Selling aggressive covered call options (i.e. aligning the strike price at or near the current price) to generate current income may augment overall portfolio returns while mitigating risk. In brief, options are a form of derivative trading that traders can utilize in order to initiate a short or long position via the sale or purchase of contacts. In the event of a covered call, this is accomplished by leveraging the shares one currently owns by selling a call contact against those shares for a premium. An option is a contract that gives the buyer of the contract the right, but not the obligation, to buy or sell an underlying security at a specified price on or before a specified date. The seller has the obligation to buy or sell the underlying security if the buyer exercises the option. An option that gives the owner the right to buy the security at a specific price is referred to as a call (bullish); an option that gives the right of the owner to sell the security at a specific price is referred to as a put (bearish). I will provide an overview of how an aggressive covered call is utilized and executed to generate current income and mitigate risk. Further details focusing on actual examples of selling in-the-money covered calls and the ability to sell these types of options in an aggressive manner to generate cash in one’s portfolio will follow. Continue reading "Aggressive Covered Call Options Strategy To Generate Current Income"

Author: The INO.com Team

I Was The Most Hated Guy On CNBC Today

I pulled some of that Fibonacci voodoo that we do on Apple and if the uptrend support does break around $96, Apple is headed into the lower 80's.

I did a video for CNBC.com and they tore me to shreds in the comments section. The last time I got this kind of reaction was when I said oil is headed towards $26.00 while trading $41 at the time.

From there we take a look at our options positions in the S&P and AMZN.

Learn more about TradingAnalysis.com here.

Plan Your Trade, and Trade Your Plan,

Todd Gordon

Look For The Market To Catch Its Breath This Week

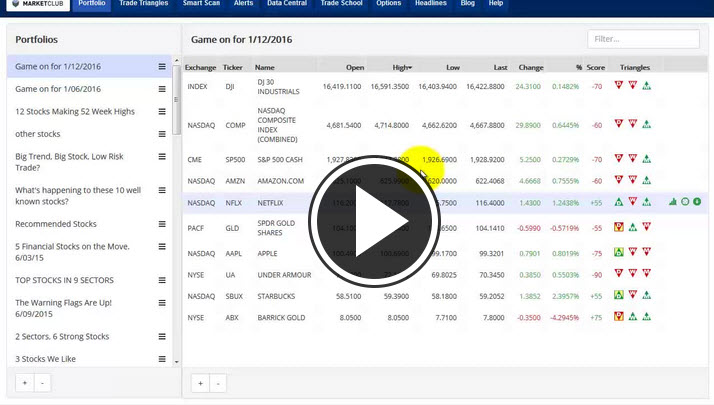

After last week's shellacking, I expect the markets to regroup and get used to a another level of trading. I do not expect to see this market rebound dramatically like it has done in the past. If one looks at the NASDAQ index on a weekly close basis, last week's closing price was the lowest level since January 26th of 2015. That does not auger well for this index in the future.

The key to remember this week is not to get overly excited and to stay disciplined. Give the market some room and time to sort out what it has to sort out and then be prepared to make your move.

Here's how I see the big picture, crude oil continues to be in a bear market and I have targeted the $28-$30 levels on the downside for now. Gold is trying to make a turn to the upside which is a reflection of everyone's nervous state about the economy and about liquidity in general. Continue reading "Look For The Market To Catch Its Breath This Week"

Catching The Big Moves

Jake Bernstein is one of the most highly respected futures analysts in the world. As the result of his many years spent researching the markets, Jake has developed numerous tools to produce sound, practical trading strategies, including ways to gauge the sentiment of the marketplace and determine what it might do next.

Jake Bernstein is one of the most highly respected futures analysts in the world. As the result of his many years spent researching the markets, Jake has developed numerous tools to produce sound, practical trading strategies, including ways to gauge the sentiment of the marketplace and determine what it might do next.

In his trademark no-nonsense style, Jake presents the case for cycles in this fast-moving video. You'll be on the edge of your seat during this eye-opening workshop as Jake demonstrates some of his favorite new trading strategies and shows you how to use them to capture what he calls "no brainer" trades during the next six to twelve months.

WATCH NOW: Catching The Big Moves

Best,

The INOTV Team

GPS vs. Road Map: Which Works Best? (Part 2)

By: Elliott Wave International

Think of Trading and Investing as a Trip

Here's my advice: View the Elliott Wave Principle as your road map to the market -- and your investment idea as a trip.

You start the trip with a specific plan in mind, but conditions along the way may force you to alter course. As I mentioned earlier, alternate Elliott wave counts are simply side roads that sometimes end up being the best path.

Elliott's highly specific rules keep the number of valid wave-pattern interpretations to a minimum. Usually, you would consider the "preferred count" to be the one that satisfies all three of Elliott's rules and the largest number of guidelines. Your top "alternate" is the one that satisfies the next largest number of guidelines, and so on.

There are only three hard-and-fast rules with the Wave Principle: Continue reading "GPS vs. Road Map: Which Works Best? (Part 2)"