The US consumer is under pressure. Consumer Confidence level fell to 89 in April, and retail sales fell by -0.3 MoM in March. And as if that weren’t enough, GDP growth missed the mark for a second consecutive quarter, with Q1 growth falling to as low as 0.5% annualized, well below expectations.

Naturally, those developments are not bringing a Fed rate hike any closer, and it leaves the Dollar widely exposed to short selling. It’s the catch-up game, where Dollar peers such as the Euro, Yen, and Aussie are gaining lost ground. The relative advantage of the US economy is narrowing, and the prospect of a tightening cycle from the Fed seems even more remote.

This isn’t the first time the Dollar has been hit by the catch-up game. Here’s how the game plays out: The Dollar turns weaker, shaving its value by several percentage points only to come back stronger in the end as the US economy regains momentum. That’s why one should tread lightly before pouncing on a Dollar short. After a series of disappointments, the chances of an upward surprise in US data is much greater. There’s a very real chance that shorting the Dollar at this stage, after a 6.5% correction, will be too late.

What Could Justify Another Short?

In order for the Dollar correction to turn much wider and justify another short two basic assumptions need to break.

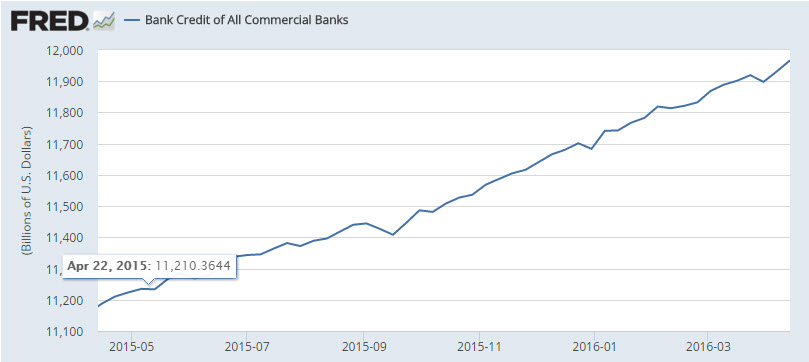

The first pillar is credit growth. As long as credit keeps growing, businesses eventually return to spending and growth eventually comes back. Since credit growth doesn’t simply just stop that’s more of a longer trend. As the chart from the Federal Reserve of St. Louis indicates. Currently, credit is still growing.

Chart courtesy of Federal Reserve Bank of St.Louis

The second pillar is jobs and employment. As long as employment levels are high, and job creation is steady (as evidenced by Nonfarm payrolls) then consumers return to spending, retail sales recover and the Dollar recovers in turn. But if Nonfarm payrolls grow by less than 100K (or worst it falls below 0) that’s a signal for Dollar weakness. One disappointment in Nonfarm payrolls undershooting the consensus isn’t enough, though. The data on Nonfarm Payrolls tends to bounce back after a negative reading. However, if two Nonfarm reports miss, that’s already suggesting a bigger trend and a deeper dollar correction.

If we narrow it down to practical levels, here is what you must know.

The Dollar Index, as seen in the chart, is trading at close proximity to 92-93 pivot zone. Meanwhile, the US Nonfarm payrolls report for April is due out next week. That leaves the Dollar with a solid chance for a bounce right off its pivot level. If the NFP disappoints by a big margin, well below 200K, it could signal weakness in the near term and the greenback could lose as much as 3% until it hits its next support.

If the next Nonfarm disappoints, we are looking at an even wider correction. And if credit growth starts stalling that’s an even longer term correction.

So, for those looking for a longer term short, all three conditions must be fulfilled. For those looking for more of a mid-term trend, two Nonfarm must miss by a wide margin. And for those seeking a quick but risky short, the upcoming Nonfarm report must disappoint first. But until then, shorting the Dollar at this level is just too risky, kind of like jumping out of an airplane without a parachute.

Chart courtesy of Netdania.com

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Lior, another nice fundamental post!

So we got first non-farm payrolls below expectations today!

The one year low for the dollar was taken out at 93.30. The dollar is done.Look out below.

I think these dollar fluctuations are due to too many short positions being taken, so the artificial demand, backed by no rise in real economic activity for the dollar rises and it goes up in value. In addition to that, many investors are going long on these short positions, which again causes the dollar to rise in value. It seems to be some kind of a vicious circle we will be undergoing for some time to come, since expansionary monetary policy is having no effect. Despite what the official figures want us to believe, there seems to be only a meagre rise in credit activity having no real effect on the economic activity, because people are taking loans to refinance their old ones, i.e. to repay their old debts and thus not contributing to a rise in aggregate demand.

No, I think this is not late at all, too much space and margin still left. Since long, i had given multiple and repeated warning about the weakness of US Dollar, so as per my view, based on my personal study, Sharp and Sudden fall against the Currencies of its most relevant counter parts is yet to come. This will not hurt only US Dollar, but we may find a great unbalancing and lack of Equilibrium of entire Global Financial Sectors across the Counters.

As far as Indian Rupee, (INR) is concern, if present exchange rate break Rs.65 against One Dollar, we may find lower marks up-to Rs. 58 and even surprising levels of of Rs. 48 or 42 or even bellow too. This INR chart showing too much sustainability pressure, so it may get some faster un expected move.

THANKS! Carol