Long before the trade war started, investors have been arguing over whether it’s better to invest in an established market like the US or growing, larger population market like China. This debate has stretched for years, well before the terms FAANG (Facebook (FB), Apple (AAPL), Amazon.com (AMZN),Netflix (NFLX), and Alphabet (GOOG)(GOOGL)) or BAT (Baidu (BIDU), Alibaba (BABA), and Tencent (TCEHY)) were coined.

But now, as the trade war between China and the US continues to heat up, investors have been battling over another China Vs. US technology investments. Perhaps because these stocks have been monster winners and some believe that since these companies are mainly technology stocks, they will be exempt from the pain that could come from the trade war. However, while it is unknown how much the trade war will affect these big technology companies, it should be noted that if each country’s economy suffers from the new tariffs, that the FAANG and BAT stocks could feel some adverse effects.

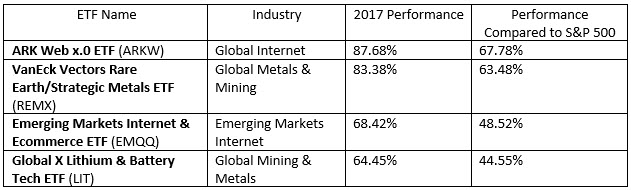

But in the meantime, if you are still interested in finding some Exchange Traded Funds which will give you exposure to FAANG and BAT stocks, you are in luck. I recently highlighted a few FAANG related ETFs which you can read about here, or continue below for some BAT related ETFs. Continue reading "Maybe FAANG Isn't For You, But BAT May Be"