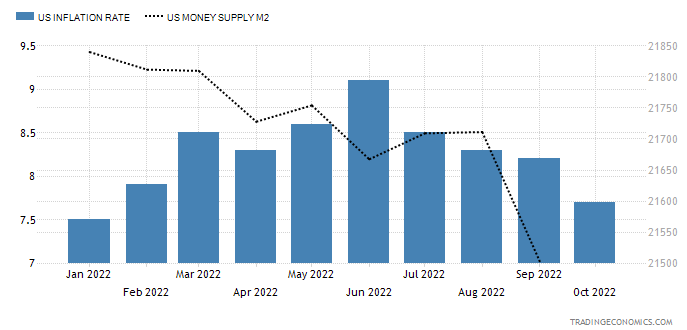

The multi-decade high inflation has kept the stock market under pressure since the beginning of the year. The Federal Reserve has been busy trying to tame persistent inflation through aggressive interest rate hikes.

After raising the benchmark interest rate six times this year, Fed Chairman Jerome Powell has cautioned that the final level of interest rates would be higher than expected.

Despite the overall macroeconomic uncertainty, leading foodservice retailer McDonald's Corporation (MCD) reported impressive financials for the third quarter ended September 30, 2022. The company operates and franchises McDonald’s restaurants with nearly 40,000 locations in over 100 countries.

MCD beat the consensus EPS and revenue estimates in the last reported quarter. Its EPS and revenue were 3.9% and 3% above analyst estimates, respectively. The company’s global comparable sales rose 9.5% year-over-year, while the U.S. comparable sales increased 6.1%. According to Placer.ai., visits to the Chicago-based chain’s U.S. restaurants rose 6.2% in September, compared to the traffic to the quick-service restaurant space rising just 0.8%.

The company’s impressive comparable sales and profit were supported by higher menu prices and increased restaurant traffic. Surging commodity and labor costs led to the company raising the prices of its burgers and fries, but customers flocked to the fast-food chain for its value meals.

MCD Chief Financial Officer Ian Borden said, “We’re gaining share right now among low-income consumers” in the United States. Borden expects the company to ride out the expected recession next year by relying on digital orders and delivery.

MCD’s President and CEO Chris Kempczinski said, “Our third quarter 2022 performance demonstrated broad-based business momentum as global comparable sales increased nearly 10%. I remain confident in our Accelerating the Arches strategy as our teams around the world continue to execute at a high level.”

“As the macroeconomic landscape continues to evolve and uncertainties persist, we are operating from a position of competitive strength. I also want to thank our franchisees, who have done a tremendous job navigating this environment, while providing great value to our customers,” he added.

MCD’s strong fundamentals allowed it to raise dividends for 46 consecutive years. Its dividend payouts have increased at a 6% CAGR over the past three years and an 8% CAGR over the past five years. Its current dividend yield is 2.27%, while its four-year average yield is 2.27%.

The stock has declined 0.1% in price year-to-date, while it has gained 5.9% over the past year to close the last trading session at $267.84. Continue reading "No-Brainer Stock For A Hawkish Fed"