Swing trading has been popular for years amongst professional traders. It is a type of trading that tries to catch the various up moves and down moves in a market over the course of a few days to a few weeks. Unlike a longer term trend trader, a swing trader typically uses technical analysis to identify markets with short term momentum.

Swing trading can be a good trading style for beginner traders, as it offers a middle ground between day trading and long term trend trading. However, it can still offer the potential for significant profits for more advanced traders.

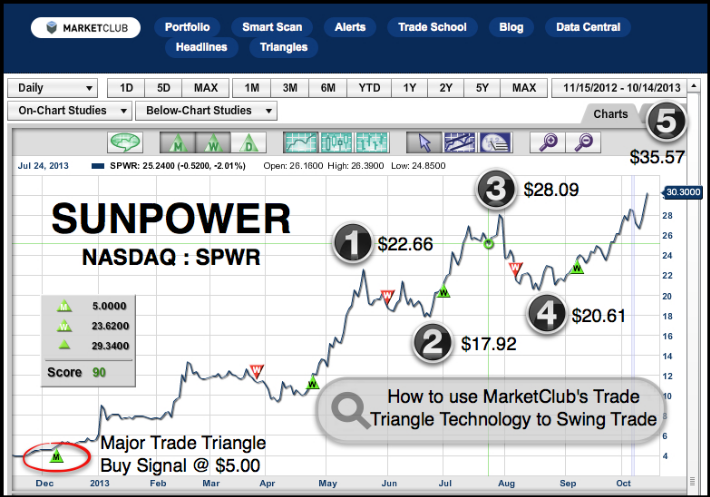

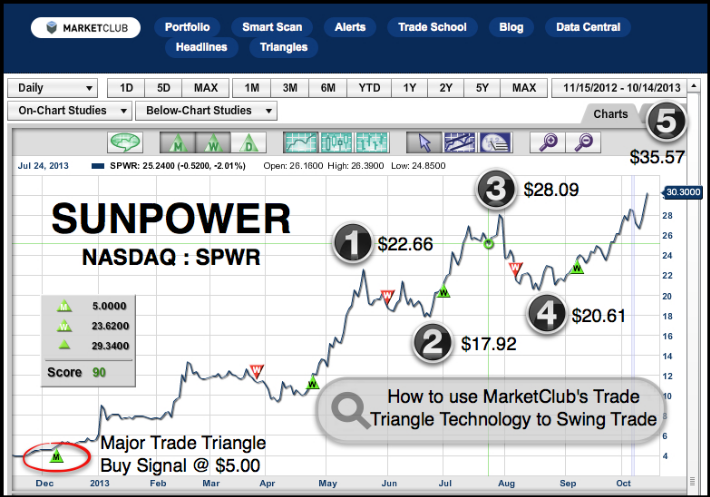

One of the key elements to successful swing trading is determining the direction of the major trend. This can be done easily using MarketClub's Monthly Trade Triangle. A green Triangle represents an uptrend and a red Triangle represents a downtrend. Using the chart for SunPower (NASDAQ:SPWR), you can see the green Monthly Trade Triangle was established on December 10, 2012, and has stayed in place for all of 2013.

Since the major trend is up for SunPower (NASDAQ:SPWR), it might be a good candidate to successfully swing trade. How far a market pulls back from a high and subsequently breaks over the previous high, can be used to determine how far that price swing will go. For example, if the price was 10 and the market pulled back to 5, the difference between 10 and 5, is 5. If the market subsequently moved over the previous high of 10, then you would add 5 to 10 and have a target zone of 15.

On the chart, you will see the numbers (1) through (5). Next to the number you will see a price point, which represents the highest stock price closing for that particular swing.

At (1), the price point was $22.66. The market then fell to (2) which represents a drop in price of $4.71.

Now, you simply add the price drop of $4.71 to the high price at (1) $22.66, which gives you a new swing point objective of $27.37.

At (3), the price point was $28.09. The market then dropped back to (4) $20.61, which represented a pullback of $7.48.

Now, the market has already moved through (3) $28.09, which is where we add on the pullback amount of (4) $7.48 to (3) $28.09. This produces our next target zone of $35.57.

We will see in the future if that level is achieved.

I hope you are able to apply this suggested method to other markets as well.

As always, I appreciate hearing back from you with your thoughts and ideas on different markets. Until then, I wish you every success in the marketplace.

All the best,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Hello traders everywhere! Adam Hewison here, President of INO.com and Co-creator of MarketClub, with your mid-day market update for Thursday, the 17th of October.

Hello traders everywhere! Adam Hewison here, President of INO.com and Co-creator of MarketClub, with your mid-day market update for Thursday, the 17th of October.