Recent Market Correction and Options

The post-pandemic gains have been negated as the accommodative monetary policies are coming to an end. The market has been smacked in the face with several macroeconomic issues via unsustainable inflation, impending interest rate hikes, and geopolitical issues. As such, a third of the Nasdaq 100 stocks are off at least 30% from their highs, half of the S&P 500 has fallen 15% or more, while the median biotech stock has sold off by 60%. Leveraging the Ark Innovation ETF (ARKK) as a proxy for the high-flying growth stocks, this composite is down 60% as well.

This multi-month period of sustained weakness has been accompanied by extreme volatility. With the increase in overall market volatility, implied volatility (IV) and IV Rank become advantageous for option traders as rich premiums can be collected when selling options. This type of extremely volatile environment that we've been faced with recently reinforces why risk-defined options (i.e., put spreads, call spreads, and iron condors) are critical if one chooses to leverage options as a component of an overall portfolio strategy. Risk-defined option trades establish your max losses and allow one to leverage a minimal amount of capital while maximizing returns.

Options and Implied Volatility

The goal of options trading is to sell options and collect premium income in a consistent and high-probability manner. Enabling your portfolio to appreciate steadily month after month without guessing which direction the market will move. The main key for options trading success is leveraging implied volatility and time premium decay to your advantage. Since options premium pricing is largely determined by implied volatility, it's this implied volatility component, when used appropriately, that provides option traders with a statistical edge in trading over the long term (Figure 1).

Implied volatility is the market's prediction of how volatile the stock will be in the future or the expected volatility of a stock. Implied volatility has many implications and relationships that should be understood.

-

1. The higher the IV, the wider the expected range of the underlying stock movement becomes

2. As IV rises, the expectations of share price movement rise, and demand for the options increase

3. When IV increases, options increase in value

4. When IV decreases, options decrease in value

Since option pricing is determined by IV, the option itself will rise and fall as IV or the expectation of volatility changes. IV largely determines whether or not options are relatively cheap or expensive. Historically, this predicted volatility always overestimates actual volatility, and it's this overestimation that can be exploited to the benefit to option sellers, providing that edge.

Figure 1 – Implied volatility (blue trace) compared to actual volatility (gold trace) demonstrating that implied volatility is nearly always overestimated when compared to actual volatility

Put simply, if the market predicted that a stock was going to move 50% in either direction when looking back at the actual move, the stock may have only moved 40% in either direction. Put another way, at the beginning of a 30-day period, IV is predicted for the equity's move over the course of the next month. However, when looking back and comparing the actual volatility after that 30-day period, it is nearly always lower; thus, IV is overestimated.

Thus, stocks are less volatile than predicted! Therefore, the value of options contracts is nearly always high relative to what the actual stock move reflects. This overestimation is where options traders can take advantage and sell overpriced options to maximize profits and probability of success over the long term.

IV Rank

How can we use IV to our advantage in options trading? This is where IV Rank comes into play and how this is the most critical variable in options trading and its success over the long term. IV Rank is a measure of current implied volatility against the historical implied volatility range (IV low - IV high) over a one-year period. Let's say the IV range is 30-60 over the past year; thus, the lowest IV value is 30, and the highest IV value is 60. We need to compare the current IV value to this range to understand how the current IV ranks in relation to its historical IV range. If the current IV value is 45, then this would equate to an IV Rank of 50% since it falls in the middle of this range.

IV Rank is used to determine when option pricing is relatively pricey or cheap compared to its historic implied volatility for a specific security. When IV Rank approaches a value of greater than 50, then option sellers can use this to their advantage to take in rich options premium with the expectation that this implied volatility will decrease. Any value above the 50 threshold is where the overestimation of actual volatility thrives, and options sellers can take in rich premiums with the expectation that IV will fall; thus, the option itself will fall in value. This provides an opportunity to sell options with rich premiums, and as IV falls, the option can expire worthless, and/or the seller can buy-to-close to realize profits prior to expiration.

Rich premiums can be paid out to option sellers with the expectation that volatility will revert to its mean. Allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves up, sideways, or down without breaking through the strike price in a high probability manner. Selling options in these high IV Rank situations serve as a two-fold benefit since time premium is always evaporating, and IV will likely revert to its mean and fall. Even if the stock moves up, down, or trades sideways without breaking through the strike, the option will be profitable as time and IV fall.

The high IV Rank provides a rich premium, and as the option life-cycle unfolds and this volatility decreases, the option time value implodes, and the option decreases in value, allowing profits to be realized earlier in the life-cycle without waiting until the expiration of the contract. Leading to consistent income generation in a high-probability manner without guessing which way the stock will move.

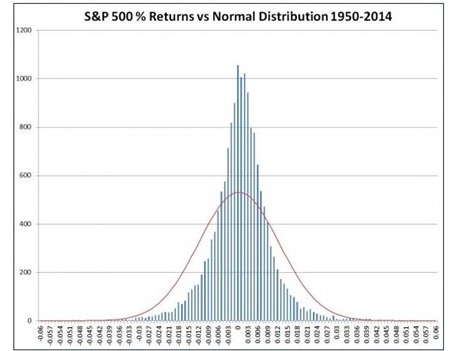

Probabilities

Picking the right direction of the market is a binary event and boils down to a 50/50 probability when compared against the movement of the S&P 500 and Dow over the long term. The number of consecutive daily moves in either direction is nearly evenly distributed, thus moving in a standard distribution over time. The Dow has fluctuated between a 2% loss and 2% gain 94% of the time and between a loss of 0.7% and gain of 0.7% of the time on a daily basis since 1900. There's an equal and even number of days when the market moved up 1% as it moved down 1%. There are no patterns or predictable cycles over a long-term basis equating stock picking to random chance and a 50/50 probability (see S&P 500 distribution of returns below). The only way to profit from this even distribution and behavior of the market is via options trading. Options allow one to dictate his probability of success and thus profit without estimating what direction the market will move. Options trading isn't about whether the stock will go up or down; it's all about the probability of the stock not moving up or down more than a specified amount based on probabilities respective to the underlying market or equity. Options are a bet on where the stock won't go, not where it will go (Figure 2).

Figure 2 – There's an equal and even number of days when the market moved up a specific percent as it moved down that same percent. There are no patterns or predictable cycles over a long-term basis as the market moves in a normal distribution

Based on all historical moves and magnitude of moves a stock has made in the past, its future absolute move (positive or negative) within standard deviations are predicted. Implied volatility (IV) is used to predict the future magnitude move of the stock over a given timeframe.

Conclusion

High IV Rank leads to overpriced or richly valued option contracts where option sellers can capitalize since implied volatility is nearly always overstated, and the actual move of the underlying stock will be less volatile than predicted. With a third of the Nasdaq 100 stocks being off at least 30% from their highs and half of the S&P 500 falling 15% or more has been accompanied by extreme volatility. With the increase in overall market volatility, implied volatility and IV Rank becomes advantageous for option traders as rich premiums can be collected when selling options. This type of extremely volatile environment that we've been faced with recently also reinforces why risk-defined options are critical if one chooses to leverage options as a component of an overall portfolio strategy. Risk-defined option trades allow one to leverage a minimal amount of capital while maximizing returns.

Noah Kiedrowski

INO.com Contributor

Disclosure: Stock Options Dad LLC is a Registered Investment Adviser (RIA) firm specializing in options-based services and education. There are no business relationships with any companies mentioned in this article. This article reflects the opinions of the RIA. Any recommendation contained in this article is subject to change at any time. No recommendation is intended to constitute an entire portfolio. The author encourages all investors to conduct their own research and due diligence prior to investing or taking any actions in options trading. Please feel free to comment and provide feedback; the author values all responses. The author is the founder and Managing Member of Stock Options Dad LLC – A Registered Investment Adviser (RIA) firm www.stockoptionsdad.com defining risk, leveraging a minimal amount of capital and maximizing return on investment. For more engaging, short-duration options-based content, visit Stock Options Dad LLC’s YouTube channel. Please direct all inquires to in**@st*************.com. The author holds shares of AAPL, ADBE, AMZN, ARKK, AXP, BA, BBY, C, CMG, CRM, DIA, DIS, FB, FDX, FXI, GOOGL, GS, HD, INTC, IWM, JPM, MRK, MSFT, NKE, NVDA, PYPL, QQQ, SPY, SQ, TWTR, UNH, USO, V and WMT.

This may be among the most comprehensive explanations of the true value of option trading I've read in a long time. The information is out there but I can finally digest it.