Today after the close Apple Inc. (NASDAQ:AAPL) reports its quarterly numbers. It reports revenues, profits and will offer some guidance and perhaps share with everybody how many iPhones it has sold, but not watches.

So, how many Apple watches have been sold? How many people have you seen wearing an Apple watch? I have to admit, I have only seen two or three folks with Apple watches on their wrists, but that's all.

As a huge Apple fan for the past three decades, I did not feel the need to rush out and purchase an Apple watch. One of the reasons was because I already had a smart watch from Pebble which suits me fine and does practically everything that the Apple watch does. The Apple watches are beautifully made, but you have to charge them every night, which to me is a non starter.

Apple is not going to share Apple watch sales with us today, that item is going to be buried along with other items they have sold in the quarter.

The general consensus among analysts is that earnings per share will increase to $1.79 from $1.28 a year earlier. They're also looking for growth of around 32% on sales to $49.3 billion.

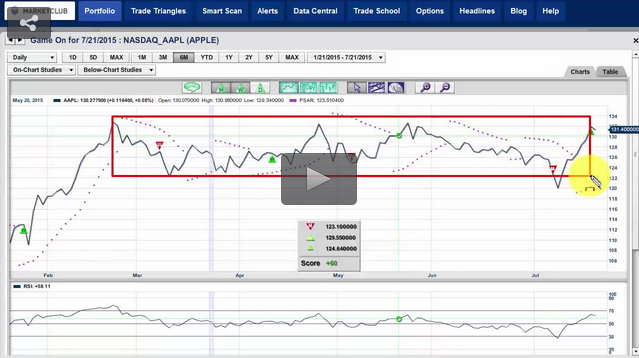

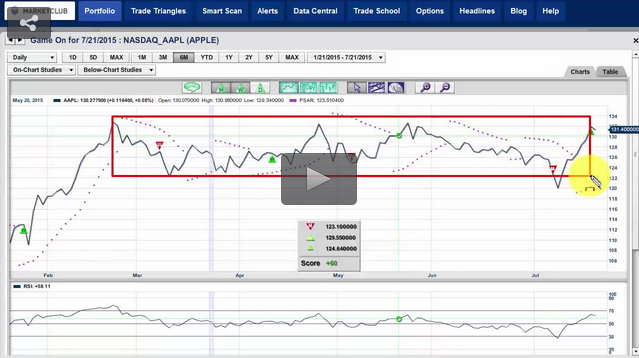

The technical picture is somewhat mixed for Apple in the sense that Apple has a monthly RED Trade Triangle that is indicating the trend for Apple is in more of a wait and see trading range right now. That could all change today should Apple move over the $134.80 level. I would also view a close today over $134 as a big clue to earnings and it would represent a new high close for Apple.

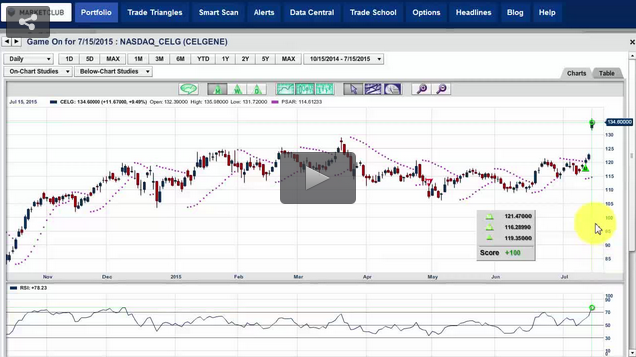

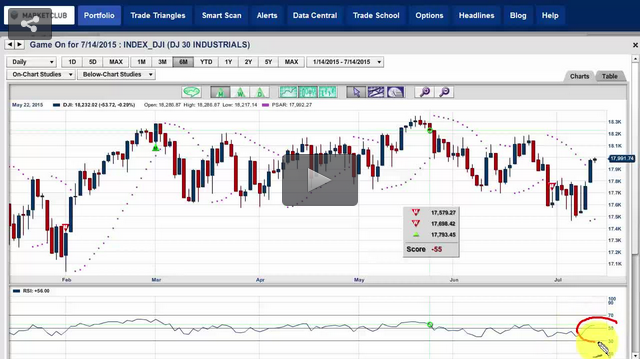

In addition to Apple, I will also be looking at the major indices, gold, crude oil and the euro.

Have a question or comment for us? Feel free to leave any questions or comments below this post.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub