Bernanke’s speech was a huge news story, and talk of QE2 ending / QE3 possibilities is going to be an even bigger spring story. So, we decided to get in on the fun, and think you should too! Guess what you think the exact number of the Dow (DJI) or Dollar (DX) value will be on the close of June 30, and the winner receives….

Bernanke’s speech was a huge news story, and talk of QE2 ending / QE3 possibilities is going to be an even bigger spring story. So, we decided to get in on the fun, and think you should too! Guess what you think the exact number of the Dow (DJI) or Dollar (DX) value will be on the close of June 30, and the winner receives….

100 Trillion Dollars! (well, some sort of 'dollars', and a place in history.)

Email your prediction (yes PREDICTION…ONE guess per person) to

Je******@in*.com

by June 1st (11:59 5/31/11). Simply posting your predictions in the comments section (while entertaining and appreciated) will not count as entering your vote. Plus, do you really want to give everyone access to your brilliant oracle insight?!

The most accurate guesses for the DJI and DX will win an Android Tablet so you can take MarketClub with you wherever you go. Follow your trades and make some “real” money with MarketClub.

We will announce who has won the title of The Smartest Man/Woman of the Universe on July 1st!

Best,

The MarketClub Team

As part of INO.com’s ongoing effort to bring solid educational information for investors, we are pleased to offer you free access to one of the most sought after grain traders in the industry. Grain floor trader Matt Pierce shares his Monday grain report with us for free. If you would like to receive this report via email for free each week, simply visit Grainanalyst.com and tell them INO sent you.

As part of INO.com’s ongoing effort to bring solid educational information for investors, we are pleased to offer you free access to one of the most sought after grain traders in the industry. Grain floor trader Matt Pierce shares his Monday grain report with us for free. If you would like to receive this report via email for free each week, simply visit Grainanalyst.com and tell them INO sent you.

Bernanke’s speech was a huge news story, and talk of QE2 ending / QE3 possibilities is going to be an even bigger spring story. So, we decided to get in on the fun, and think you should too! Guess what you think the exact number of the Dow (DJI) or Dollar (DX) value will be on the close of June 30, and the winner receives….

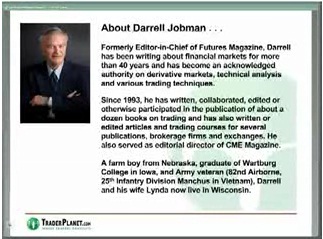

Bernanke’s speech was a huge news story, and talk of QE2 ending / QE3 possibilities is going to be an even bigger spring story. So, we decided to get in on the fun, and think you should too! Guess what you think the exact number of the Dow (DJI) or Dollar (DX) value will be on the close of June 30, and the winner receives…. Are you a short term trader or thinking of becoming one? Then chances are, you don't want to miss this free video seminar by former Editor-in-Chief of Futures Magazine, Darrell Jobman! Darrell has become an acknowledged authority on derivative markets, technical analysis and various trading techniques. He has participated in the publication of about a dozen books on trading, and has written articles and trading courses for publications, brokerage firms, and exchanges.

Are you a short term trader or thinking of becoming one? Then chances are, you don't want to miss this free video seminar by former Editor-in-Chief of Futures Magazine, Darrell Jobman! Darrell has become an acknowledged authority on derivative markets, technical analysis and various trading techniques. He has participated in the publication of about a dozen books on trading, and has written articles and trading courses for publications, brokerage firms, and exchanges.