Monday, August 24th will long be remembered by investors as the day the world turned red. Every exchange in the world is showing big losses. It all started in China when the Shanghai index closed down 8% for the day, its biggest daily loss since 2007. The drop in China quickly moved over to Europe where the FTSE 100 and other major indices all lost upwards of 4%.

What happened?

The experts and pundits will all point to different reasons why this happened, but the reality is, the market has been having problems for some time and those problems have manifested themselves in the minds of investors who suddenly perceive things as being not so rosy.

I have said many times before that markets tend to slide faster than they glide. Simply translated, that means they go down a lot faster than they go up and we have certainly seen that in the last week or so.

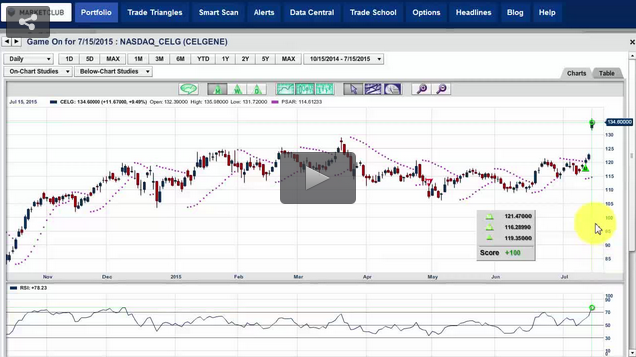

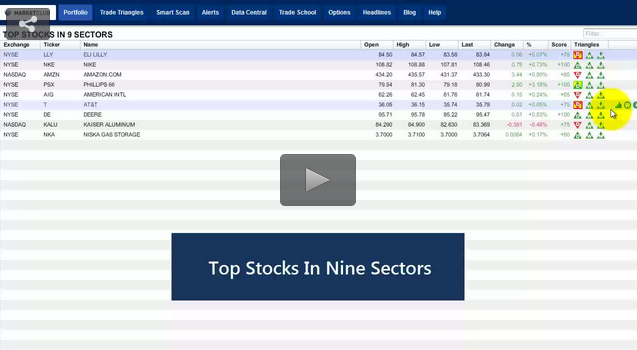

One of the strongest market movers for any market is perception. Perception suddenly took a very negative turn this past week for most of the major indices. We have a lot to be thankful for as the Trade Triangle technology warned us on 6/30/15 that the markets were beginning to change direction. I pointed this out on Friday in my video and showed the long-term trend line that goes all the way back to 2009 when the lows were seen in the market. At the time of my video, the Dow was down around 160 points and was very close to breaking the below this long-term trend line. As the day progressed, that support line was clearly broken with the Dow closing down over 500 points for the day. The breaking of this long-term trend line is a big deal, in my opinion, and it represents more than just a correction in a bull market. Continue reading "It's Over!"