The stock market had an amazing year in 2017, with the S&P 500 increasing more than 19.9%, but some Exchange Traded Funds performed substantially better. Most investors wouldn’t expect a large fund to outperform the S&P 500, unless they were using leverage, taking on outsized risk through trading in volatility, or investing entirely in international/developing markets.

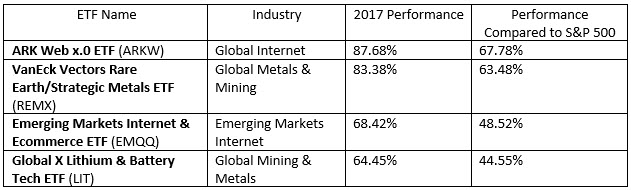

But, surprisingly there were a few ETF’s that not only outperformed the S&P 500 but crushed it while just being mildly risky. Below is a list of a few of them and then an explanation as to why they performed well and whether or not their hot streak can continue in 2018.

While this list was intended to help investors find ETF’s which offered lower risk than one would find with leveraged ETF’s, the best performer still had a little more risk than most investors should be comfortable with. The outsized risk with ARK WEB x.0 ETF (ARKW) is that its largest holding is in the Bitcoin Investment Trust (GBTC), which makes up 6.71% of the fund. The next largest is Amazon.com (AMZN) making up 6.08% of the fund. Twitter (TWTR), Athenahealth (ATHN), 2U (TWOU), Tesla (TSLA), Netflix (:NFLX), NVIDIA (NVDA), Alphabet (GOOG)(GOOGL), and JD.com (JD) round out the fund top ten holdings. GBTC’s performance in 2017 was primarily the reason ARKW crushed the overall market, but moving forward investors shouldn’t bet on that continuing to happen.

Ever since the Bitcoin futures began trading on the CBOE and CME, the price of Bitcoin has stabilized. If you are considering buying ARKW, just know that you are taking on more risk than a typical ETF due to its exposure to Bitcoin, but maybe that is why you want to own ARKW. Personally, though if I were thinking about investing in Bitcoin, I would just invest directly into the crypto-currency, not muddy the waters with GBTC due to its pricing. Continue reading "2017's Best Performing Non-Leveraged ETFs"