This week we have a stock market forecast for the week of 7/25/21 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

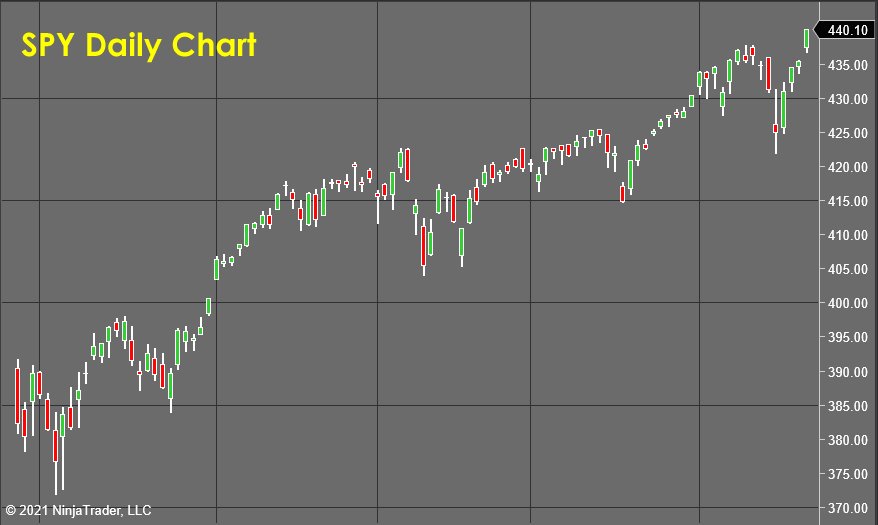

The S&P 500 (SPY)

Another week of organic bearish sentiment and stimulus bringing bullish energy into the market. These cross-currents make many of the inputs I use to forecast prices buddy and unreliable, so it puts me on the sidelines until the odds for success improve.

Let’s take a minute to unpack the word “odds.”

I want you to think of the markets like a political campaign for governor of a state.

In order to win that race, you must get many different groups with totally different goals and needs to endorse and vote for you. If you can get all these different entities to the table, then you will have the votes to win, and if you get a TON of these groups, the odds for your victory become as close to 100% as can exist in the political world.

The market is an endless auction, an endless election with the “voters” being market participants “voting” with their money as they put it into or take it out of a stock.

When I saw “the odds are high” in this column, I’m saying that there are a TON of different constituencies in the market that I believe are about to start getting triggered to buy or sell.

This cascade of different interests, who are all IN ALIGNMENT for a brief moment, will cause a short-term imbalance in the supply and demand forces, and the market will experience a nice trending move.

When the market is postured the way it is now, there IS NO ALIGNMENT, so while I have a generally bearish posture from my analysis and believe that the breakout will fizzle, there isn’t enough evidence of alignment to make it worth taking any risk.

So the best choice in a low odds (low alignment) environment is to do nothing. This is the hardest thing when you have a responsibility to clients or readers who expect information on a regular schedule. Hopefully, this market forecast will offer a unique insight into how a career trader cycles aggressiveness as market conditions change for and against them.

S&P Global, Inc. (SPGI)

S&P Global, Inc. (SPGI) is the rating and index management company's parent company behind the S&P 500. This stock has been on a tear, and so there will be many market participants who have big paper profits burning a hole in their pockets. There are a LOT of other factors, each with a substantial constituency reacting to it, that will trigger a sell signal if/when the price goes below the $415 per share area (Lower edge of the Red Zone). All this alignment will give me a high odds scenario just like I have described above, so it’s the ONLY attractive stock I found when I scanned the markets today.

The reward potential of this trade will hinge on how many of these aligned constituencies are triggered by a move down in price. When the price hits the $405-$410 area, I’ll be able to take a measurement of the supply and demand forces and see if, indeed, this has happened.

IF we do have alignment, then we could see the price drop to break below the $400 area; if they do not trigger and align, then it will be time to take profits and move on.

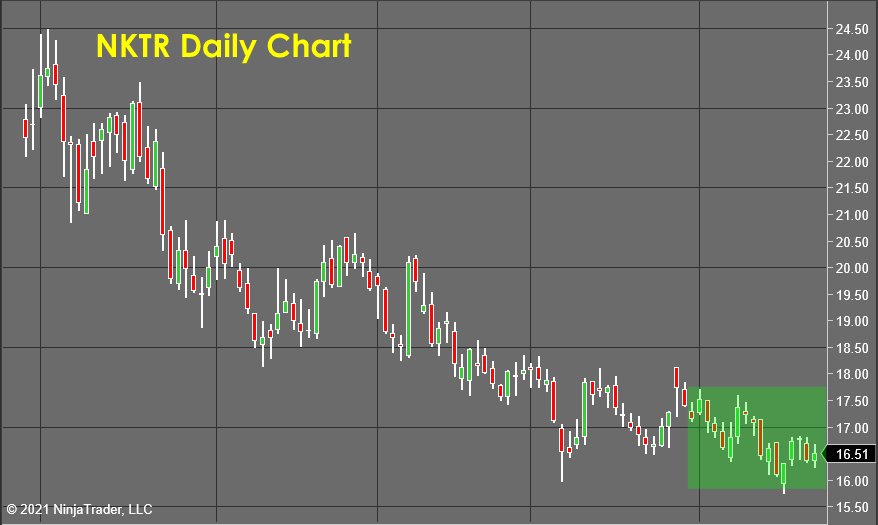

Nektar Therapeutics (NKTR)

Based on what I just shared with you, NKTR was a lower probability trade with huge profit potential. This means that while it didn’t have a ton of alignment between constituencies, it had the potential to pay off so well that it was worth the risk of getting whipsawed.

And that’s exactly what it seems to have done to me. After taking out the stop-loss orders below the $16 per share area (Green Zone), it has reversed and is coiling again, with the odds raising for a bullish breakout.

For those doing their own analysis, you might keep this on your radar for a re-entry. However, for me, once a stock has triggered stop losses, I know that many readers who haven’t worked on their mental game enough will have some strong emotions connected to this stock which will likely affect their management of any re-entry.

For this reason, I’m walking away from NKTR since my goal for this column is both to show you how consistently the market can be forecast and that our methodology is worth considering if you are NOT a consistent trader yet, and also to serve those who are still on their path to their goals.

Getting them involved in an emotionally challenging trade doesn’t serve them and will likely end up in them breaking down during a wiggle and missing out on the bigger move. So, I will let NKTR do what it will for at least a few weeks.

To Learn How To Accurately and Consistently Forecast Market Prices Just Like Me, Using Market Vulnerability Analysis™, visit Market Forecasting Academy for the Free 5 Day Market Forecasting Primer.

Check back to see my next post!

Bo Yoder

Market Forecasting Academy

About Bo Yoder:

Beginning his full-time trading career in 1997, Bo is a professional trader, partner at Market Forecasting Academy, developer of The Myalolipsis Technique, two-time author, and consultant to the financial industry on matters of market analysis and edge optimization.

Bo has been a featured speaker internationally for decades and has developed a reputation for trading live in front of an audience as a real-time example of what it is like to trade for a living.

In addition to his two books for McGraw-Hill, Mastering Futures Trading and Optimize Your Trading Edge (translated into German and Japanese), Bo has written articles published in top publications such as TheStreet.com, Technical Analysis of Stocks & Commodities, Trader’s, Active Trader Magazine and Forbes to name a few.

Bo currently spends his time with his wife and son in the great state of Maine, where he trades, researches behavioral economics & neuropsychology, and is an enthusiastic sailboat racer.

He has an MBA from The Boston University School of Management.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.