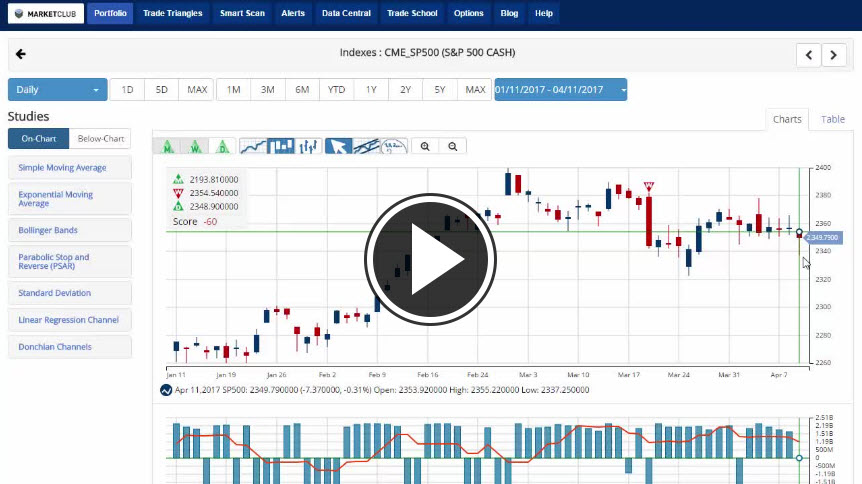

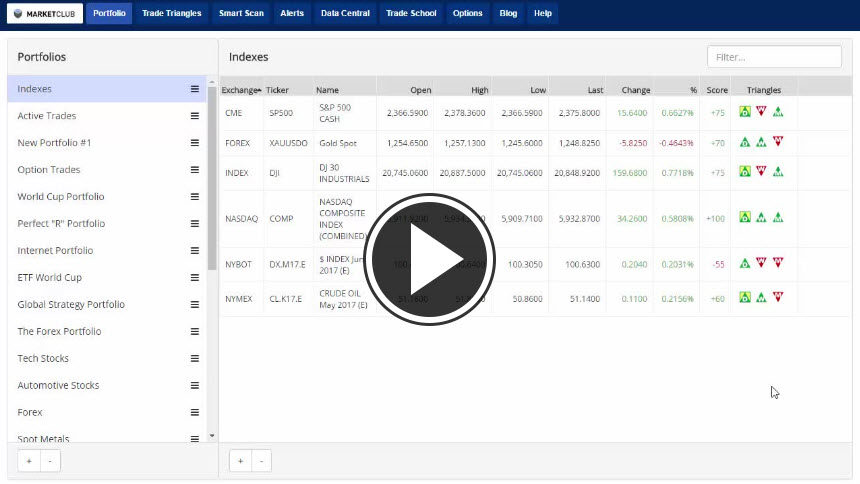

Hello MarketClub members everywhere. The indexes are looking and pacing to snap a 3-day losing streak today with the big 3 all being in the green. This move comes on the heels of a relatively quiet holiday weekend where fears of geopolitical upheaval that never came to fruition.

Traders have turned their attention to a slew of corporate earnings this week, led off by Netflix and of course United Airlines, who both report after the close today.

Netflix Inc. (NASDAQ:NFLX) is expected to report earnings of .37 EPS according to analysts. That would be more than a 38% increase compared with the .6 ESP Netflix reported during the same quarter a year ago.

Analysts expect United Continental Holdings Inc. (NYSE:UAL) earnings per share to drop 69% to .38 EPS, this decline is a reflection of higher fuel costs. Revenue is expected to increase 2% to $8.379 billion.

Key levels to watch this week: Continue reading "Market Looking To Break 3 Day Losing Streak"