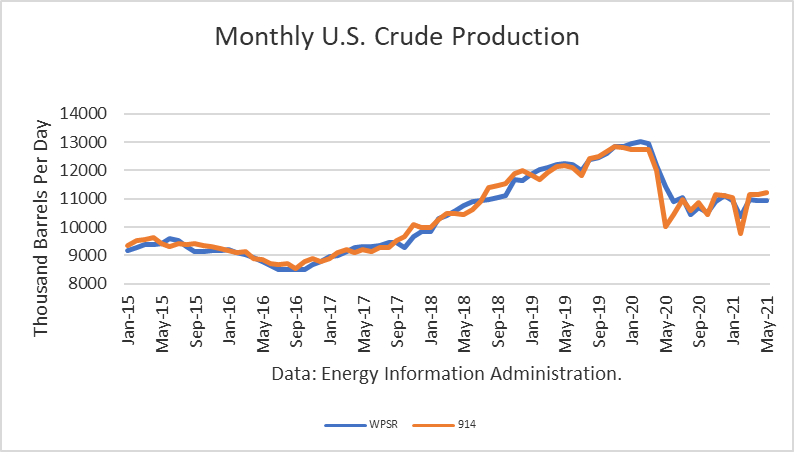

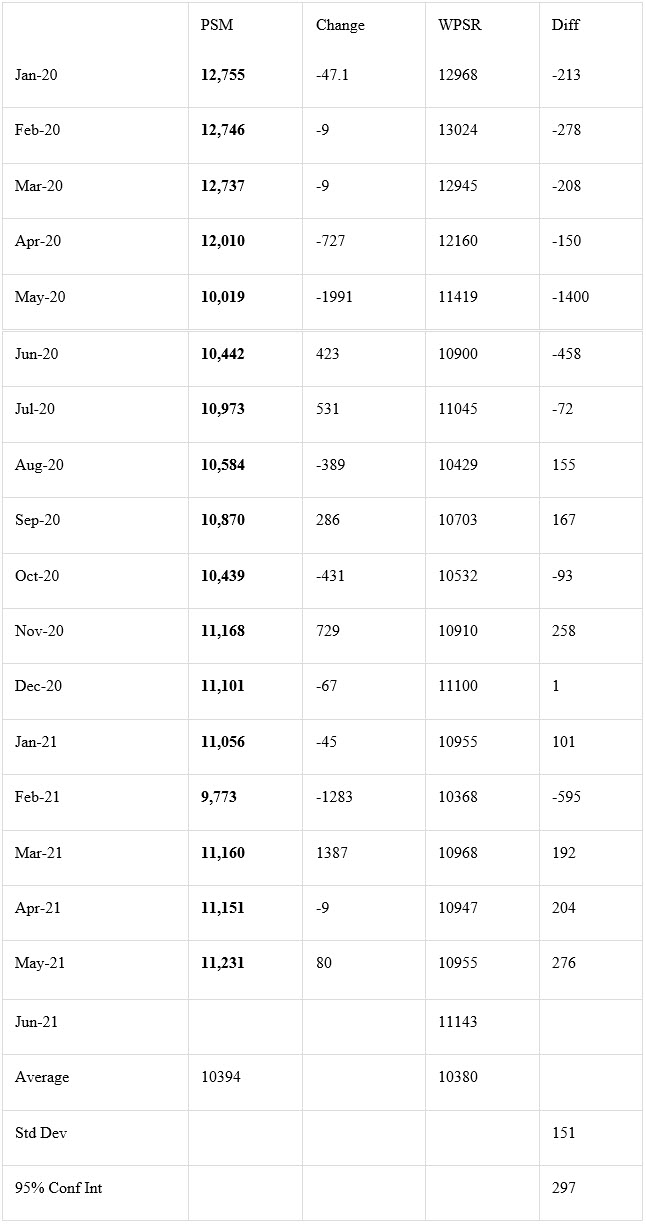

The Energy Information Administration reported that May crude oil production rose by 80,000 barrels per day, averaging 11.231 mmbd. This follows a modest decline in April. The May 914 figure compares to the EIA’s weekly estimates (interpolated) of 10.955 mmbd, a figure that was 276,000 lower than the actual 914 monthly estimate.

The largest gain was in New Mexico (49,000 b/d), followed by The Gulf of Mexico (29,000 b/d) and North Dakota (26,000 b/d). On the other hand, production in Texas actually declined by 22,000 b/d.

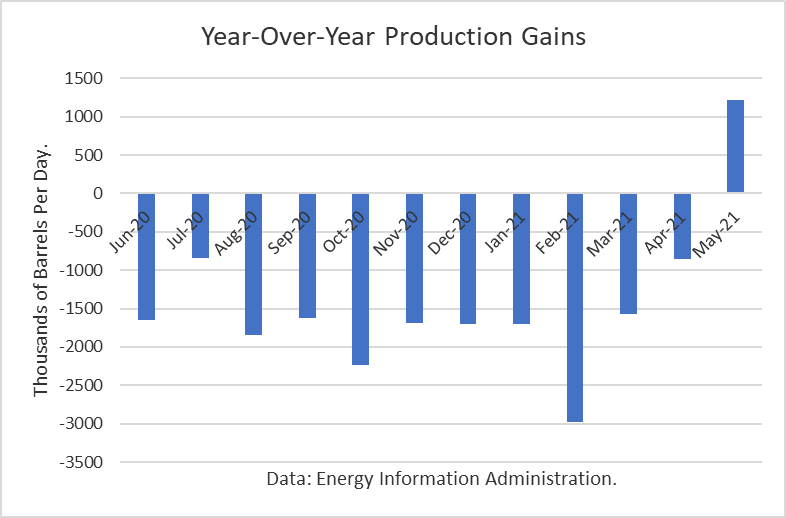

Given the huge reduction in May 2020, production recovered by 1.2 mmb/d over the past 12 months. This number only includes crude oil.

The EIA-914 Petroleum Supply Monthly (PSM) average figure was nearly identical to the weekly data average reported by EIA in the Weekly Petroleum Supply Report (WPSR).

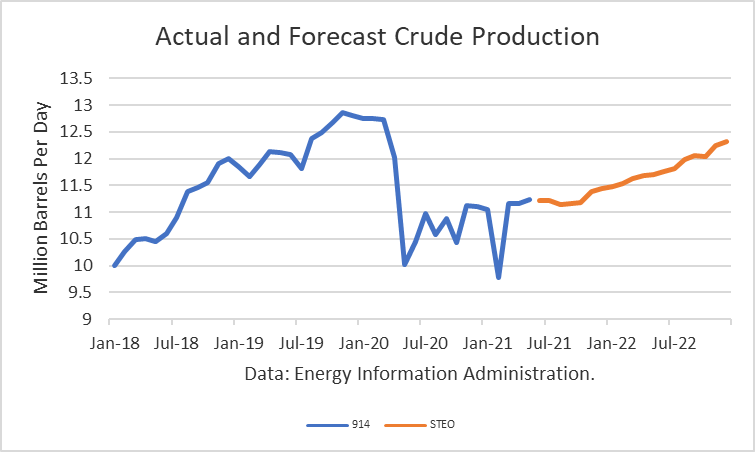

The 914 figure was identical to the 11.230 mmbd estimate for that month in the July Short-Term Outlook. As a result, there would be no reason for a “rebenchmarking” to EIA’s model in future production levels.

The EIA is projecting that 2021 production will exit the year at 11.450 mmbd. And for 2022, it projects an exit at 12.310 mmbd.

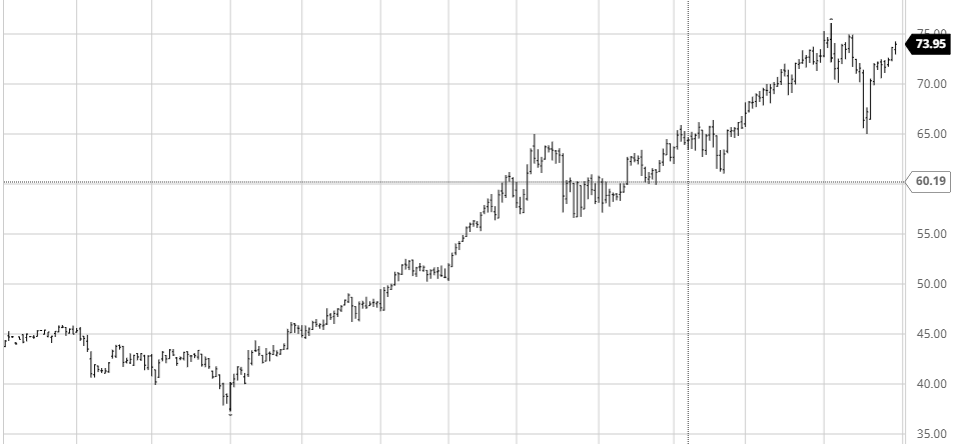

Drilling rigs have been steadily rising, and the September WTI contract has rebounded to $ 73.95 /bbl as of July 30th.

Conclusions

The unprecedented oil price collapse of 2020 has not only been totally erased, but WTI is at its highest level since late 2018 when the market expected Iranian crude exports to be halted even though OPEC+ has agreed to raise production by about 2 mmbd through the end of 2021.

U.S. crude production has responded to a limited extent despite the higher prices. As a result, it appears that EIA projections for low growth in 2021 and 2022 may be too pessimistic.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.