Earlier in the month, we discussed the Top Performing ETFs of 2019. In this post, we'll discuss the worst performing ETFs of 2019.

After a down year in 2018, the stock market roared back in 2019 despite a number of political headwinds and many market participants calling for a recession to commence during the second half of the year. Fortunately, that never happened and the market shrugged off most of the negative headlines throughout the year since for the most part, economic numbers remained strong and while corporate earnings and revenue growth may be slowing, they are still in positive territory, which is undoubtedly a good sign.

With the S&P 500 (SP500) ending the year up 28.9%, the Dow Jones Industrial Average (DJI) rose 22.3%, and the NASDAQ (COMP) increased by 35.2% in 2019, one may wonder how anyone could have lost money in 2019, but unfortunately, some Exchange Traded Funds and therefore investor, did actually see negative returns during a year when the major indexes all crushed it.

Most investors who ended the year negative may want to forget about what happened. But those investors who focus on understanding why their investments went south are the ones who will learn from their mistakes and hopefully avoid making them in the future. The start of a new year is an excellent time to review your investing thesis and try to pinpoint why some investments didn’t turn out the way you imagined they would. So let’s take a look at the top five worst performing ETFs of 2019 in a number of different categories the average investor had to choose from in 2019 to see if you owned one or more of them.

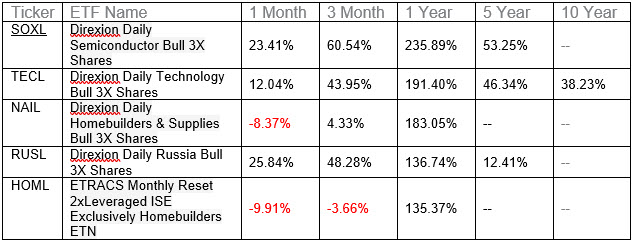

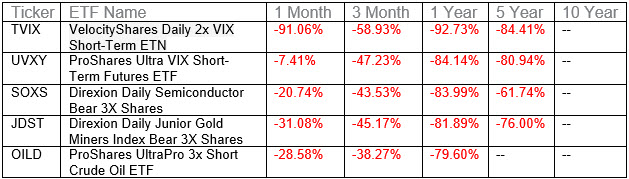

The following table shows the performance of the worst five ETFs in 2019, as well as their performance over the last month, the previous three months, the last five and ten years.

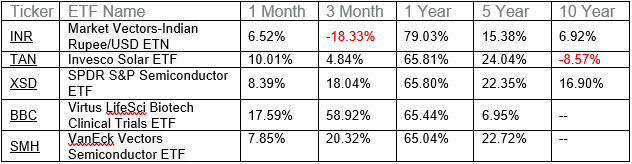

The following table shows the performance of the worst five Non-Leveraged ETFs in 2019, as well as their performance over the last month, the previous three months, the last five and ten years. Continue reading "Worst Performing ETFs in 2019"