What is it about gold that makes people view it differently than any other asset class, creating an almost religious fixation* on the metal? As long-term monetary insurance, you would think that it would be among the more boring items; sort like insurance annuities. But that is not the case.

What is it about gold that makes people view it differently than any other asset class, creating an almost religious fixation* on the metal? As long-term monetary insurance, you would think that it would be among the more boring items; sort like insurance annuities. But that is not the case.

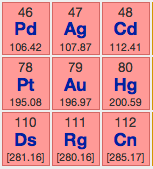

Gold is routinely propped up on a pedestal and obsessed upon in the world of money and finance. In actuality, gold is a geological element that has been deemed by humans to be money or to closely track monetary value, with a track record measured in centuries. Why, there it is on WebElements‘ element chart bracketed by things like Mercury, Cadmium and Copernicium, among other 'precious' metals.

'There is no fever like gold fever' I suppose, and that is what gets many market players in trouble. How can an asset of unquestionable value be trashed so routinely and with such ease when US and global policy makers are taking their inflationary operations to new heights, right out in the open? Why, the US just nominated Bernanke clone Janet Yellen as the new Fed Chair. Gold should skyrocket!

Well no, it shouldn’t because it hasn’t. As a counter cyclical asset (counter to the economic recovery that policy makers are trying to engineer) its price continues to reside in the dumps as the average market participant still leans toward confidence in policy makers and a view that "the crisis" is over; meaning that the crash of 2008 was a 'one off' that was the result of some financial institutions that screwed the pooch and have been brought back in line.

Gold is simply a value marker and insurance against the possibility that the US crisis in 2008 and the European crisis in 2011 were emblematic of much deeper and ingrained problems that will bubble (no pun intended) up to the surface once again at a place and time yet to be determined. Gold is insurance in support of the idea that new debt can leverage, but not fix, the economy. That is gold's ultimate fixation.**

The bottom line is that gold should not get caught up in some kind of imagined war of good against evil. That is because it is not an idol, it is a tool to be used by right-minded investors to protect themselves against certain financial risks while going about business in an increasingly complex and leveraged financial system.

If they have fixed*** the system, gold is done for now. We'll keep watching gold’s ratios to positively correlated markets for the big picture clues there. If they have not fixed the system, people who calmly viewed gold as a value instrument rather than a speculation play in the casino, will be rewarded.

Meanwhile, I would advise tuning out the gold price micro managers, the gold bug cheering squads and the likes of the Vampire Squid itself, Goldman Sachs, with its 'bearish, no bullish, no bearish…' line. It is all noise.

* Fixation, def. 1: n., an obsessive interest in or feeling about someone or something;

** Fixation, def. 2: n., the action of making something firm or stable

*** Fix, def. v., mend; repair

Biiwii.com, Notes From the Rabbit Hole, Twitter, Free eLetter

Lutz, you klutz, the real fixation is pretending that there is no rational reason for standards. When the U.S. was on the gold standard, no one was talking about the daily London fix- if you had any doubts, you took it to a national bank and exchanged twenty of them for an ounce of gold. It is almost funny the fifty ways you can prove the new $100 bills are genuine- all you have no idea of is how many of them are being printed

In world financed by an ocean of debased fiat currencies, real goods would seem to be the only thing in which real value resides.

There is no intention to ever fix the system; to do so would require, at minimum, return to a stable currency. The founders knew this, and provided for ONLY coinage of gold and silver in the Constitution. Non governmental parties were allowed to produce their own currency but the federal government and the states were restricted to coinage created from a fixed measure of those metals. Now we have a the federal reserve, a private bank, printing paper money, or just creating it out of thin air, and buying things with it. This is enormously profitable for the bank, and they use it to buy presidential candidates and congresspeople. They rule through their bought and paid for agents in DC, and now neither they nor their representatives at the other major banks are even answerable under federal law for their crimes. They are looting the nation, and they have no intention of ever stopping. The only chance to save the nation is a radical shift in the political philosophy at the grass roots. There is a chance of this, which is the reason for the split in the GOP, and the reason the GOP leadership altered the convention rules after the nomination was secured for Romney in 2012; only by a violent attack against his conservative opponents was he saved from loss. The GOP base failed to turn out for him as a consequence, and though he did well enough among Democrats and the independents, his GOP voters were significantly fewer than McCain got. It is quite unlikely that the banksters will allow a conservative to win the WH because of a risk to their central bank franchise, hence terminal inflation is our fate. As for reasons the price has not risen, it is being fixed at a below market price, as it has been for nearly forty years, by a team operation run by the Treasury and the federal reserve. The foreign interests in opposition to this country have decided to allow the scheme to continue so long as they can buy gold at a below market price, however, there is not enough gold left now to continue to supply foreigners and still maintain the fix at the present levels. This is why the Indians are being coerced into restraining their imports, and why the inventories of deliverable metal at the Comex have reached all time lows. Time is running out, and the price of gold will sooner or later explode higher, because everyone in the world knows the fed is in control here, and will not stop until the nation has been looted completely, or the fed has been deprived of its franchise by angry voters. Lutz must certainly know all this.

There's a reason a pure gold standard does not work in a huge, or even large, economy. Seek out and watch "The Secret of Oz" - Bill Still on YouTube. Using physical metal as the basis of currency throttles the velocity of money. And affords the bankers and uber rich the ability to hoard and manipulate inflation such that they drive the poor and middle class in and out of their meager assets (their homes and small businesses). Now, I'm no fan of the FED, they do nothing but kowtow to the Rothschild's of the world (and the investment banks they own and run). But fiat currency, done right, is the only way to lubricate and facilitate a 7-10 billion soul economy. Unfortunately, no culture has yet "done it right."

So true!!!!!!

You have a good feeling for the money system.

But: We all already pay for the depts of public househoulds, since the interest rate is very low, but inflation is about 2,0%. Thus, our money continously loose value. No wonder, and of course that inflation rate, even a somewhat higher rate, is at a acceptable level. Otherwise FED would not be able to maintain this policy. This is the price for the "value of money", which we actually have.

"...affords the bankers and uber rich the ability to hoard and manipulate inflation such that they drive the poor and middle class in and out of their meager assets (their homes and small businesses). "

So what you described as accountable to a gold standard failure is precisely what's being done with fiat dollars in a digital credit economy today. Where is the wealth of the nation being accrued as you read this?

The myth that a base of standard public value of gold or anything intrinsically else, 'hobbles' the economy through lack of liquidity or velocity of money is exactly that. Myth. The gold standard 'failed' by design of those financial banking entities that wanted absolute control over the supply of money. Read The Creature from Jekyll Island to understand exactly who and why.

It isn't the medium of exchange that's caused the breaking of our economy. It's the destruction of standards of valuation through endless financial schemes utilizing unbridled leverage of debt within shadow banking thats distorted and destroyed all public basis of value.

Chronic manipulation of markets and interest rates by the Fed is an absolute statement of failed economy. The machinations employed since private banking overtook our monetary system have created the nightmarish imbalances that have now reduced one fifth of all Americans to a permanent state of poverty and public dependence

If you think that this ends well for our country and the world, think again. It's certainly not gold now that's responsible for our economic decline. It's the self-same banking establishment that circumvents the law, at first, as in 1929, then destroys all constraints imposed to protect the public from its criminal intent of economic domination.

Why do you think that we've become a police state? Poverty is the fate for all but the very rich, their political servants and the police that protect them.

It's amazing that still so few understand how totally screwed we are and why. It's not due to a gold standard, my friend. It's due to a system of overriding and all consuming evil maintained by our friends at the Fed.

@gazooks, Agreed all around.

My point, as I did not complete it re: fiat currency, is that neither the gold standard, a return to the gold standard nor the current manipulation of wealth through quantitative easing and the maniacal saturation of fiat currency are what any society should strive for nor exist under.

A gold standard does favor the rich. Flagrant mismanagement of fiat currency also favors the rich. So far all the worlds governments have accomplished financially is to weaken the very foundation of humanity's ability to exchange value for value but this willy-nilly printing of money.

To continue my thread on fiat currency, or legal tender or promissory note or cheque or IOU (all just paper promising that there is value attached to it - somewhere), what societies need is more akin to BitCoin.

It's true that a gold standard can throttle the velocity of money and allow hoarding by the rick. It's true that fiat currency facilitates the liquid exchange of value for value and will be necessary in our immense world economy. Yet it's also true that unbridled printing of paper or digital paper currency defeats the whole purpose of a fiat currency (Zimbabwe).

What the US needs is a constitutional amendment that brings the issuance of $dollars back into the government itself. And then within that amendment the establishment of a relational equation that fixes the amount of fiat currency than can enter (or exit) the economy over time. This is similar to BitCoin where the expectations of the float is set in stone and nothing nor no one can change it.

The FED has WAY too much power. There is not a man I despise more than Chairman Bernanke. The FED has failed and unfortunately there is no way to prove that its recent policies helped or hindered recovery. But no doubt Greenspan's treatment of interest rates helped cause the problem. The swirly-whirly, topsy-turvy mess we're in now is so screwed up that a fix is probably impossible.

But, a Congressional act to take over the power of the country's money, establish rules for the issuance of dollars, and rules for the alteration of interest rates (just as important as fiat flooding) would go miles to re-establishing order and normalcy to this monetary morass we're in now.

The global derivatives bubble was never fixed in 2008, it was enabled

again, and now grew bigger than ever, well into quadrillion of dollars.

Free market was stopped in 2008, failure was rewarded. We are yet to

reap the consequences of all that. The key bubble in 2008 was not subprime

mortgages, the key bubble that topped Lehman was a myriad of derivatives.

Still alive, kicking, and ever growing bigger, thanks to enablers at the Fed.

During the entire quantitative easing session of the last 2+ years where trillions of extra dollars have been injected into a broken system gold has fallen. How could this be? The dollar was continuously debased yet gold fell! The inflation that was supposed to accompany devaluing the dollar never materialized. The QE that was injected never made it into the M1 and M2 stream, the huge investment banks that received the QE continue to covet those dollars. The velocity of the dollar never increased. The US government in team with the FED sought to inflate the stock market which became the only game in town. Other world currencies also debased which artificially propped up the dollar. And so gold fell. In this hindsight it seems rational. Yet at the time gold's descent seemed unfathomable.

So, for the future, will the seemingly irrational now come to pass? When tapering finally kicks in (Yellen most certainly will start, and soon), which boost interest rates and drive the dollar up - will gold ALSO rise, irrationally? Or will we finally see a return to historic expectations and see gold driven lower and lower. The equity markets seem indomitable. Or is this recent flurry of IPOs of companies with no income a sign that a 2001'esque venture capital exit strategy is now taking over? Will the stock market ever reset? Who knows. But the times of irrationality look to continue.

If you don't know that gold is and has been manipulated at least in our life time,get informed.

Your account is well done, but if I look at what is gold for me,

I can easily follow Lutz.

Indeed, ppl say: 'There is no fever like gold fever', but this fever is mostly asscociated with looking at gold bars and coins, when you own it. It's the special shine and appearance, it's magic connected with rarity.

If I would buy gold, I only would do it as a storage of value, but not depending on its actual "valuation". This is why I would never trade gold in the manner like I would trade shares. Hasn't gold price climbed to enormous levels already?

Maybe we should think about a new valuation standard: The Röntgenium-Standard. Even more rare than gold, hard to access, but in the same group as gold. We can easily predict it's properties.

So with respect of trading: Of course gold price will always rise, when markets seems to be in trouble, and of course a gold price needs to be found on daily basis. But gold trading or price forecasts for gold for me is something "unnecessearry. " Trading gold for the sake of making money has nothing to do with buying gold for the sake of buying "hard assets". When trading gold, than you also can speculate on other commodities, in the same way. Then someone doesn't buy gold for the reasons that he wants to own assets, but to make money by trading.

Your philosophy reminds me of the Mercenary Geologist's where he physically holds precious metals only as a form of insurance. Insurance against the vastly remote possibility of national or world calamity. Given a large enough account, more than say, $3M, I can easily see how this would a wise play. Put 10% of your net worth into owning gold and silver (and maybe platinum and palladium). But for those of us who have limited assets, owning a few gold coins is much less satisfying, and much less insurance than a couple of pound of gold might provide.

It is interesting that the folks in and around the beltway believe that they are able to solve a problem such an economy fixated on fossil fuels, when in fact the reality is that gold will ultimately be a hedge against the false beliefs that everything will be solved by a few calmer heads in the capital. My belief is that over the long term, and I mean years, not weeks or months, gold, and the miners of this commodity, will do well for my portfolio.