progress in resolving its standoff with OPEC+ and that a compromise deal is being discussed that will raise the UAE's crude production quota to 3.65 million bpd from about 3.17 mmbd currently.

The current “reference production” and adjustments levels are detailed in the table below.

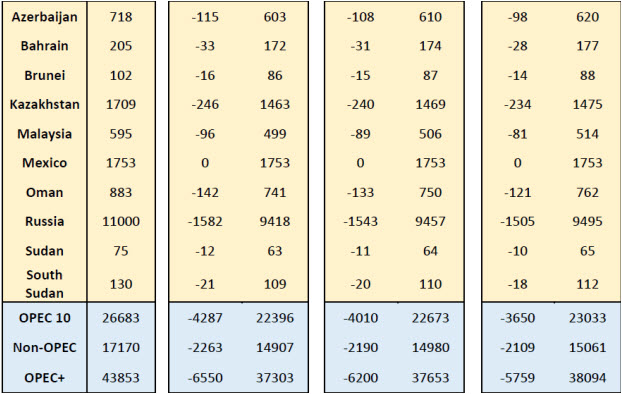

The EIA has assumed the following OPEC production levels for its STEO:

Oil Price Implications

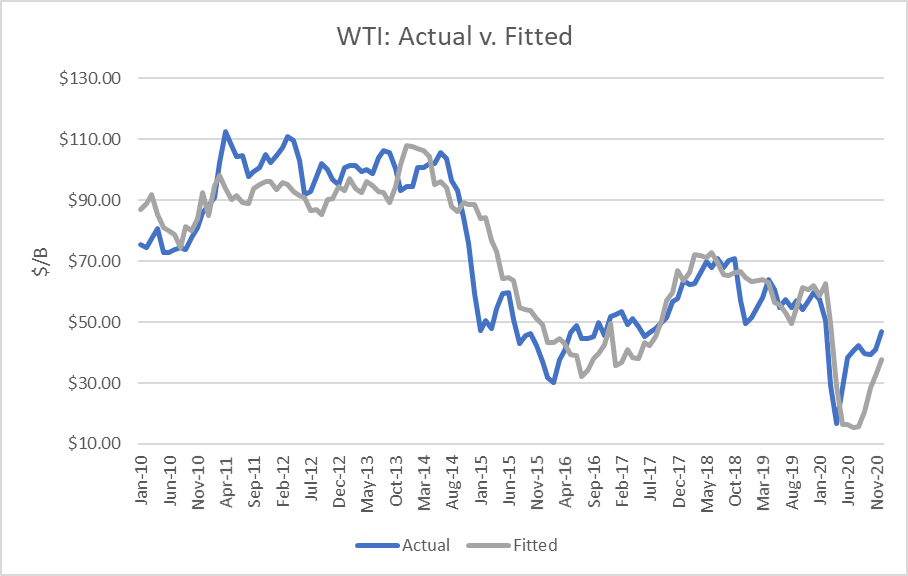

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2020. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 82 percent.

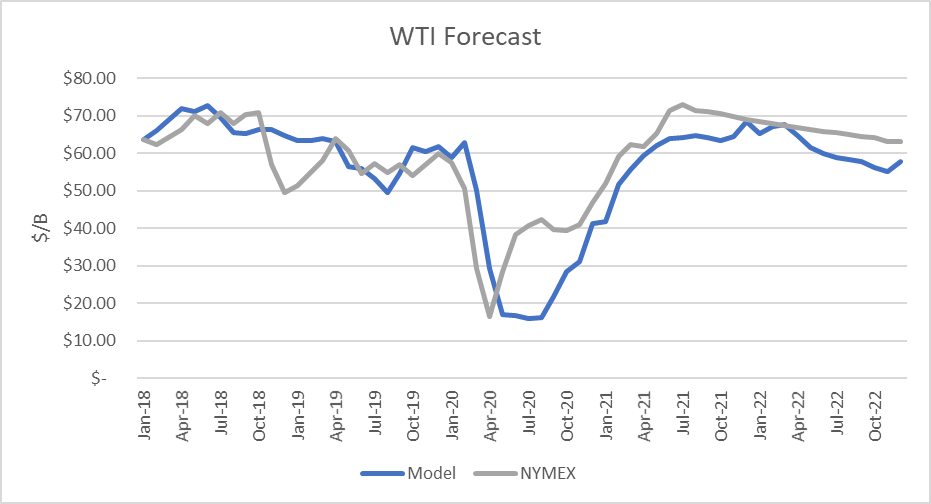

I used the model to assess WTI oil prices for the EIA forecast period through 2021 and 2022 and compared the regression equation forecast to actual NYMEX futures prices as of July 15th. The result is that oil futures prices are presently overpriced through the forecast horizon ending December 2022 even without taking into account the likely increase in OPEC+ production for the balance of 2021.

Uncertainties

April 2020 proved that oil prices can move dramatically based on market expectations and that they can drop far below the model’s valuations, whereas prices in May through April proved that the market factors in future expectations beyond current inventory levels.

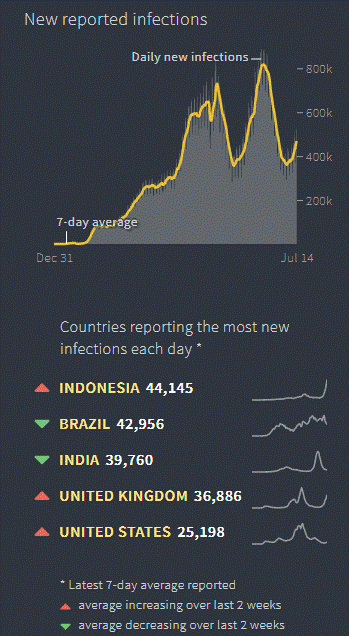

In addition to the uncertainty of how deeply and how long the coronavirus will disrupt the U.S. and world oil consumption. Covid cases have once again risen due to the spread of the delta variant.

At issue is how fast the vaccine will be deployed in the U.S. and worldwide. The pace of deployment has been relatively slow in Europe and some countries.

Another issue is whether high oil prices provide enough incentive to other producers, such as shale, to restore their production. In the latest weeks, U.S. production has been rising and has reached 11.4 mmbd.

Finally, at issue is how Iran’s production will rise in the months ahead with or without a nuclear deal. Biden has clearly stated that he wants the U.S. back in the deal and it has been reported that the US will end the sanctions on Iran’s oil and tanker industries. That could put around 1.5 more million barrels a day back into the world market or cause Saudi Arabia and others to cut production further to make room for Iran.

Conclusions

Given the recovery in oil prices, some are extrapolating further rises to $100 per barrel. The inventory forecast above clearly does not support such a rise and global inventories are likely to rise above the level indicated above due likely OPEC+ increases which are favored by both Saudi Arabia and Russia.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.