For today's guest blog post I decided to contact Christopher Hill from Investorazzi.com. I emailed him and asked him his opinion on stocks, and what the experts are doing. Christopher has been running Investorazzi.com for quite a while now and to say I'm a fan is an understatement. Check out his blog post below and check out his site...it's worth the visit!

==================================================================

Investing Legends Buying Up Stocks

To say U.S. equities have been beaten up lately is an understatement. As I write this post Monday evening:

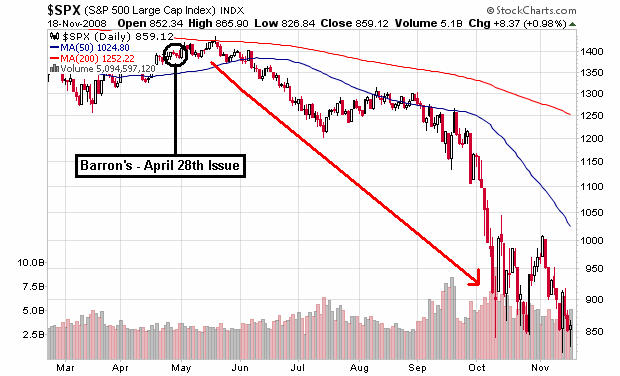

* The Dow Jones Industrial Average is off almost 38 percent for 2008 (See CHART here)

* The Standard & Poor's 500 Index is down 42 percent for the year (See CHART here)

* The Nasdaq Composite Index is now at a five-year low (See CHART here)

Turn on the news and you’d think investors couldn't get out of the stock market fast enough. Remember that old story about someone's cousin losing their shirt from investing in commodities? I suppose some are saying that about equities these days.

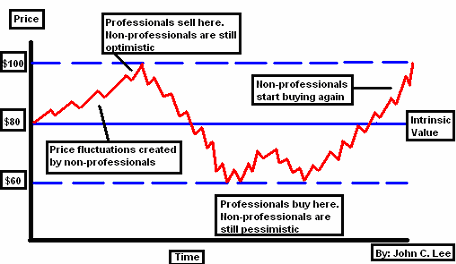

Yet, in times like these I remember a certain saying. "Buy when there's blood in the streets." Or, as legendary investors Jeremy Grantham and Warren Buffett might say, on the Street. For those of you who aren't familiar with Jeremy Grantham, he is the Chairman of Boston-based GMO, a privately-held global investment firm with $152 billion under management as of the end of 2007. The British money manager, whose clients have included U.S. Vice President Dick Cheney and former U.S. presidential candidate John Kerry, has made some terrific calls in the past quarter century:

* In 1982, said the U.S. stock market was ripe for a “major rally.” That year was the beginning of the longest bull run ever.

* In 1989, called the top of the Japanese bubble economy.

* In 1991, predicted the resurgence of U.S. large cap stocks.

* In 2000, correctly called the rallies in U.S. small cap and value stocks.

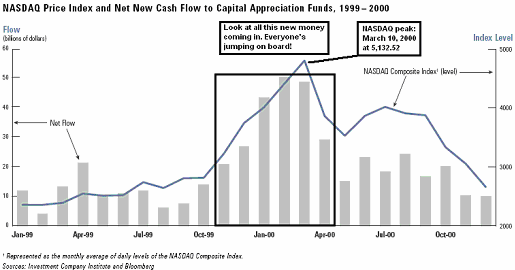

* In January 2000, warned of an impending crash in technology stocks, which took place two months later.

* In April 2007, nailing the current crisis, he wrote to shareholders, "From Indian antiquities to modern Chinese art, from land in Panama to Mayfair; from forestry, infrastructure and the junkiest bonds to mundane blue chips; it’s bubble time!"

As for Warren Buffett? Well, who hasn't heard of the "Oracle of Omaha?" Buffett, the richest person in the world with more than $62 billion (according to the 2008 Forbes list), amassed his multibillion dollar fortune mainly through investing in stocks and buying companies through Berkshire Hathaway, where he serves as Chairman.

These days, Grantham and Buffett both sense blood on the Street--- and are acting accordingly. Paul J. Lim of the New York Times wrote this past Sunday:

“Mr. Grantham said in an interview that even though his firm began buying stocks in early October, after prices fell to attractive levels, the market had a tendency to “overshoot” during sell-offs… Mr. Grantham noted that GMO began buying only after its portfolios had fallen below some key thresholds. For example, in GMO’s global balanced portfolio of stocks and bonds, the firm’s minimum allocation to equities is usually 45 percent. But after the market sell-off, that equity allocation dipped to around 38 percent. So once stock prices began to look attractive, GMO started rebalancing back into what it regards as the most undervalued types of equities: emerging markets stocks and high-quality domestic blue chip shares. After a few rounds of purchases, stocks now make up around 55 percent of GMO’s global balanced portfolio.

Mr. Grantham says that although he doesn’t know how well he timed his purchases, ‘we do know that seven years out, these will be good purchases for us.’”

Even if stock prices continue to decline, Grantham told Douglas Appell of Pensions & Investments back on October 27, he still plans on buying more equities. Appell wrote:

“Going forward, Mr. Grantham said GMO will be ‘steady buyers as the market goes down.’ The firm risks being too early, but will be in position ‘to make a ton of dough’ when the inevitable recovery comes, he said.”

Like Grantham, Buffett has also been actively acquiring shares of companies. And like the British investor, he hasn't made a secret of his intentions. In fact, back on October 17 he wrote in the New York Times:

“The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary.

So … I’ve been buying American stocks. This is my personal account I’m talking about, in which I previously owned nothing but United States government bonds. (This description leaves aside my Berkshire Hathaway holdings, which are all committed to philanthropy.) If prices keep looking attractive, my non-Berkshire net worth will soon be 100 percent in United States equities.”

And what was it that triggered Buffett's latest spending spree? The man some call “The World’s Greatest Investor” explained:

“A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors.”

Blood on the Street, perhaps? Morgan Housel of the financial website Motley Fool wrote Monday:

“What's the Oracle been up to lately? In the past quarter, Berkshire purchased about 24 million shares of ConocoPhillips (NYSE: COP), upping its existing stake to 84 million shares -- currently worth just less than $4 billion. As of the filing date of Sept. 30, ConocoPhillips stood as Berkshire's fourth-largest common stock holding, behind Wells Fargo (NYSE: WFC), Coca-Cola (NYSE: KO), and Procter & Gamble (NYSE: PG).

That's a pretty serious vote of confidence. Conoco shares have crashed more than 40% in the past three months, as global economies screech to a halt. In the short term, that pullback is probably justified -- energy was getting ahead of itself for a while. So did Buffett buy at the peak? Nah. For long-term investors who want to make the bold assumption that energy isn't just a passing fad, there are some serious, serious bargains being made right now.

Berkshire's other purchases in the quarter included a new 2.9 million-share investment in electrical goods manufacturer Eaton, as well as a 1.8 million-share increase in its existing stake in NRG Energy (NYSE: NRG).”

Should stock prices continue to fall, I have a feeling we’ll hear a lot more about these two investing legends--- especially regarding their latest acquisitions.

Christopher Hill

Editor Investorazzi.com

==================================================================

Good Trades

Good Trades