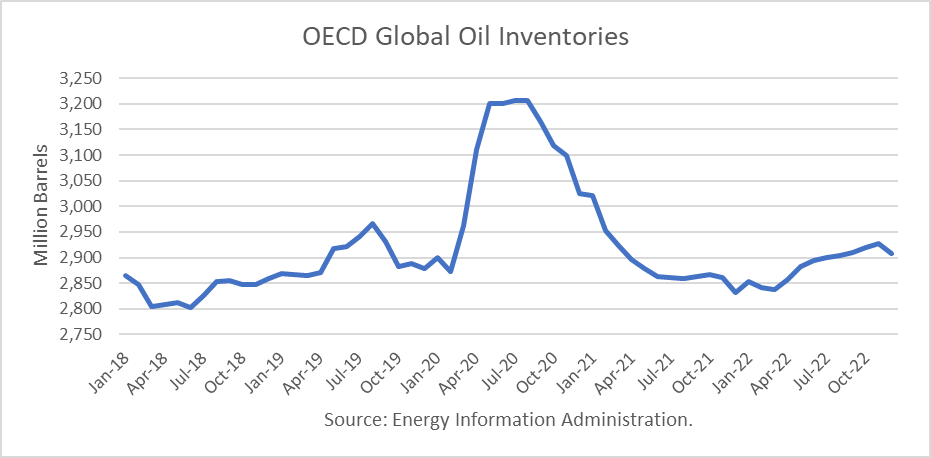

The Energy Information Administration released its Short-Term Energy Outlook for July, and it shows that OECD oil inventories likely peaked at 3.207 billion in July 2020. In June 2021, it estimated stocks fell by 12 million barrels to end at 2.864 billion, 337 million barrels lower than a year ago.

The EIA estimated global oil production at 96.75 million barrels per day (mmbd) for June, compared to global oil consumption of 97.90 mmbd. That implies an undersupply of 1.15 mmb/d, or 34 million barrels for the month. Given the decrease in OECD stocks, non-OECD stocks are implied to have increased by 20 million barrels.

For 2021, OECD inventories are now projected to draw by net 194 million barrels to 2.832 billion. For 2022 it forecasts that stocks will build by 76 million barrels to end the year at 2.908 billion.

The EIA forecast does not incorporate the OPEC+ plan to increase production by 400,000 b/d each month from August to December. The plan was not formally put into place because of an objection by the UAE to obtain a higher quota. All OPEC decisions must be unanimous. However, UAE's energy ministry said on July 14th that there had been significant progress in resolving its standoff with OPEC+ and that a compromise deal is being discussed that will raise the UAE's crude production quota to 3.65 million bpd from about 3.17 mmbd currently.

The current “reference production” and adjustments levels are detailed in the table below. Continue reading "World Oil Supply And Price Outlook, July 2021"